Welcome to a comprehensive analysis of Theta Network (THETA), a pioneering blockchain platform designed to revolutionize the video streaming and entertainment industry. As the digital landscape continues its rapid evolution, Theta aims to address critical challenges faced by traditional media infrastructure, such as high content delivery costs, poor video quality, and centralized control. This article delves into Theta’s innovative technology, its market performance over the past year, and provides a detailed price forecast using an advanced proprietary algorithm, AlphaForecast, offering insights into its potential trajectory in the coming months and years.

Understanding Theta Network and Its Core Technology

Theta Network stands out in the crowded crypto space by offering a decentralized video delivery network. Its core mission is to enable efficient, high-quality, and cost-effective content distribution by leveraging a global peer-to-peer network. Instead of relying on centralized servers, Theta incentivizes users to share their excess bandwidth and computing resources to relay video streams, dramatically reducing content delivery network (CDN) costs for media companies and improving the streaming experience for end-users.

The network operates on a dual-token economic model: THETA and TFUEL. THETA is the governance token, used for staking by validators and guardians to secure the blockchain and participate in protocol governance. Holders of THETA can earn TFUEL, which serves as the utility token for all operations within the Theta ecosystem. This includes payments for video streams, decentralized applications (dApps) deployment, and interactions on the platform. This innovative design ensures that the network is decentralized, secure, and self-sustaining.

Theta’s technological prowess extends beyond video delivery. Its blockchain supports smart contracts and decentralized applications, fostering a vibrant ecosystem for NFTs, metaverse experiences, and various media-focused dApps. The platform has attracted significant attention through strategic partnerships with major media and entertainment companies, further solidifying its position as a serious contender in the Web3 media revolution. Its robust infrastructure, combined with its strong community and growing adoption, positions Theta Network as a key player in shaping the future of digital content.

Historical Price Analysis: A Look Back at the Last 12 Months

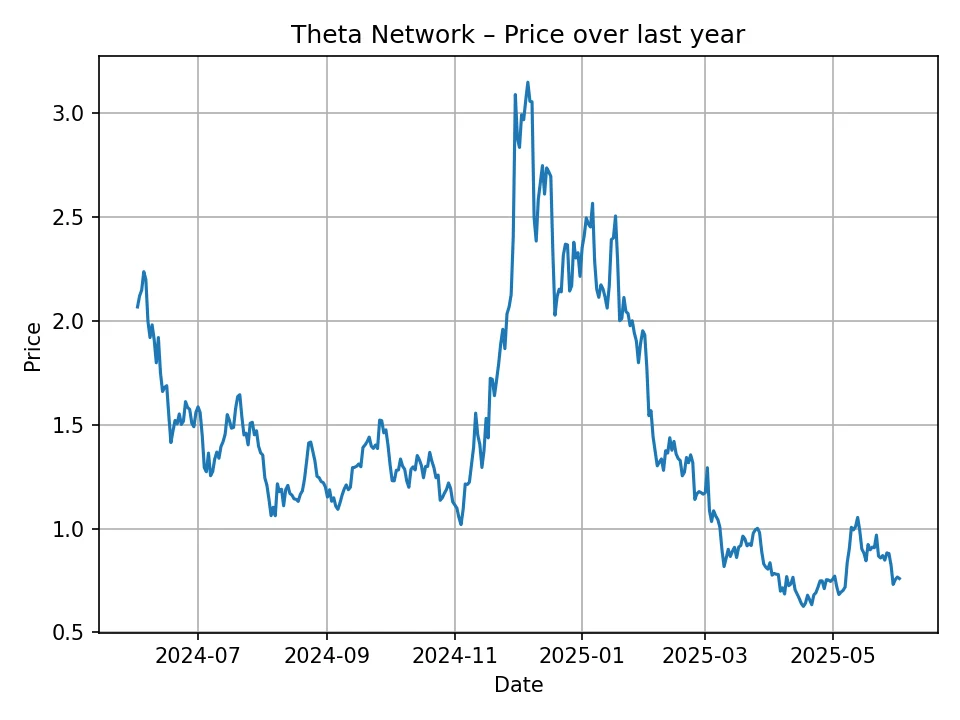

To better understand Theta Network’s potential future, it’s essential to examine its historical price performance. Over the past 12 months, the THETA token has experienced considerable volatility, reflecting the broader dynamics of the cryptocurrency market, coupled with project-specific developments.

Starting around early June 2024, THETA’s price was approximately $0.76 USD. The subsequent period saw a mix of upward movements and corrections. Throughout early June to late July, the price hovered around the $0.70-$1.00 range, with some minor fluctuations. A notable period of growth occurred in early August and September, where THETA climbed, reaching highs near $1.50 – $1.60 USD. This uptrend was likely influenced by positive market sentiment or specific project milestones that garnered investor interest.

However, this period of growth was followed by a correction in late September and October, pushing the price back down towards the $1.00 – $1.20 range. The market then entered a phase of consolidation, with THETA trading largely sideways, albeit with minor dips. This period saw the price frequently retesting support levels around $0.80-$0.90, indicating a strong baseline of investor interest despite overall market pressures.

A more significant rally was observed towards the end of 2024 and early 2025, when THETA experienced a strong surge. During this time, the price escalated significantly, reaching a peak close to $3.15 USD. This impressive run showcased the token’s potential for rapid appreciation when market conditions are favorable and investor confidence is high. Such a surge could be attributed to a combination of factors, including the broader crypto market’s bullish trend, positive news surrounding Theta’s partnerships, or significant upgrades to its mainnet.

Following this peak, THETA underwent a natural correction, pulling back from its highs. The price then stabilized, hovering in the $2.00 to $2.50 range for a period, before gradually declining to its more recent levels. As of early June 2025, the last observed price from our historical data stands at approximately $0.76 USD. This retracement highlights the inherent volatility in the crypto market and the tendency for assets to consolidate after significant price pumps.

Analyzing the past 12 months reveals a dynamic journey for THETA, characterized by periods of robust growth, subsequent corrections, and phases of price consolidation. The journey from roughly $0.76 to a peak of $3.15 and then back to $0.76 provides valuable context for future predictions, underscoring both its potential for significant gains and the importance of understanding market cycles and risk.

Key Factors Influencing Theta Network’s Price

Several critical factors are expected to influence Theta Network’s price performance in the short and long term:

- Technological Advancements and Roadmap Execution: Theta’s continuous development of its core technology, including improvements to its decentralized video platform, new dApp integrations, and blockchain upgrades, will be crucial. Successful execution of its roadmap, such as advancements in the Theta Edge Network and enhanced NFT capabilities, could significantly boost investor confidence and utility for the THETA and TFUEL tokens.

- Adoption and Strategic Partnerships: The real-world utility of Theta Network hinges on its adoption by content creators, media companies, and enterprises. New partnerships with major players in the entertainment, gaming, or metaverse sectors would expand the network’s reach, drive demand for TFUEL, and consequently enhance the value proposition of THETA.

- Tokenomics and Staking Incentives: The mechanics of THETA and TFUEL, including staking rewards and burning mechanisms, play a vital role. Strong incentives for staking THETA to secure the network, coupled with increasing utility and demand for TFUEL, can create a deflationary pressure on THETA, potentially leading to price appreciation over time.

- Broader Cryptocurrency Market Trends: As with most altcoins, Theta Network’s price is highly correlated with the overall health and sentiment of the cryptocurrency market. Bitcoin’s performance, regulatory news, macroeconomic factors, and prevailing risk appetite among investors will inevitably influence THETA’s trajectory. A bullish crypto market generally provides tailwinds for altcoins, while a bearish sentiment can lead to widespread declines.

- Competitive Landscape: While Theta has a unique value proposition, it operates in an increasingly competitive environment. The emergence of new decentralized content platforms or improvements in traditional CDN technologies could pose challenges. Theta’s ability to maintain its technological edge and expand its ecosystem will be key to fending off competition.

Theta Network Price Prediction: Short-Term Outlook (12 Months)

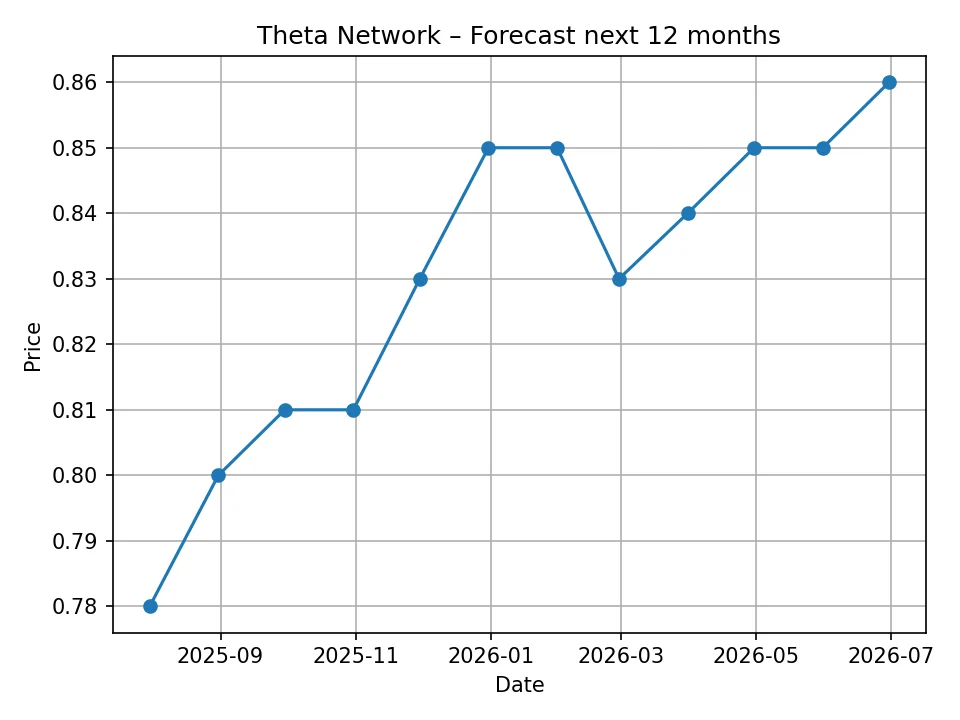

Our proprietary AlphaForecast algorithm provides a monthly price prediction for Theta Network for the next 12 months. This forecast considers historical data, market trends, and various technical indicators to project potential price movements.

Here is the detailed monthly price prediction from July 2025 to June 2026:

| Month/Year | Predicted Price (USD) |

|---|---|

| 2025-07 | 0.78 |

| 2025-08 | 0.80 |

| 2025-09 | 0.81 |

| 2025-10 | 0.81 |

| 2025-11 | 0.83 |

| 2025-12 | 0.85 |

| 2026-01 | 0.85 |

| 2026-02 | 0.83 |

| 2026-03 | 0.84 |

| 2026-04 | 0.85 |

| 2026-05 | 0.85 |

| 2026-06 | 0.86 |

According to AlphaForecast, Theta Network is projected to experience a relatively stable, yet gradually appreciating trend over the next 12 months. Starting from approximately $0.78 in July 2025, the forecast suggests a slow but steady climb, reaching around $0.86 by June 2026. This prediction indicates that the algorithm anticipates a period of consolidation and moderate growth, rather than explosive rallies, for the short term. It suggests that while significant immediate gains may not be on the horizon, the network is expected to maintain its value and see slight increases, potentially driven by continued development and subtle market shifts. This stability could appeal to investors looking for less volatile assets within the cryptocurrency space.

Theta Network Price Prediction: Long-Term Outlook (10 Years)

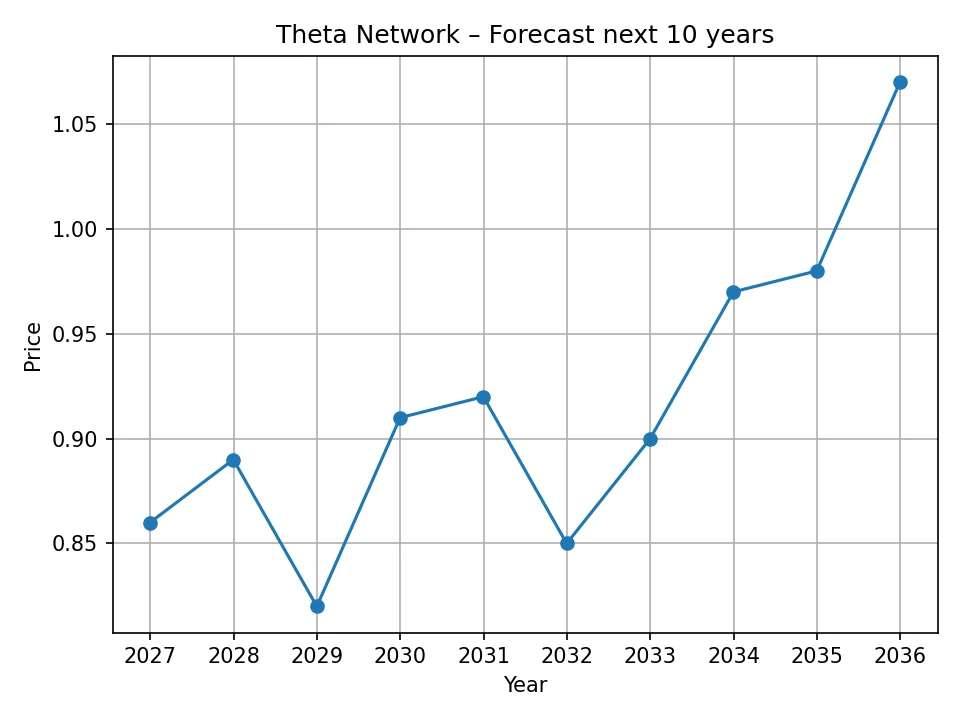

Looking further ahead, our AlphaForecast algorithm extends its predictions for Theta Network over the next decade, offering a glimpse into its potential long-term value.

Here is the detailed annual price prediction from 2026 to 2035:

| Year | Predicted Price (USD) |

|---|---|

| 2026 | 0.86 |

| 2027 | 0.89 |

| 2028 | 0.82 |

| 2029 | 0.91 |

| 2030 | 0.92 |

| 2031 | 0.85 |

| 2032 | 0.90 |

| 2033 | 0.97 |

| 2034 | 0.98 |

| 2035 | 1.07 |

The long-term forecast from AlphaForecast suggests a path of gradual appreciation for Theta Network over the next ten years. While the initial years show modest increases and even some slight pullbacks (e.g., in 2028 and 2031), the overall trend indicates a slow but steady growth trajectory. By 2035, the algorithm predicts THETA could reach approximately $1.07 USD. This long-term outlook implies that the algorithm projects Theta Network will continue to establish its position in the decentralized media space, with its value gradually increasing as adoption grows and its ecosystem matures. It suggests that sustained fundamental development and increased utility are expected to contribute to its value over a prolonged period, rather than relying on short-term speculative pumps. The forecast points to Theta’s potential as a consistent performer within the crypto market, slowly building value based on its underlying technology and expanding use cases.

Potential Risks and Challenges for Theta Network

While Theta Network presents a compelling vision for the future of decentralized media, it faces several inherent risks and challenges that could impact its price trajectory:

- Market Volatility: The cryptocurrency market is notoriously volatile, and THETA is not immune to sudden price swings influenced by global macroeconomic conditions, regulatory changes, or shifts in investor sentiment.

- Regulatory Scrutiny: The regulatory landscape for cryptocurrencies and blockchain technology is still evolving. Adverse regulations or government crackdowns in key markets could negatively affect Theta’s operations and adoption.

- Competition: The decentralized video and content delivery space is becoming increasingly competitive. While Theta has a head start, new entrants or significant advancements by existing competitors could challenge its market position.

- Technological Hurdles: Scaling a decentralized network to handle massive volumes of video traffic and complex dApps presents significant technical challenges. Any major technical glitches or security breaches could erode trust and hinder adoption.

- Adoption Rate: The success of Theta Network heavily relies on the widespread adoption of its platform by both content providers and end-users. If adoption rates are slower than anticipated, or if companies prefer traditional solutions, the network’s growth and token value could be limited.

- Dependence on TFUEL Utility: The value of the THETA token is intrinsically linked to the utility and demand for TFUEL. If the TFUEL ecosystem fails to generate sufficient transaction volume or utility, it could impact the overall tokenomics.

Conclusion

Theta Network represents a fascinating and ambitious project with the potential to fundamentally transform the digital media landscape. Its innovative decentralized video delivery network, dual-token model, and growing ecosystem position it as a significant player in the Web3 space. The historical performance of THETA illustrates its capacity for both significant gains and natural corrections, reflecting the dynamic nature of the crypto market.

Our AlphaForecast algorithm suggests a period of gradual stability and modest growth for THETA over the next 12 months, followed by a slow but consistent appreciation over the long term. While the predicted growth is not parabolic, it indicates a steady, underlying confidence in Theta’s fundamentals and its long-term viability. As Theta continues to execute its roadmap, forge new partnerships, and enhance its technological capabilities, its value proposition could strengthen.

However, investors must remain cognizant of the inherent risks associated with the cryptocurrency market, including volatility, regulatory uncertainty, and competition. Thorough due diligence and a clear understanding of personal risk tolerance are paramount before making any investment decisions. Theta Network’s journey ahead will undoubtedly be influenced by broader market forces, its ability to expand its ecosystem, and the successful implementation of its visionary technology.

Disclaimer: The price predictions provided in this article are based on data analyzed by our proprietary AlphaForecast algorithm. Cryptocurrency markets are highly volatile and subject to significant fluctuations. These forecasts are for informational purposes only and do not constitute financial advice. We are not responsible for any investment decisions made based on these predictions. Investors should conduct their own research and consult with a qualified financial advisor before making any investment in cryptocurrencies.

Maxwell Reed is the first editor of Cryptovista360. He loves technology and finance, which led him to crypto. With a background in computer science and journalism, he simplifies digital currency complexities with storytelling and humor. Maxwell began following crypto early, staying updated with blockchain trends. He enjoys coffee, exploring tech, and discussing finance’s future. His motto: “Stay curious and keep learning.” Enjoy the journey with us!