Solana (SOL) has emerged as a prominent player in the blockchain arena, distinguished by its high-performance capabilities and ambitious vision for decentralized applications. Designed to support thousands of transactions per second with exceptionally low fees, Solana aims to solve the scalability issues that have historically plagued earlier blockchain technologies. Its innovative proof-of-history (PoH) consensus mechanism, combined with proof-of-stake (PoS), enables rapid transaction finality and a robust infrastructure for a burgeoning ecosystem of decentralized finance (DeFi), non-fungible tokens (NFTs), and gaming projects. As the digital asset landscape continues to evolve, understanding the underlying technology and market dynamics driving Solana’s value is crucial for anyone interested in its future price potential.

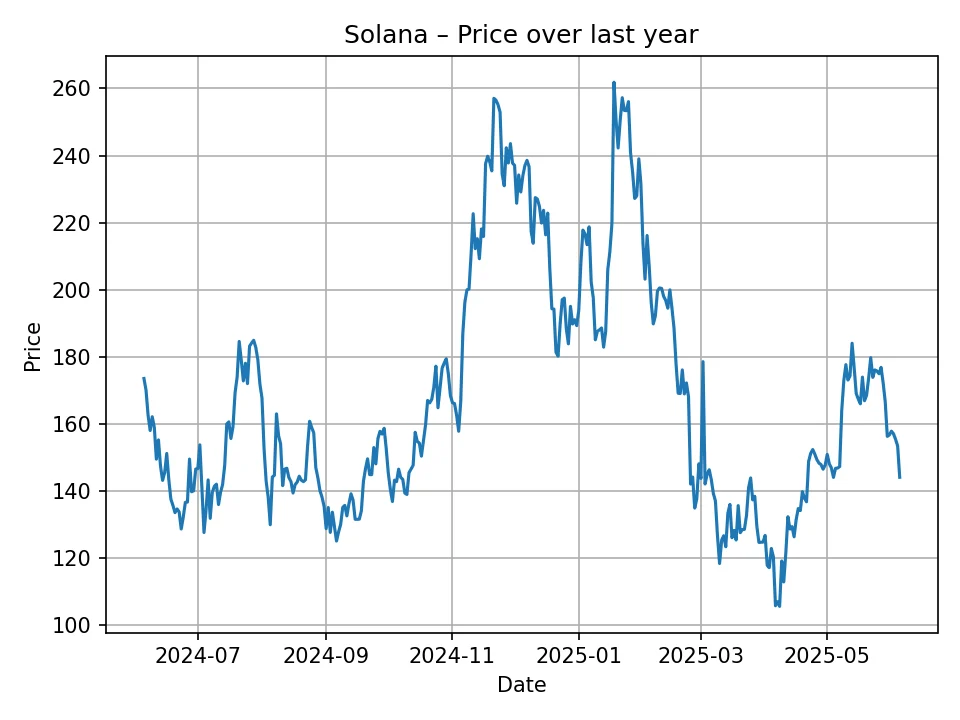

Solana’s Performance: A Look Back at the Last 12 Months

To contextualize future price predictions, it’s essential to examine Solana’s historical performance. Over the past twelve months, Solana has experienced considerable price fluctuations, characteristic of the volatile cryptocurrency market. Reviewing the daily historical data, Solana’s price has navigated a wide range. The lowest point observed was approximately $105.51 USD, while the highest peak reached approximately $261.87 USD. As of the latest available data, Solana is trading around $144.02 USD.

This journey reflects periods of significant upward momentum, often fueled by broader market rallies, specific ecosystem developments, or increased institutional interest. Conversely, there have been corrective phases, sometimes amplified by general cryptocurrency downturns, network stability concerns, or profit-taking by investors. The ability to sustain high transaction throughput has been a major draw, but past network outages have introduced periods of uncertainty, impacting investor confidence and price stability. Despite these challenges, Solana has demonstrated resilience, with a substantial portion of its market cap and developer activity intact, underscoring its underlying value proposition. The current price of around $144 indicates it is trading below its 12-month high, suggesting potential room for growth if favorable market conditions return and network improvements are sustained.

Key Factors Influencing Solana’s Price Trajectory

Solana’s price is influenced by a complex interplay of technological advancements, ecosystem growth, market sentiment, and broader macroeconomic factors. Understanding these drivers is crucial for any informed prediction.

Technological Strengths and Development

At its core, Solana’s appeal lies in its technical prowess. Its unique blend of Proof-of-History (PoH) and Proof-of-Stake (PoS) allows for unparalleled transaction speed and scalability compared to many competitors. The continued development and optimization of its core protocol, such as the ongoing work on Firedancer, a new validator client designed to further enhance network throughput and stability, are critical. Successful implementation of such upgrades can significantly boost confidence and attract more users and developers. Conversely, any technical setbacks, such as past network outages or newly discovered vulnerabilities, could exert downward pressure on the price.

Ecosystem Development and Adoption

The vitality of Solana’s ecosystem is a direct indicator of its health and long-term viability. This includes the growth of decentralized applications (dApps) across various sectors like DeFi, NFTs, and gaming. A thriving ecosystem attracts more users, increases network activity, and drives demand for the SOL token. Key metrics to watch include the total value locked (TVL) in Solana’s DeFi protocols, the volume of NFT sales, the number of active users, and the diversity of projects building on the chain. Partnerships with established businesses and integration into real-world applications also play a significant role in expanding Solana’s reach and utility.

Market Dynamics and Macro Trends

The cryptocurrency market rarely operates in isolation. Solana’s price is heavily influenced by the overall market sentiment, particularly the performance of Bitcoin and Ethereum, which often dictate the broader trend for altcoins. A bullish Bitcoin market tends to pull altcoins, including Solana, upwards, while a bearish trend can lead to widespread declines. Macroeconomic factors, such as inflation rates, interest rate decisions by central banks, and global economic stability, also impact investor risk appetite. When traditional markets show signs of stress, investors may reduce their exposure to riskier assets like cryptocurrencies, affecting Solana’s valuation.

Regulatory Landscape

The evolving global regulatory landscape for cryptocurrencies poses both opportunities and risks. Clear and favorable regulations could provide institutional investors with greater confidence, leading to increased capital inflow into the market. Conversely, restrictive or uncertain regulations could stifle innovation and investment, potentially impacting Solana’s adoption and price. Classifying cryptocurrencies as securities, for instance, could subject them to stringent rules, affecting their trading and utility.

Competition and Innovation

Solana operates in a highly competitive blockchain environment. It faces strong competition from other Layer 1 blockchains like Ethereum (especially post-merge and with its scaling solutions), Avalanche, Polygon, and newer entrants. The ability of Solana to maintain its competitive edge through continuous innovation, superior performance, and a compelling developer experience is crucial for its sustained growth. The market is constantly seeking the next big thing, and Solana must continue to innovate to stay relevant and attractive to developers and users alike.

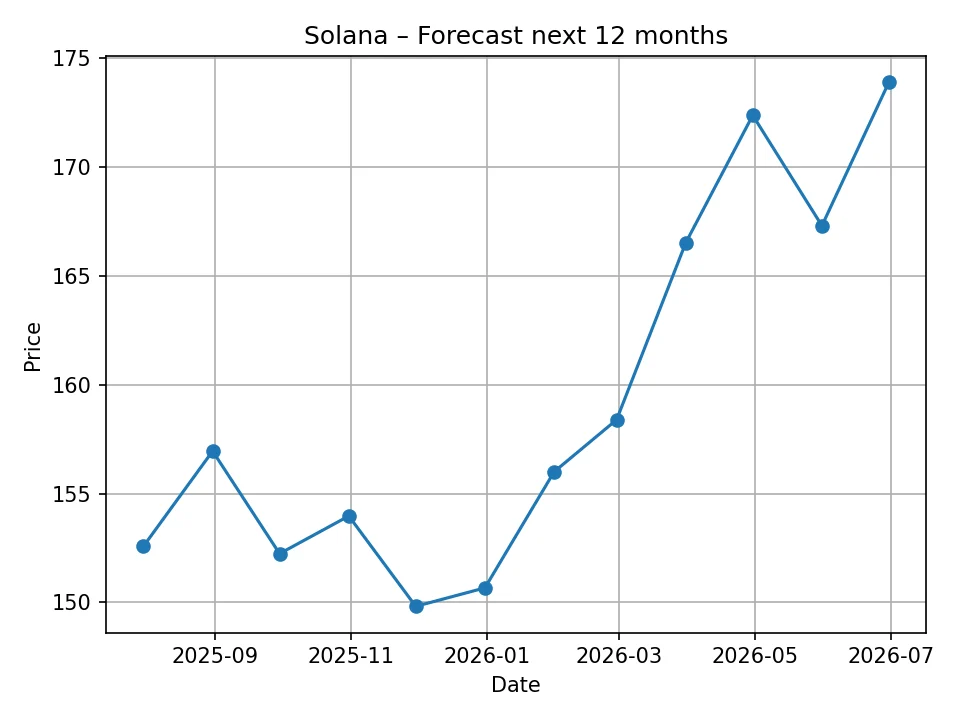

Solana Price Prediction: Short-Term Outlook

Our proprietary CleverCast algorithm has analyzed Solana’s historical data and current market conditions to provide a short-term price forecast for the next twelve months. The algorithm suggests a generally stable to gradually increasing trend, reflecting a period of consolidation and potential slow growth for Solana.

Solana (SOL) Monthly Price Forecast (USD)

| Month | Predicted Price (USD) |

|---|---|

| 2025-07 | 152.58 |

| 2025-08 | 156.95 |

| 2025-09 | 152.24 |

| 2025-10 | 153.97 |

| 2025-11 | 149.82 |

| 2025-12 | 150.67 |

| 2026-01 | 156.00 |

| 2026-02 | 158.39 |

| 2026-03 | 166.52 |

| 2026-04 | 172.37 |

| 2026-05 | 167.30 |

| 2026-06 | 173.89 |

Based on the CleverCast monthly forecast, Solana is anticipated to see a modest increase over the next year. Starting from approximately $152.58 in July 2025, the price is predicted to experience minor fluctuations but generally trend upwards, reaching an estimated $173.89 by June 2026. This projection suggests that while significant parabolic gains might not be expected in the immediate future, Solana is likely to maintain a positive trajectory, consolidating its position and potentially attracting steady investment. This short-term stability could be attributed to ongoing network improvements and a gradual expansion of its ecosystem, counterbalanced by persistent market volatility.

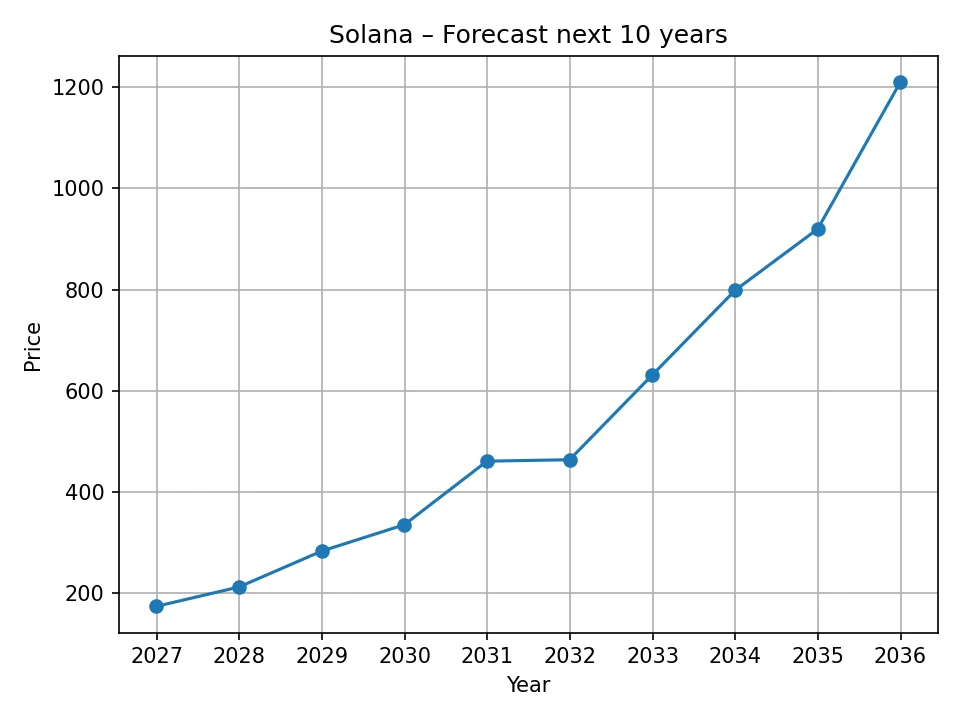

Solana Price Prediction: Long-Term Horizon

Looking beyond the immediate horizon, the CleverCast algorithm also provides a compelling long-term price prediction for Solana over the next decade, indicating substantial growth potential.

Solana (SOL) Annual Price Forecast (USD)

| Year | Predicted Price (USD) |

|---|---|

| 2026 | 173.89 |

| 2027 | 212.19 |

| 2028 | 283.18 |

| 2029 | 335.30 |

| 2030 | 460.88 |

| 2031 | 463.79 |

| 2032 | 631.62 |

| 2033 | 798.48 |

| 2034 | 919.78 |

| 2035 | 1209.89 |

The long-term forecast by CleverCast paints a highly optimistic picture for Solana. Starting from an annual average of $173.89 in 2026, the price is projected to experience consistent and significant growth, potentially reaching over $1,200 by 2035. This long-term appreciation is likely premised on several key factors: continued adoption of blockchain technology, Solana’s ability to maintain its competitive edge in scalability and performance, and the expansion of its ecosystem to attract mainstream users and enterprise solutions. If Solana successfully implements its roadmap, such as further decentralization and enhanced network stability through projects like Firedancer, and capitalizes on growing institutional interest in the blockchain space, these ambitious targets could be within reach. The predicted growth suggests that Solana could solidify its position as a leading layer-1 blockchain, driving increased utility and demand for its native token.

Opportunities and Challenges for Solana

While the future looks promising according to the CleverCast algorithm, Solana, like any cryptocurrency, faces both significant opportunities and inherent challenges that will shape its trajectory.

Opportunities

- Technological Innovation and Upgrades: The continuous development of the Solana blockchain, particularly major upgrades like Firedancer, could dramatically improve network reliability and scalability. These enhancements are crucial for attracting and retaining enterprise-level applications and institutional investors.

- Expansion of Use Cases: Solana’s high throughput makes it ideal for various bandwidth-intensive applications, including gaming, social media platforms, and high-frequency trading. As these sectors increasingly adopt blockchain technology, Solana is well-positioned to capture a significant market share.

- Growing Developer Community: A vibrant and expanding developer ecosystem is vital for any blockchain. Solana’s attractive features, such as the Rust programming language support, lower transaction costs, and strong community backing, continue to draw talented developers, leading to more innovative dApps and infrastructure.

- Institutional Adoption: As the cryptocurrency market matures, institutional investors are increasingly looking for scalable and reliable platforms. Solana’s performance metrics make it an attractive option for large-scale financial applications, potentially leading to significant capital inflows.

- Emerging Markets and Web3 Adoption: Developing economies and younger generations are often early adopters of new technologies. Solana’s low fees and fast transactions make it accessible for users in regions where traditional financial services are expensive or inefficient, fostering broader Web3 adoption.

Challenges

- Network Stability and Outages: Solana has faced a number of network outages and performance issues in the past, which have raised concerns about its reliability and decentralization. Addressing these issues definitively is paramount to restoring and maintaining full investor confidence.

- Intense Competition: The Layer 1 blockchain space is fiercely competitive. Solana must continuously innovate and differentiate itself from established players like Ethereum (especially with its ongoing scalability improvements) and other high-performance chains to maintain its market position.

- Regulatory Uncertainty: The lack of clear, consistent global cryptocurrency regulations remains a significant challenge. Adverse regulatory decisions, particularly in major economic blocs, could impact Solana’s operations, utility, and market liquidity.

- Centralization Concerns: Critics sometimes point to Solana’s relatively higher hardware requirements for validators and its initial token distribution as potential centralization concerns compared to more decentralized blockchains. Addressing these perceptions is important for long-term credibility.

- Overall Market Volatility: The broader cryptocurrency market is inherently volatile, and Solana is not immune to these swings. External economic shocks, changes in investor sentiment, or FUD (fear, uncertainty, doubt) can lead to rapid price corrections, regardless of Solana’s fundamentals.

Conclusion: Navigating Solana’s Future

Solana stands at a pivotal juncture in the cryptocurrency landscape. Its technical foundation provides a robust platform for the next generation of decentralized applications, and its ecosystem continues to expand with innovative projects. The historical data reveals a history of significant volatility, yet also periods of strong growth and resilience.

Our CleverCast algorithm’s short-term monthly forecast suggests a period of gradual appreciation for Solana, indicating sustained investor interest and ongoing development. The long-term annual prediction, extending to 2035, paints a much more ambitious picture, envisioning Solana reaching new highs and cementing its position as a leading blockchain. This long-term optimism is underpinned by the potential for continued technological advancements, wider adoption of Web3 technologies, and Solana’s ability to effectively compete and adapt in a dynamic market.

However, it is crucial for investors to remain cognizant of the inherent risks, including market volatility, regulatory changes, and the need for Solana to consistently address network stability concerns. The future success of Solana will ultimately depend on its capacity to leverage its technological strengths, foster a robust and secure ecosystem, and navigate the complex macroeconomic and regulatory environment. For those looking to invest in the future of high-performance blockchain, Solana presents a compelling, albeit volatile, opportunity.

Please note: The price predictions provided in this article are generated by our proprietary CleverCast algorithm, which uses historical data and various analytical models to forecast future prices. While we strive for accuracy, cryptocurrency markets are highly volatile and unpredictable. These forecasts should not be taken as financial advice. We are not responsible for any investment decisions made based on this information. Always conduct your own research and consult with a qualified financial advisor before making any investment.

Maxwell Reed is the first editor of Cryptovista360. He loves technology and finance, which led him to crypto. With a background in computer science and journalism, he simplifies digital currency complexities with storytelling and humor. Maxwell began following crypto early, staying updated with blockchain trends. He enjoys coffee, exploring tech, and discussing finance’s future. His motto: “Stay curious and keep learning.” Enjoy the journey with us!