The cryptocurrency market, known for its dynamic shifts and rapid innovations, continues to captivate investors and technologists alike. Among the myriad of projects vying for prominence, Sei has emerged as a distinct Layer 1 blockchain, purpose-built to revolutionize decentralized exchanges (DEXs) and high-frequency trading applications. As of mid-2025, market participants are keenly observing Sei’s trajectory, seeking to understand its potential value in an ever-evolving digital asset landscape. This comprehensive price prediction article delves into Sei’s fundamentals, historical performance, and future outlook, leveraging a proprietary algorithmic model to offer a forward-looking perspective.

Understanding Sei (SEI)

Sei is a specialized Layer 1 blockchain meticulously designed for trading. Unlike general-purpose blockchains that aim to support a wide range of decentralized applications, Sei’s core focus is on providing the fastest, most secure, and most efficient environment for trading-centric applications, including decentralized exchanges, DeFi protocols, and Web3 gaming platforms. Its unique architecture addresses the “exchange trilemma” – the challenge of achieving decentralization, scalability, and capital efficiency simultaneously.

At the heart of Sei’s innovation lies its technical prowess. It employs a novel consensus mechanism known as Twin-Turbo Consensus, which significantly reduces block finality times, making it one of the fastest chains in the industry. This high throughput and low latency are critical for trading applications, where milliseconds can mean the difference between profit and loss. Furthermore, Sei integrates a built-in order matching engine directly into its blockchain, which is a game-changer for DEXs. This feature allows for efficient and fair execution of trades, preventing front-running and ensuring a more level playing field for traders.

Sei also leverages parallelization, enabling it to process multiple transactions concurrently, further boosting its capacity. This blend of speed, specialized design, and a developer-friendly environment positions Sei as a compelling infrastructure layer for the next generation of financial applications in Web3. Its native utility token, SEI, plays a crucial role in securing the network through staking, facilitating transaction fees, and participating in governance decisions, thereby intrinsically linking its value to the network’s adoption and activity.

Historical Price Analysis of SEI (Last 12 Months)

Analyzing Sei’s price performance over the past 12 months provides crucial context for understanding its current market position and potential future movements. From June 2024 to June 2025, Sei (SEI) experienced significant volatility, reflecting both broader cryptocurrency market trends and specific developments within its ecosystem.

During this period, Sei’s price fluctuated between approximately $0.14 and $0.71 USD. The average price across these 12 months hovered around $0.44 USD. Early in this timeframe, Sei saw prices around the $0.40-$0.41 range, experiencing a dip towards the end of June 2024. Throughout the latter half of 2024, the price exhibited a general downtrend, hitting multiple lows in the $0.20-$0.30 range, with occasional bounces. Notably, there were periods of strong upward momentum, such as in late 2024 and early 2025, where SEI climbed from the $0.30s to break past $0.40 and even touch highs above $0.70. These peaks likely correlated with positive market sentiment, major project announcements, or broader altcoin rallies.

However, the latter part of the 12-month cycle, leading up to June 2025, indicates a more pronounced downward trajectory. After reaching its highs, SEI experienced a notable correction, gradually declining from its peaks and settling into a range below its historical average. The most recent price point in the historical data, leading up to the current date of June 15, 2025, stands at approximately $0.1763 USD. This represents a significant decline from its annual highs and is below the observed 12-month average. This recent downturn could be attributed to a combination of factors, including a cooling off in the broader crypto market, profit-taking by early investors, or perhaps delays in anticipated project milestones.

The historical data underscores Sei’s inherent volatility, a common characteristic of emerging altcoins. While it has demonstrated the capacity for significant price surges, it has also been susceptible to prolonged periods of consolidation or decline. Understanding these past movements is vital, as they often provide clues about how the asset might react to future market conditions and internal developments.

Key Factors Influencing Sei’s Price Trajectory

Predicting the future price of any cryptocurrency, including Sei, involves a complex interplay of various factors. These can be broadly categorized into macroeconomic trends, cryptocurrency market dynamics, and project-specific developments.

Global Economic and Macroeconomic Landscape

The broader global economic environment significantly influences investor sentiment across all asset classes, including cryptocurrencies. Factors such as inflation rates, interest rate policies by central banks (like the U.S. Federal Reserve), geopolitical events, and the overall health of traditional financial markets can either encourage or deter investment in riskier assets like crypto. When inflation is high, and interest rates rise, investors often pull funds from speculative assets, leading to downward pressure. Conversely, periods of quantitative easing or economic stimulus can inject liquidity, potentially benefiting the crypto market.

Moreover, the strengthening or weakening of the U.S. Dollar (USD) can impact the valuation of cryptocurrencies, as most are priced against it. A stronger USD typically means a weaker purchasing power for other currencies, potentially making crypto investments more expensive for international investors. Global regulatory shifts, particularly from major economic powers, also cast a long shadow. Clarity or uncertainty regarding crypto regulations can significantly impact institutional adoption and retail investor confidence.

Cryptocurrency Market Dynamics

The overall health and sentiment of the broader cryptocurrency market are paramount. Bitcoin’s performance, in particular, often sets the tone for the entire altcoin market. A Bitcoin bull run tends to pull altcoins, including Sei, upwards, while a Bitcoin correction usually leads to a broader market downturn. Events such as Bitcoin halvings, which reduce the supply of new Bitcoin, historically precede bullish cycles. However, the exact timing and magnitude of such effects are subject to debate.

Furthermore, capital flows between different blockchain ecosystems play a role. If a significant amount of capital shifts from general-purpose Layer 1s to specialized chains or vice-versa, it can impact Sei’s valuation. The total market capitalization of the crypto space, liquidity levels, and the activity of large institutional players (whales) also exert considerable influence on individual asset prices.

Sei-Specific Developments and Ecosystem Growth

Beyond external market forces, Sei’s internal growth and technological advancements are critical determinants of its long-term value:

- Technological Milestones and Roadmap Execution: The successful implementation of features outlined in Sei’s roadmap, such as further consensus upgrades, network optimizations, and increased transaction throughput, will be vital. Any delays or technical issues could undermine investor confidence.

- Ecosystem Development and dApp Adoption: The number and quality of decentralized applications (dApps) building on Sei are crucial indicators of its utility and network effect. Growth in DeFi protocols, gaming dApps, and particularly DEXs leveraging Sei’s specialized infrastructure will drive demand for SEI tokens (for transaction fees, staking, etc.).

- Partnerships and Integrations: Strategic partnerships with other blockchain projects, traditional financial institutions, or prominent Web2 companies can significantly enhance Sei’s visibility, adoption, and interoperability. Integrations with bridges or other cross-chain solutions are also important for liquidity.

- Liquidity and Trading Volume: Increased trading volume for SEI across various exchanges (both centralized and decentralized) indicates growing interest and accessibility. Higher liquidity generally makes an asset more attractive to larger investors.

- Community Engagement and Developer Activity: A vibrant and growing community of users and developers around Sei is a sign of long-term health. Active development, proposals for network upgrades, and a strong social media presence contribute to sustained interest.

- Competition: Sei operates in a highly competitive Layer 1 space, particularly against other high-performance chains like Solana, Avalanche, and Near Protocol, as well as specialized chains focusing on similar niches. Its ability to maintain a competitive edge in terms of speed, cost, and developer tools is paramount.

In essence, Sei’s price will be a function of its ability to execute on its vision, attract a robust ecosystem, and navigate the broader market and regulatory landscapes. Strong fundamentals, coupled with favorable market conditions, are necessary for sustained price appreciation.

Price Prediction Methodology: EdgePredict Algorithm

The price forecasts presented in this article are generated using a sophisticated, proprietary algorithm named EdgePredict. This advanced model is designed to analyze vast amounts of historical data, including past price movements, trading volumes, market trends, and a variety of macroeconomic indicators. EdgePredict employs a combination of machine learning techniques, statistical analysis, and pattern recognition to identify potential future price trajectories. While specific details of the algorithm remain confidential, its core strength lies in its ability to process complex, multi-dimensional data sets to derive probabilistic outcomes for digital asset valuations. It is important for readers to understand that all predictions, by their very nature, are speculative and subject to unforeseen market changes. The EdgePredict algorithm provides an informed perspective based on its computational analysis of available data, but it does not guarantee future results.

Sei (SEI) Monthly Price Forecast (Next 12 Months)

Based on the analysis by the EdgePredict algorithm, the monthly price forecast for Sei (SEI) for the next 12 months, from July 2025 to June 2026, suggests a period of relative stability with minor fluctuations, remaining within a tighter range compared to its historical volatility. The model anticipates that SEI will hover around its current price levels, with a slight upward trend towards the end of this period.

Monthly Price Forecast Table

| Month/Year | Predicted Price (USD) |

|---|---|

| 2025-07 | 0.173 |

| 2025-08 | 0.168 |

| 2025-09 | 0.164 |

| 2025-10 | 0.165 |

| 2025-11 | 0.167 |

| 2025-12 | 0.170 |

| 2026-01 | 0.170 |

| 2026-02 | 0.177 |

| 2026-03 | 0.185 |

| 2026-04 | 0.176 |

| 2026-05 | 0.178 |

| 2026-06 | 0.176 |

The forecast indicates that Sei will begin July 2025 at approximately $0.173 USD, very close to its current price. This suggests that the algorithm does not foresee an immediate significant rebound or further sharp decline in the short term. For the remainder of 2025, the price is projected to experience a slight dip, reaching a low of around $0.164 USD in September, before gradually recovering to $0.170 USD by December. This sideways to slightly bearish movement could reflect a period of market consolidation, where investors are evaluating the broader crypto market direction or waiting for more tangible developments from the Sei ecosystem.

As we move into early 2026, the EdgePredict model suggests a modest increase in momentum. January 2026 is predicted to maintain the $0.170 mark, followed by a noticeable uptick to $0.177 USD in February and a peak of $0.185 USD in March. This period of slight growth could be indicative of renewed investor interest, perhaps driven by successful project updates, increased dApp usage on the Sei network, or a more positive shift in overall crypto market sentiment following the end of the calendar year. However, this growth is not projected to be sustained in April 2026, where the price is expected to pull back to $0.176 USD, stabilizing around $0.178 USD in May and ending the 12-month period at $0.176 USD in June 2026.

Overall, the monthly forecast portrays a relatively conservative outlook for Sei over the next year. It suggests that while there might be minor fluctuations and small uptrends, SEI is likely to remain within a narrow trading range, reflecting a period of accumulation or consolidation rather than explosive growth. Investors should interpret this as a signal for potential long-term accumulation strategies if they believe in the project’s underlying technology and future adoption, rather than anticipating quick, substantial gains within this timeframe. This forecast implies that short-term catalysts might be limited, or that the market is still processing Sei’s value proposition and waiting for more widespread adoption to drive significant price movements.

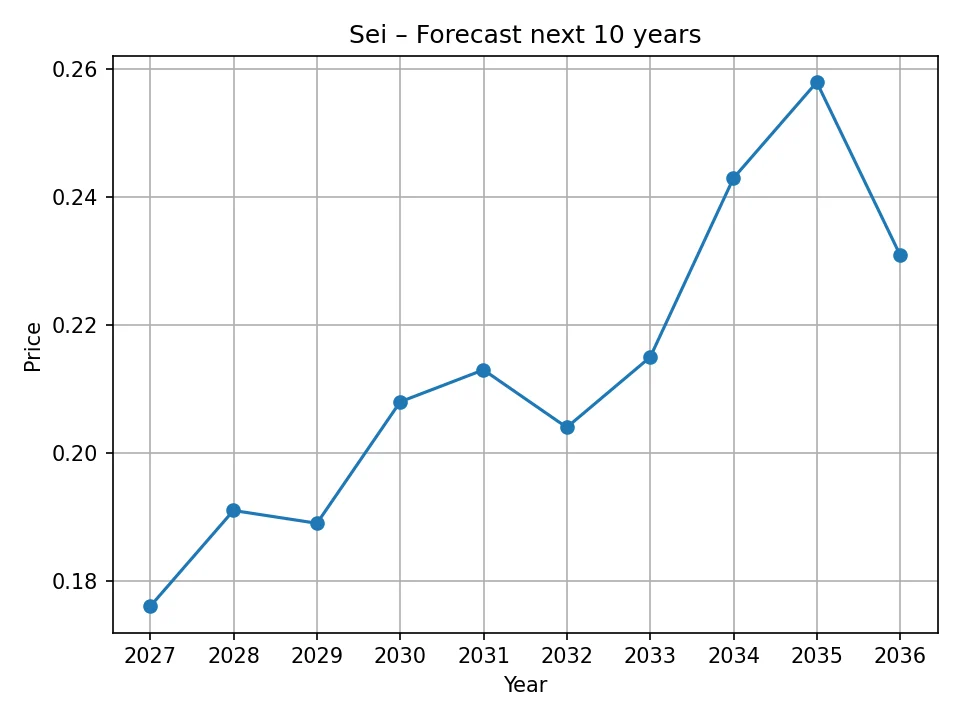

Sei (SEI) Long-Term Price Forecast (Next 10 Years)

The long-term price forecast for Sei (SEI) spanning the next decade, from 2026 to 2035, as predicted by the EdgePredict algorithm, paints a picture of gradual, sustained growth, albeit at a modest pace. The model suggests that Sei’s value will steadily appreciate over time, reaching new all-time highs within this long-term horizon, but not necessarily mirroring the parabolic surges seen in earlier crypto cycles.

Yearly Price Forecast Table

| Year | Predicted Price (USD) |

|---|---|

| 2026 | 0.176 |

| 2027 | 0.191 |

| 2028 | 0.189 |

| 2029 | 0.208 |

| 2030 | 0.213 |

| 2031 | 0.204 |

| 2032 | 0.215 |

| 2033 | 0.243 |

| 2034 | 0.258 |

| 2035 | 0.231 |

The forecast commences with an average annual price of $0.176 USD for 2026, aligning perfectly with the conclusion of the monthly forecast. This indicates that the algorithm anticipates the current consolidation phase to extend into the early years of this long-term projection. In 2027, a moderate increase is predicted, with the average price rising to $0.191 USD. This upward movement suggests that Sei might begin to gain more traction as its ecosystem matures and its specialized Layer 1 capabilities become more recognized by developers and users.

However, 2028 shows a slight dip to $0.189 USD, suggesting that long-term growth might not be linear and could include periods of minor corrections or market re-evaluation. This could be due to broader market cycles, increased competition, or natural ebbs and flows in adoption. The growth trend resumes in 2029, with the price reaching $0.208 USD, and continuing into 2030 at $0.213 USD. These years could potentially align with major advancements in decentralized finance, increased demand for high-speed trading infrastructure, and greater integration of Web3 technologies into mainstream applications.

A minor pullback to $0.204 USD is projected for 2031, reinforcing the idea that even in a long-term uptrend, market volatility and corrections are inherent. The most significant growth within this 10-year span is predicted to occur from 2032 to 2034. Sei is forecasted to climb to $0.215 USD in 2032, then accelerate to $0.243 USD in 2033, and ultimately reach its peak within this forecast period at $0.258 USD in 2034. This projected peak in the mid-2030s could signify a period where Sei has firmly established itself as a leading blockchain for trading, attracting substantial liquidity and a large user base. By this point, its technical advantages might have translated into significant market share, driving demand for the SEI token.

Finally, the forecast for 2035 shows a slight retreat to $0.231 USD. This ending value, while still significantly higher than current prices, suggests that the growth might stabilize or experience a modest correction after its peak, perhaps as new technologies emerge or market dynamics shift once again. It is important to note that even at its projected peak of $0.258 USD, this long-term forecast does not see Sei returning to its historical highs witnessed in early 2025 (around $0.71 USD). This conservative long-term outlook implies that while Sei is expected to grow, the algorithm anticipates a more mature market environment where extreme price volatility might be less common, or that its current market positioning sets a new baseline for future growth that is lower than its initial peak. Investors considering a long-term position in Sei based on these predictions should focus on the steady, incremental growth rather than expecting rapid, multi-fold returns that were characteristic of earlier, less mature crypto markets. This suggests that Sei’s value appreciation will be driven more by fundamental adoption and utility than speculative hype.

Risks and Challenges for Sei

While Sei presents a compelling value proposition as a specialized Layer 1 blockchain for trading, its journey to widespread adoption and sustained price appreciation is not without significant risks and challenges. Understanding these potential hurdles is crucial for any investor considering SEI.

- Market Volatility: The cryptocurrency market is inherently volatile. Even well-established assets experience dramatic price swings, and newer, less liquid assets like Sei are even more susceptible. Broader market downturns, often triggered by macroeconomic events, regulatory crackdowns, or shifts in investor sentiment, can disproportionately affect altcoins.

- Intense Competition: The Layer 1 blockchain space is fiercely competitive. Sei faces formidable rivals such as Solana, Avalanche, and Near Protocol, which also boast high transaction speeds and growing ecosystems. Moreover, it must contend with other specialized chains and evolving Layer 2 solutions that aim to address scalability and efficiency for DeFi and trading. Sei’s long-term success hinges on its ability to consistently outperform and innovate faster than its competitors.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains fragmented and uncertain across different jurisdictions. Onerous regulations, particularly concerning decentralized exchanges or specific DeFi protocols that might build on Sei, could hinder adoption or even force projects to relocate or cease operations. Clarity in regulation could be beneficial, but adverse regulatory actions pose a significant risk.

- Technological Risks: Despite its advanced architecture, any blockchain project carries inherent technological risks. Bugs in the code, network vulnerabilities, successful hacks, or consensus failures could severely damage trust and lead to a rapid devaluation of the token. The success of future upgrades and the continuous security auditing of the network are paramount.

- Adoption and Network Effect: For Sei to truly thrive, it needs a strong network effect – a critical mass of developers building dApps and users actively trading or interacting on the chain. Attracting developers away from more established ecosystems can be challenging, requiring substantial grants, developer support, and a compelling user experience. If adoption remains limited, the utility and demand for the SEI token will be constrained.

- Liquidity and Market Depth: While Sei aims to facilitate high liquidity for dApps on its network, the liquidity of the SEI token itself on exchanges is also important. Insufficient liquidity can lead to higher price volatility and make it difficult for large investors to enter or exit positions without significantly impacting the price.

- Dependence on Decentralized Trading: Sei’s primary value proposition is its optimization for decentralized trading. If the broader trend shifts away from DEXs towards centralized exchanges due to regulatory pressures, user preference for simplicity, or other factors, Sei’s core utility might be diminished.

These risks highlight the speculative nature of investing in emerging cryptocurrency projects. While Sei’s technological foundation is strong, its future success will depend on its ability to mitigate these challenges, adapt to market changes, and continuously deliver on its promises.

Conclusion

Sei represents a significant innovation in the blockchain space, specifically designed to address the unique demands of high-performance decentralized trading. Its specialized Layer 1 architecture, featuring a Twin-Turbo Consensus and a built-in order matching engine, positions it as a promising contender in the competitive landscape of decentralized finance and Web3 applications. Historical data reveals a volatile journey for SEI, marked by both substantial rallies and periods of significant correction, reflecting its nature as a relatively new and dynamic digital asset.

Looking forward, the EdgePredict algorithm’s monthly forecast for the next 12 months (July 2025 – June 2026) suggests a phase of relatively stable price action for Sei, largely consolidating around the $0.16 to $0.18 USD range. This indicates that while minor fluctuations are expected, the immediate future may not see dramatic parabolic growth but rather a period of market re-evaluation and potential accumulation. For long-term investors, the 10-year forecast (2026 – 2035) offers a more optimistic outlook, projecting gradual but sustained growth for SEI. The algorithm anticipates a steady appreciation, with prices potentially reaching around $0.258 USD by 2034, before a slight moderation. This long-term trend suggests that if Sei successfully executes its roadmap, fosters a thriving ecosystem, and overcomes competitive and regulatory challenges, its value could steadily increase over time, albeit with a more modest trajectory compared to the peak highs observed in early 2025.

The success of Sei, and consequently the value of its SEI token, will ultimately depend on several critical factors: its ability to attract and retain developers, the widespread adoption of dApps on its network, favorable macroeconomic conditions, and the evolution of the regulatory environment for decentralized technologies. While the specialized nature of Sei provides a clear competitive edge in its niche, it also exposes it to the inherent risks of a focused market. As with all cryptocurrency investments, thorough personal research, a comprehensive understanding of the associated risks, and a clear investment strategy are paramount.

Disclaimer: The price predictions provided in this article are generated using a proprietary algorithmic model (EdgePredict) and are based on the analysis of historical data and current market trends. These forecasts are purely speculative and should not be considered financial advice. The cryptocurrency market is highly volatile and unpredictable, and actual prices may differ significantly from the predicted values. Investing in cryptocurrencies carries a high level of risk, and you could lose all of your invested capital. We are not responsible for any investment decisions made based on the information presented herein. Always consult with a qualified financial professional before making any investment decisions.

Maxwell Reed is the first editor of Cryptovista360. He loves technology and finance, which led him to crypto. With a background in computer science and journalism, he simplifies digital currency complexities with storytelling and humor. Maxwell began following crypto early, staying updated with blockchain trends. He enjoys coffee, exploring tech, and discussing finance’s future. His motto: “Stay curious and keep learning.” Enjoy the journey with us!