The cryptocurrency market, known for its dynamic and often unpredictable movements, continues to attract significant attention from investors and enthusiasts alike. Within this vibrant ecosystem, decentralized finance (DeFi) protocols play a crucial role, offering innovative solutions for trading, lending, and yield generation. Among these, Raydium (RAY) stands out as a prominent automated market maker (AMM) and liquidity provider built on the Solana blockchain, distinguishing itself with its unique blend of features and emphasis on high-speed, low-cost transactions.

As of June 5, 2025, the digital asset landscape is constantly evolving, with new narratives and technological advancements shaping the future of various projects. Raydium, by leveraging Solana’s robust infrastructure, aims to deliver a superior trading experience by integrating an on-chain order book with a traditional AMM, a characteristic that sets it apart from many other DeFi platforms. This article delves into a comprehensive price prediction for Raydium (RAY), analyzing its historical performance, identifying key influencing factors, and leveraging advanced algorithmic forecasts to project its potential trajectory in the short to long term. Understanding these elements is essential for anyone looking to navigate the complexities and opportunities presented by this innovative DeFi protocol.

Understanding Raydium (RAY) and Its Core Value Proposition

Raydium is more than just a decentralized exchange (DEX); it’s a foundational piece of the Solana DeFi ecosystem. Launched in February 2021, its primary goal was to provide liquidity and new features to the burgeoning Solana network, which was rapidly gaining traction for its high throughput and low transaction fees. Unlike many AMMs that rely solely on liquidity pools, Raydium takes a hybrid approach by routing orders to Serum’s central limit order book, allowing for faster trades, deeper liquidity, and more competitive pricing.

This integration with Serum is a significant differentiator. When users swap tokens on Raydium, the protocol either uses its own liquidity pools or taps into Serum’s order book, ensuring that users always get the best possible price for their trades. This hybrid model offers the best of both worlds: the ease of use of an AMM with the efficiency and depth of a traditional order book exchange.

Beyond its core exchange functionalities, Raydium offers a suite of DeFi services that enhance its utility and appeal. Liquidity Provision is central to its operation; users can deposit token pairs into liquidity pools to earn trading fees, thereby providing the necessary capital for swaps. This is a fundamental component of any AMM, rewarding participants for contributing to the platform’s liquidity. Moreover, Raydium also features Yield Farming, where liquidity providers can stake their LP (Liquidity Provider) tokens to earn additional RAY tokens, further incentivizing participation and commitment to the platform’s growth.

The RAY token itself is the native utility and governance token of the Raydium ecosystem. Holders of RAY can stake their tokens to earn a portion of protocol fees, participate in governance decisions, and gain access to exclusive features. This includes participation in AcceleRaytor, Raydium’s launchpad platform, which helps new projects raise capital and launch their tokens on the Solana network. This feature is particularly valuable as it positions Raydium as a key enabler for new innovations within the Solana ecosystem, attracting more users and developers to its platform.

The fundamental advantages of building on Solana are critical to Raydium’s performance. Solana’s ability to process tens of thousands of transactions per second (TPS) with near-instant finality and minimal transaction costs (USD 0.00025 per transaction, on average) provides Raydium with a robust and scalable foundation. These technical capabilities directly translate into a smoother, more efficient, and cost-effective user experience compared to many Ethereum-based DEXs, which often grapple with network congestion and high gas fees. Raydium’s strategic position within this high-performance network is a major factor in its long-term viability and growth potential.

Historical Price Performance of Raydium (RAY) Over the Last 12 Months

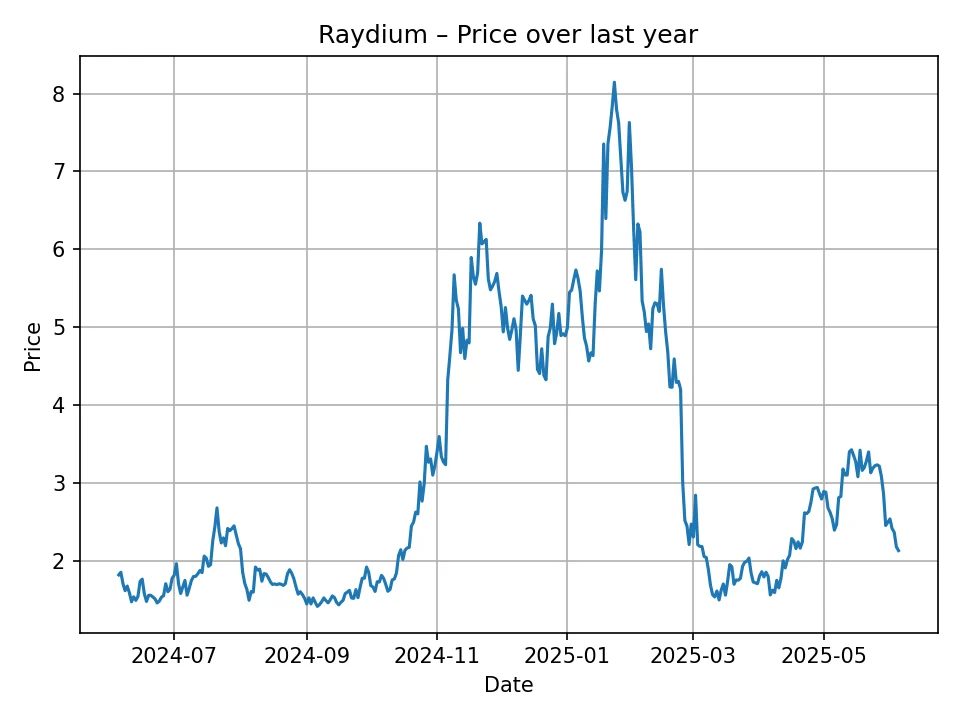

Analyzing the historical price data for Raydium (RAY) over the past 12 months provides crucial context for understanding its current market position and potential future movements. From June 2024 to June 2025, RAY has experienced significant fluctuations, characteristic of the broader cryptocurrency market’s volatility. The provided daily historical data indicates a journey marked by periods of sustained growth, sharp corrections, and phases of consolidation. Let’s examine this trajectory, noting key trends and price points.

At the beginning of this 12-month period, around early June 2024, RAY was trading in the range of USD 1.80 to USD 1.90. The initial months saw some consolidation, with prices generally ranging between USD 1.40 and USD 2.00. There were notable spikes, such as the period in July 2024, where RAY briefly touched around USD 2.67, indicating strong buying interest at certain junctures. However, these peaks were often followed by pullbacks, reflecting profit-taking and overall market caution.

The latter half of 2024 brought increased momentum. By October and November 2024, RAY started to show more consistent upward movement. It surpassed the USD 3.00 mark, reaching as high as USD 3.46 in November 2024. This bullish trend continued into early 2025, with a significant surge in January and February 2025. During this period, RAY broke through previous resistance levels, ascending rapidly from around USD 4.00 to over USD 7.00. A notable high was observed in early February 2025, where the price reached an impressive USD 8.14, showcasing strong market confidence and a clear upward trajectory. This spike was likely influenced by broader bullish sentiment in the crypto market, possibly tied to Bitcoin’s performance or growing interest in the Solana ecosystem.

However, the rapid ascent was met with an equally sharp correction in late February and March 2025. Prices plummeted from the USD 7-8 range down to approximately USD 4.00 to USD 5.00, reflecting typical market retracements after significant rallies. This period demonstrated the inherent volatility of crypto assets, where even strong gains can be quickly reversed. April and May 2025 saw further downward pressure, with RAY trading mostly in the USD 2.00 to USD 3.00 range, occasionally dipping below USD 2.50.

The current price, based on the last data point provided, hovers around USD 2.13 as of June 5, 2025. This suggests that while RAY experienced substantial growth and excitement earlier in the year, it has since corrected significantly, settling into a lower range. This recent price action could be attributed to a number of factors, including broader market corrections, shifts in investor sentiment, or specific developments (or lack thereof) within the Raydium or Solana ecosystem. The journey from a low of USD 1.41 to a high of USD 8.14 and then back to USD 2.13 within a year underscores the speculative nature of cryptocurrency investments and the importance of understanding market cycles.

Key Factors Influencing Raydium’s Price Trajectory

The price of Raydium (RAY), like any other cryptocurrency, is subject to a complex interplay of various factors. Understanding these influences is crucial for forming a holistic view of its potential future price movements. These factors can broadly be categorized into market-wide trends, ecosystem-specific developments, technological advancements, and regulatory considerations.

1. Broader Cryptocurrency Market Sentiment

The most significant overarching factor is the general sentiment of the cryptocurrency market. If Bitcoin (BTC) and Ethereum (ETH) experience a strong bullish trend, driven by institutional adoption, favorable regulatory news, or increased retail participation, altcoins like RAY often follow suit. Conversely, a bear market, characterized by price declines across the board, geopolitical tensions, or negative regulatory announcements, will inevitably exert downward pressure on RAY’s price. The market’s overall risk appetite dictates much of the short-term volatility and long-term trends for individual assets.

2. Solana Ecosystem Growth and Performance

Raydium is intricately linked to the success and health of the Solana blockchain. As a native DeFi protocol on Solana, its growth is directly proportional to the adoption, stability, and development within the Solana ecosystem. Factors such as new dApp launches on Solana, increased transaction volume on the network, improvements in network stability (addressing past outages), and Solana’s ability to attract more developers and users will directly benefit Raydium. A thriving Solana ecosystem translates to higher demand for liquidity and trading services, which Raydium provides.

3. Platform Development and Innovation

Continuous innovation and development by the Raydium team are vital for sustained growth. This includes upgrading the core AMM and order book functionalities, implementing new features (e.g., concentrated liquidity, improved UI/UX, cross-chain capabilities), and forming strategic partnerships. For instance, enhancements that make Raydium more efficient, secure, or user-friendly can attract more liquidity providers and traders, increasing the platform’s total value locked (TVL) and trading volume. Conversely, stagnation or unaddressed technical issues could lead to a decline in user engagement and price.

4. Competition in the DeFi Space

The decentralized exchange landscape is highly competitive. Raydium faces competition not only from other AMMs on Solana (like Orca, Jupiter, and Saber) but also from DEXs on other high-performance chains (e.g., Avalanche, Polygon, BNB Chain). The ability of Raydium to maintain its competitive edge through unique features, superior execution, and strong community engagement will be critical. If other platforms offer more attractive yield farming opportunities, better liquidity, or faster trading, it could draw users away from Raydium, impacting its token value.

5. Regulatory Environment

The evolving global regulatory landscape for cryptocurrencies poses both opportunities and threats. Clear and favorable regulations could foster broader adoption and institutional investment, benefiting projects like Raydium. However, restrictive regulations, bans, or increased scrutiny on DeFi protocols could stifle innovation and participation, leading to price declines. Compliance with potential future regulations regarding KYC/AML (Know Your Customer/Anti-Money Laundering) or specific DeFi activities will be a significant challenge for all decentralized platforms.

6. Macroeconomic Factors

Broader macroeconomic conditions, such as inflation rates, interest rate decisions by central banks, and global economic stability, can indirectly influence crypto prices. During periods of high inflation or economic uncertainty, some investors might turn to cryptocurrencies as a hedge, while others might de-risk by selling volatile assets. The availability of capital and investor confidence in traditional markets can also impact the flow of funds into the riskier cryptocurrency market.

7. Tokenomics and Supply Dynamics

The tokenomics of RAY, including its total supply, circulating supply, vesting schedules for team and early investors, and token burning mechanisms, play a role in its price. If a significant portion of locked tokens is released into the market, it could increase selling pressure. Conversely, successful token burning events or high demand for staking RAY for governance or launchpad participation can create scarcity and support the price. The utility of the RAY token within the ecosystem (e.g., fee discounts, staking rewards, governance rights) directly impacts its demand.

8. Trading Volume and Liquidity

High trading volume and deep liquidity are indicators of a healthy and active DEX. Increased trading activity on Raydium means more fees generated for liquidity providers and the protocol, enhancing the value proposition of the RAY token. High liquidity also reduces slippage for traders, making the platform more attractive. A sustained increase in trading volume suggests growing adoption and utility, which can positively influence the price.

Considering these factors collectively provides a nuanced perspective on Raydium’s potential price movements. While some factors are internal to the project, many are external and subject to broader market forces.

Raydium (RAY) Price Prediction: Short-Term Outlook (2025-2026)

Based on the AlphaForecast algorithm, Raydium (RAY) is projected to experience gradual but steady growth over the next 12 months. This short-term forecast suggests a period of consolidation and moderate appreciation, building upon its current foundational value within the Solana ecosystem. As of June 5, 2025, with a current price around USD 2.13, the algorithm anticipates a positive trajectory.

For July 2025, the prediction stands at USD 2.13, indicating a period of stabilization from the current price. This suggests that the immediate volatility might subside, allowing RAY to establish a new support level. Moving into late summer, August 2025 shows a slight increase to USD 2.14, followed by a more noticeable jump in September 2025 to USD 2.26. This modest rise in the third quarter could be attributed to a general recovery in the broader crypto market or specific positive developments within the Solana ecosystem that directly benefit DEXs like Raydium.

The algorithm predicts a slight dip in October 2025 to USD 2.20, which could be a minor correction before resuming its upward trend. November and December 2025 are forecasted to show incremental gains, reaching USD 2.27 and USD 2.30 respectively. The end of 2025 could see Raydium closing the year above the USD 2.30 mark, signifying a healthy recovery from its recent lows.

Entering 2026, the positive momentum is expected to continue. January 2026 is projected at USD 2.31, with February 2026 seeing a more significant increase to USD 2.40. March 2026 might experience a minor pullback to USD 2.33, highlighting the inherent ebb and flow of crypto prices even within an overall bullish trend. The spring months of 2026, April and May, are predicted to bring further gains, reaching USD 2.41 and USD 2.43 respectively.

By June 2026, exactly one year from the current date, the AlphaForecast algorithm anticipates Raydium to reach USD 2.59. This represents an increase of approximately 21% from its current price of USD 2.13, suggesting a relatively conservative yet consistent growth over the short term. This forecast might indicate that the algorithm expects Raydium to benefit from steady adoption, continued development on Solana, and perhaps a stable or moderately bullish overall crypto market environment. It suggests that while dramatic spikes might not be the primary expectation, a reliable upward movement is projected, making it a potentially stable asset for the short-term horizon.

Raydium (RAY) Monthly Price Forecast (July 2025 – June 2026)

The following table provides a detailed monthly price prediction for Raydium (RAY) in USD, according to the AlphaForecast algorithm:

| Month/Year | Predicted Price (USD) |

|---|---|

| July 2025 | 2.13 |

| August 2025 | 2.14 |

| September 2025 | 2.26 |

| October 2025 | 2.20 |

| November 2025 | 2.27 |

| December 2025 | 2.30 |

| January 2026 | 2.31 |

| February 2026 | 2.40 |

| March 2026 | 2.33 |

| April 2026 | 2.41 |

| May 2026 | 2.43 |

| June 2026 | 2.59 |

This table illustrates a steady, incremental increase, reflecting the algorithm’s expectation of sustained growth within the Raydium and Solana ecosystems.

Raydium (RAY) Price Prediction: Long-Term Outlook (2026-2035)

The long-term price prediction for Raydium (RAY) extending from 2026 to 2035, as projected by the AlphaForecast algorithm, paints an optimistic picture of sustained growth and significant appreciation. This extended forecast takes into account the potential for broader cryptocurrency adoption, the continued maturation of the Solana ecosystem, and Raydium’s evolving role within the decentralized finance landscape.

Starting from the projected USD 2.59 at the end of 2026, the algorithm anticipates a steady ascent. For 2027, the price is forecasted to reach USD 2.90. This indicates continued, albeit moderate, growth as Raydium solidifies its market position and the Solana network potentially attracts more institutional and retail users.

The momentum is expected to pick up significantly in the subsequent years. By 2028, RAY is predicted to reach USD 3.65, demonstrating a more accelerated growth rate. This could be driven by a confluence of factors, including potential advancements in Raydium’s core technology, successful integration of new DeFi primitives, or a general crypto bull run fueled by wider mainstream acceptance. This period often aligns with Bitcoin’s halving cycles, which historically trigger broader market rallies.

The upward trend continues into 2029, with a forecast of USD 4.42, and by 2030, RAY is projected to hit USD 4.94. This steady increase suggests that Raydium is expected to maintain its relevance and utility in a maturing DeFi market. By this time, decentralized exchanges might have captured a larger share of the overall trading volume, benefiting well-established platforms like Raydium.

Looking further into the decade, the predictions become even more compelling. In 2031, RAY is forecasted to reach USD 5.79. The algorithm anticipates substantial growth in the mid-2030s, reflecting a vision where blockchain technology and decentralized finance become even more ingrained in global financial systems. For 2032, the projection stands at USD 7.46, marking a significant leap. This kind of growth could be indicative of Raydium achieving a dominant position within the Solana DeFi landscape or even expanding its reach through cross-chain interoperability solutions.

The latter half of the decade continues this strong positive outlook. By 2033, RAY is predicted to be at USD 8.21, surpassing its historical high from early 2025. This suggests that the algorithm believes Raydium has the potential not only to recover its past glory but to establish new all-time highs. The forecast for 2034 is USD 9.18, approaching the double-digit mark. Finally, by 2035, the AlphaForecast algorithm projects Raydium (RAY) to reach an impressive USD 10.51. This long-term projection implies a belief in Raydium’s fundamental value, its ability to adapt to market changes, and the overall enduring growth of the Solana ecosystem and decentralized finance as a whole. Such a forecast would signify a substantial return on investment from current levels, assuming the market evolves favorably and Raydium continues to innovate and expand its user base.

Raydium (RAY) Yearly Price Forecast (2026 – 2035)

The following table outlines the long-term price predictions for Raydium (RAY) in USD, generated by the AlphaForecast algorithm:

| Year | Predicted Price (USD) |

|---|---|

| 2026 | 2.59 |

| 2027 | 2.90 |

| 2028 | 3.65 |

| 2029 | 4.42 |

| 2030 | 4.94 |

| 2031 | 5.79 |

| 2032 | 7.46 |

| 2033 | 8.21 |

| 2034 | 9.18 |

| 2035 | 10.51 |

This table illustrates a clear growth trend over the next decade, with significant acceleration anticipated in the latter half of the period, reflecting the potential maturation and expansion of the DeFi sector.

Expert Opinions and Market Consensus

While specific expert opinions on Raydium’s precise price trajectory can vary widely, a general consensus among market analysts and industry observers often revolves around several key themes concerning DeFi protocols on high-performance blockchains like Solana. Many experts acknowledge the fundamental strengths of Raydium, particularly its hybrid AMM and order book model, which provides a unique advantage in liquidity and execution efficiency.

Optimistic analysts often highlight Solana’s technological superiority in terms of speed and cost as a primary driver for Raydium’s potential growth. They foresee a future where more dApps and users migrate to Solana due to its scalability, thereby increasing demand for Raydium’s services (swaps, liquidity provision, launchpad). The AcceleRaytor launchpad is frequently cited as a significant value proposition, as it enables Raydium to be at the forefront of new project innovation within the Solana ecosystem, attracting fresh capital and attention.

Furthermore, analysts who favor long-term DeFi adoption believe that as decentralized finance becomes more mainstream and regulated, well-established and robust platforms like Raydium will be ideally positioned to capture a larger market share. They argue that the utility of the RAY token, encompassing governance, staking rewards, and participation in the launchpad, creates a strong demand-side dynamic that could support its price appreciation over time.

However, more cautious or conservative experts often point to the inherent volatility of the crypto market and the intense competition within the DEX space. They emphasize that while Solana offers advantages, the ecosystem is still maturing and susceptible to network issues or challenges in attracting consistent developer talent. Concerns about regulatory uncertainty, potential security vulnerabilities (smart contract risks), and the possibility of new, more innovative DeFi protocols emerging could temper long-term expectations. Some also stress that the market capitalization of Raydium is still relatively small compared to industry giants, making it more susceptible to large price swings due to market sentiment or whale activity.

Overall, the market consensus seems to be cautiously optimistic for Raydium’s long-term potential, largely contingent on the continued success and growth of the Solana blockchain and Raydium’s ability to innovate and maintain its competitive edge. Most analysts agree that while short-term price movements will remain volatile, the underlying technology and utility of Raydium position it as a significant player in the evolving DeFi landscape.

Risks and Challenges for Raydium (RAY)

Despite its innovative approach and strong position within the Solana ecosystem, Raydium (RAY) faces several risks and challenges that could impact its future price trajectory. A balanced perspective requires acknowledging these potential headwinds:

1. Intense Competition within DeFi

The decentralized exchange landscape is highly saturated and fiercely competitive. Raydium must continually innovate to stand out against other established DEXs on Solana (e.g., Orca, Jupiter, Phoenix) and increasingly sophisticated cross-chain solutions. New protocols with novel features or more aggressive incentive programs could attract liquidity and users away from Raydium, putting downward pressure on its trading volume and TVL.

2. Solana Network Stability and Performance

Raydium’s performance is inextricably linked to the stability and efficiency of the Solana blockchain. While Solana has significantly improved its network reliability, past outages and periods of congestion have highlighted a vulnerability. Any future network disruptions, whether due to technical issues, increased demand, or malicious attacks, could directly impair Raydium’s functionality, erode user trust, and lead to capital flight. Perceived instability of the underlying blockchain could deter both users and developers.

3. Smart Contract Vulnerabilities and Security Risks

As a DeFi protocol, Raydium relies heavily on complex smart contracts. These contracts are always susceptible to bugs, exploits, or hacks. A successful security breach, such as a major exploit leading to loss of user funds, could have devastating consequences for Raydium’s reputation, user confidence, and subsequently, its token price. While audits are conducted, the risk of unforeseen vulnerabilities remains a persistent challenge in the DeFi space.

4. Regulatory Uncertainty

The regulatory environment for cryptocurrencies and decentralized finance is still evolving globally. Governments and financial authorities are increasingly scrutinizing DeFi protocols, particularly concerning issues like anti-money laundering (AML), know-your-customer (KYC) requirements, and investor protection. Unfavorable regulations, outright bans in certain jurisdictions, or strict compliance requirements could force Raydium to alter its operations, limit its accessibility, or face legal challenges, thereby impeding its growth and adoption.

5. Market Volatility and Liquidity Fluctuations

The broader cryptocurrency market is inherently volatile, subject to rapid and unpredictable price swings driven by macro-economic factors, geopolitical events, or sudden shifts in investor sentiment. As an altcoin, RAY is generally more susceptible to these market-wide movements than larger cryptocurrencies like Bitcoin or Ethereum. Furthermore, liquidity in DeFi pools can fluctuate. If liquidity providers withdraw their assets, it can lead to increased slippage for traders, making the platform less attractive and potentially reducing overall trading volume.

6. Tokenomics and Inflationary Pressures

While the RAY token has utility, its long-term value depends on a delicate balance of supply and demand. If the rate of token emissions (e.g., through yield farming rewards) outpaces the demand for its utility, it could lead to inflationary pressures and price dilution. The team must carefully manage token distribution and implement effective burning mechanisms or demand drivers to ensure the long-term scarcity and value of RAY.

7. Dependence on Serum (and the broader Solana DeFi infrastructure)

Raydium’s hybrid model relies on Serum’s central limit order book. While this offers advantages, it also means Raydium is somewhat dependent on Serum’s continued operation and success. Any issues with Serum or significant changes to its protocol could potentially affect Raydium’s core functionality. More broadly, its deep integration into the Solana DeFi stack means any systemic issues within that infrastructure could cascade to Raydium.

Addressing these risks requires continuous innovation, robust security measures, adaptive strategies to regulatory changes, and strong community engagement. The ability of the Raydium team to navigate these challenges will be crucial for its long-term success and price appreciation.

Conclusion

Raydium (RAY), as a pivotal decentralized exchange and liquidity provider on the Solana blockchain, presents a compelling case for its long-term potential within the rapidly expanding decentralized finance landscape. Its innovative hybrid model, combining an Automated Market Maker with Serum’s central limit order book, offers users a unique blend of efficiency, deep liquidity, and competitive pricing. Coupled with its suite of DeFi features, including liquidity provision, yield farming, and the AcceleRaytor launchpad, Raydium has carved out a significant niche by leveraging Solana’s high-speed and low-cost infrastructure.

The historical price performance of RAY over the past year has been a testament to both its growth potential and the inherent volatility of the crypto market, showcasing periods of significant appreciation followed by natural corrections. Despite recent pullbacks, the algorithmic forecast from AlphaForecast suggests a cautiously optimistic outlook for Raydium’s future. The short-term monthly predictions indicate a steady recovery and gradual ascent through 2025 and into mid-2026, consolidating its value above the USD 2.50 mark.

Looking further ahead, the long-term yearly predictions through 2035 paint a more robust growth picture, projecting RAY to potentially surpass its previous all-time highs and even reach the USD 10.00 threshold. This optimistic forecast is predicated on several key factors: the continued maturation and scalability of the Solana ecosystem, Raydium’s ongoing innovation and development, broader adoption of decentralized finance, and favorable macroeconomic conditions. The utility of the RAY token as a governance asset and a gateway to new projects through AcceleRaytor will likely contribute significantly to its demand and scarcity over time.

However, it is equally important to acknowledge the inherent risks. The intense competition within the DeFi space, the potential for smart contract vulnerabilities, evolving regulatory landscapes, and the overarching volatility of the cryptocurrency market all pose significant challenges. Furthermore, Raydium’s reliance on the Solana network means its performance is inextricably linked to Solana’s continued stability and growth. Investors must consider these factors carefully.

In summary, Raydium’s strategic position on Solana, coupled with its robust set of features, provides a strong foundation for future growth. While the path ahead may be marked by market fluctuations, the long-term outlook, as suggested by algorithmic analysis, points towards a positive trajectory for RAY. For those considering an investment, comprehensive research, an understanding of the underlying technology, and a clear grasp of personal risk tolerance are paramount. The world of digital assets demands diligence and a forward-looking perspective.

Please note: We are not responsible for the price predictions provided. The price forecasts in this article have been generated using a proprietary algorithm (AlphaForecast) and should be considered for informational purposes only. The cryptocurrency market is highly volatile, and actual prices may vary significantly from these predictions. Investing in cryptocurrencies carries substantial risk, and individuals should conduct their own thorough research and consult with a financial advisor before making any investment decisions.

Maxwell Reed is the first editor of Cryptovista360. He loves technology and finance, which led him to crypto. With a background in computer science and journalism, he simplifies digital currency complexities with storytelling and humor. Maxwell began following crypto early, staying updated with blockchain trends. He enjoys coffee, exploring tech, and discussing finance’s future. His motto: “Stay curious and keep learning.” Enjoy the journey with us!