Pudgy Penguins have emerged as a significant force within the burgeoning non-fungible token (NFT) landscape, transcending their initial role as mere digital collectibles to become a prominent brand synonymous with innovation and community in Web3. Launched in July 2021, this collection of 8,888 unique penguin avatars quickly captivated the attention of crypto enthusiasts and mainstream audiences alike. Beyond their charming aesthetics, Pudgy Penguins have cultivated a robust and engaged community, often referred to as the “Huddle,” which forms the bedrock of their enduring appeal and intrinsic value.

What sets Pudgy Penguins apart in a crowded NFT market is their ambitious vision for real-world integration and intellectual property (IP) utilization. The project has pioneered novel approaches, including the launch of physical plush toys and figurines based on the digital assets, known as Pudgy Toys. These toys come with scannable NFC chips, allowing owners to verify authenticity and claim digital counterparts in the “Pudgy World” metaverse. This bridging of the digital and physical realms represents a crucial step towards broader adoption and understanding of NFTs, transforming abstract digital art into tangible products that resonate with a wider demographic. The success of Pudgy Toys, retailing in major outlets like Walmart, underscores the brand’s ability to penetrate traditional markets, offering a unique value proposition that extends beyond mere digital ownership.

The strategic leadership under Luca Netz has further propelled the brand, emphasizing sustained growth, community empowerment, and the development of a comprehensive ecosystem. Initiatives like Pudgy World, a metaverse experience, and the upcoming LIL Pudgys collection, which serves as a breeding mechanism and utility token for the ecosystem, are testament to the project’s long-term aspirations. These developments aim to create a self-sustaining economy and a vibrant interactive environment for holders, continually adding utility and intrinsic value to the core Pudgy Penguin NFTs. As the cryptocurrency and NFT markets evolve, understanding the trajectory of such influential projects becomes paramount for investors and enthusiasts alike. This article delves into the historical performance of Pudgy Penguins and provides a forward-looking price prediction, offering insights into its potential future in the dynamic digital asset space.

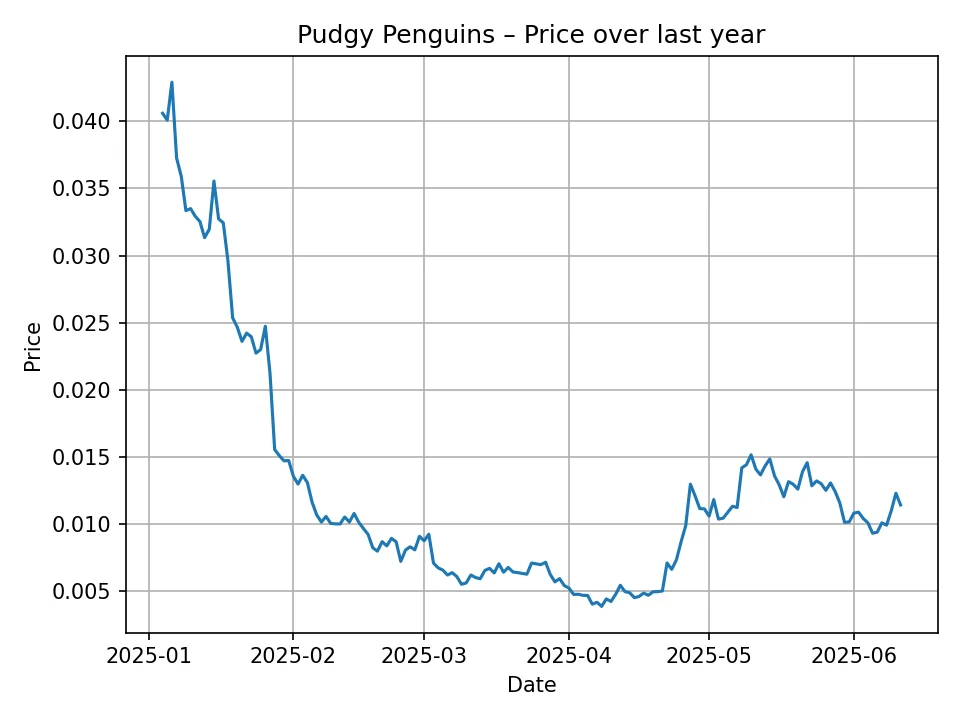

Historical Price Performance of Pudgy Penguins (Last 12 Months)

Analyzing the historical price data of Pudgy Penguins over the past 12 months provides crucial insights into the asset’s volatility, market sentiment, and underlying trends. The period from June 2024 to June 2025 has been marked by significant fluctuations, reflecting the broader dynamics of the NFT and cryptocurrency markets.

At the beginning of this 12-month period, around June 2024, the price of Pudgy Penguins stood at approximately 0.0406 USD. This relatively higher valuation might have reflected a period of optimism or sustained interest following earlier market events. However, this initial stability or upward momentum did not last. The data clearly shows a noticeable downturn in the subsequent months. By July 2024, prices had already seen a considerable decline, dipping below 0.030 USD. This downward trajectory continued, indicating a strong bearish sentiment or a broader market correction affecting the NFT sector.

The decline became even more pronounced towards the end of summer and early autumn of 2024. The price plummeted significantly, reaching lows around 0.015 USD in August and further decreasing to around 0.010 USD by September. This period likely coincided with a “crypto winter” or a significant cooling off in the NFT market, where speculative assets saw substantial corrections. Many NFT collections experienced similar depreciation as investor interest waned and liquidity tightened. For Pudgy Penguins, despite its strong brand and community, it was not immune to these macro market forces. The price continued its descent, hitting its lowest point within this 12-month window around 0.0040 USD in late 2024, specifically around October and November. This represented a drastic reduction from its starting point, highlighting the extreme volatility inherent in the NFT market.

The bottoming out phase, around the 0.004 USD mark, persisted for a period, suggesting a period of consolidation where selling pressure eased, but strong buying interest had yet to fully materialize. Prices hovered in the range of 0.004 USD to 0.007 USD through the late autumn and early winter of 2024-2025. This period might have been characterized by patient accumulation by long-term holders or those identifying potential value at distressed prices.

A notable shift began to appear in early 2025. From January onwards, the data shows a gradual, yet discernible, recovery. The price began to climb back from its lows, steadily moving upwards. By February and March 2025, Pudgy Penguins had re-established a price point above 0.010 USD, indicating renewed investor confidence and possibly an improving sentiment across the broader crypto and NFT landscape. This resurgence could be attributed to several factors: a general market recovery, specific positive developments within the Pudgy Penguins ecosystem (such as successful product launches or community initiatives gaining traction), or renewed speculative interest in high-profile NFT projects.

The recovery continued into April and May 2025, with prices consolidating around the 0.011 USD to 0.014 USD range. The final data point in the 12-month historical series shows the price at approximately 0.0114 USD as of June 2025. While significantly lower than the starting point of 0.0406 USD a year prior, this demonstrates a substantial recovery from its all-time lows within this period. This pattern of a sharp decline followed by a slow, steady recovery is typical of many speculative assets during market corrections and subsequent periods of stabilization. The ability of Pudgy Penguins to rebound from its lows underscores its inherent brand strength and the loyalty of its community, suggesting a certain level of resilience even in adverse market conditions.

Factors Influencing Pudgy Penguins Price Dynamics

The price of a digital collectible like Pudgy Penguins is not solely dictated by speculative trading but by a complex interplay of internal project developments, broader market trends, and external macroeconomic factors. Understanding these influences is critical for any comprehensive price prediction.

NFT Market Trends and Cycles

The non-fungible token (NFT) market is inherently cyclical, often characterized by periods of intense hype followed by significant corrections. Pudgy Penguins’ price is heavily influenced by the overall sentiment and liquidity within the broader NFT ecosystem. During “NFT bull runs,” investor enthusiasm, increased trading volumes, and rising floor prices for leading collections tend to push up the value of established projects like Pudgy Penguins. Conversely, during “NFT bear markets” or periods of reduced interest, prices can experience substantial declines, regardless of a project’s individual merits. The last 12 months, as observed in the historical data, likely encompassed a period of significant market contraction and subsequent tentative recovery, directly impacting Pudgy Penguins’ valuation.

Utility and Ecosystem Development

For an NFT project to maintain and grow its value, it must evolve beyond being just a profile picture. Pudgy Penguins has been at the forefront of adding tangible utility and building a comprehensive ecosystem. The development of Pudgy Toys, which bridge the digital and physical worlds, is a prime example. The success of these toys in traditional retail channels like Walmart significantly enhances brand recognition and provides a revenue stream, which can be reinvested into the ecosystem. Furthermore, the creation of Pudgy World, a metaverse experience, and the forthcoming LIL Pudgys collection (acting as a “breeding” mechanism) are crucial for fostering ongoing engagement and utility for holders. Continuous innovation and successful execution of these utility-driven initiatives can directly bolster demand and, consequently, the price of the core Pudgy Penguin NFTs by providing intrinsic value beyond mere aesthetics.

Community Strength and Engagement

The “Huddle” – the Pudgy Penguins community – is arguably one of the strongest and most active in the NFT space. A robust and engaged community acts as a powerful force for price stability and growth. Community members are often the most vocal advocates, driving organic marketing, fostering secondary market activity, and contributing to the project’s overall resilience. Strong community support can help cushion price drops during market downturns and amplify price increases during bull markets. The ability of the Pudgy Penguins team to maintain and grow this loyal fanbase through transparent communication, exclusive events, and value-adding initiatives is paramount to its long-term success.

Broader Cryptocurrency Market Performance

While NFTs are a distinct asset class, their valuations are often correlated with the broader cryptocurrency market, particularly Ethereum (ETH), as most high-value NFTs, including Pudgy Penguins, are built on the Ethereum blockchain. A strong ETH price typically leads to increased liquidity and confidence across the entire Ethereum ecosystem, making investors more willing to allocate capital to NFTs. Conversely, a significant downturn in ETH or the wider crypto market can trigger a sell-off in NFTs as investors seek to de-risk or convert assets to more stable currencies. Gas fees on the Ethereum network can also indirectly affect NFT trading activity; high fees can deter smaller transactions and reduce overall market fluidity.

Macroeconomic Factors and Regulatory Landscape

Global macroeconomic conditions, such as inflation rates, interest rate changes by central banks, and overall economic stability, can significantly impact investor sentiment towards speculative assets like NFTs. During periods of economic uncertainty or rising interest rates, investors may pull funds from riskier assets in favor of safer investments, leading to downward pressure on NFT prices. Furthermore, the evolving regulatory landscape for cryptocurrencies and NFTs globally poses both opportunities and threats. Clear and favorable regulations could foster broader adoption and institutional investment, while restrictive or ambiguous regulations could stifle growth and introduce uncertainty.

Brand Partnerships and Mainstream Adoption

Pudgy Penguins has demonstrated a remarkable ability to forge partnerships and achieve mainstream recognition. The distribution of Pudgy Toys in major retail chains is a prime example. Continued success in securing high-profile brand collaborations, media appearances, or celebrity endorsements can significantly enhance the project’s visibility, attract new investors, and solidify its status as a recognized consumer brand. This mainstream adoption moves Pudgy Penguins beyond the niche crypto community, tapping into larger consumer markets and driving long-term value appreciation.

Exclusivity, Scarcity, and Liquidity

With a fixed supply of 8,888 NFTs, Pudgy Penguins possess inherent scarcity, a key driver of value for collectibles. However, liquidity—the ease with which an asset can be bought or sold without significantly affecting its price—also plays a role. A healthy market requires sufficient buyers and sellers. While Pudgy Penguins typically maintain decent liquidity for a top-tier NFT collection, sudden shifts in market sentiment or large-scale selling events can impact individual asset prices within the collection, especially for rarer traits.

Understanding Our Prediction Methodology: EchoPredict

Our price forecasts for Pudgy Penguins are generated using EchoPredict, a proprietary algorithm designed to analyze complex market dynamics and project future price movements. This sophisticated model leverages a multi-faceted approach, incorporating a comprehensive array of data points to deliver robust and informed predictions.

EchoPredict is built upon the principles of advanced machine learning and statistical modeling. It meticulously processes extensive historical price data, volume trends, and volatility metrics specific to the asset in question, in this case, Pudgy Penguins. Beyond raw price action, the algorithm also accounts for broader market indicators, recognizing the interconnectedness of the crypto and NFT ecosystems. This includes analyzing trends in major cryptocurrencies like Ethereum, overall NFT market capitalization, and various sentiment indicators derived from market activity.

The strength of EchoPredict lies in its adaptive learning capabilities. It continuously refines its predictive models by incorporating new data, allowing it to adjust to evolving market conditions and unforeseen shifts. While it does not directly incorporate subjective factors like community sentiment or specific project announcements (which are qualitative and harder to quantify for an automated system), its analysis of trading volumes and price reactions inherently reflects market participants’ collective response to such events. By identifying patterns and correlations within historical data that might be imperceptible to human analysis, EchoPredict aims to provide a data-driven outlook on future price trajectories. It’s important to understand that while EchoPredict offers a scientifically derived projection, the inherently volatile nature of digital assets means no prediction can be entirely infallible. The forecasts presented are based on the algorithm’s current understanding of market data and trends.

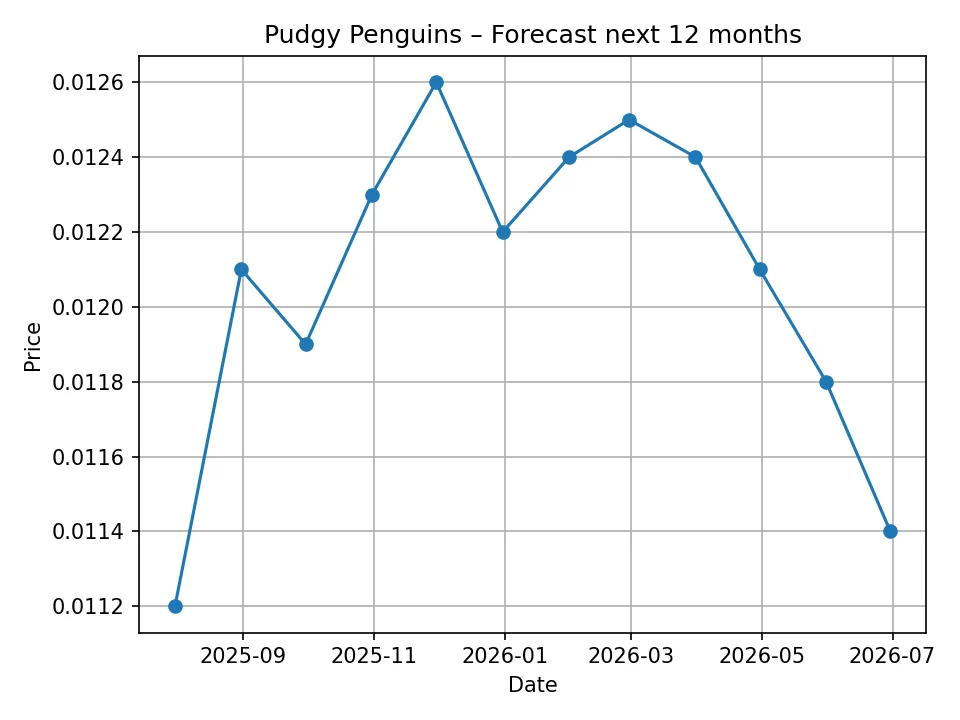

Pudgy Penguins Price Prediction: Monthly Outlook (July 2025 – June 2026)

The short-to-medium term outlook for Pudgy Penguins, as projected by the EchoPredict algorithm, indicates a period of relative stability with minor fluctuations. This forecast suggests that after the recent recovery observed in the historical data, the asset may enter a phase of consolidation rather than immediate explosive growth. Investors should anticipate a market that continues to find its footing, with prices moving within a defined range.

Here is the detailed monthly forecast:

| Month | Predicted Price (USD) |

|---|---|

| July 2025 | 0.0112 |

| August 2025 | 0.0121 |

| September 2025 | 0.0119 |

| October 2025 | 0.0123 |

| November 2025 | 0.0126 |

| December 2025 | 0.0122 |

| January 2026 | 0.0124 |

| February 2026 | 0.0125 |

| March 2026 | 0.0124 |

| April 2026 | 0.0121 |

| May 2026 | 0.0118 |

| June 2026 | 0.0114 |

The monthly predictions show a gentle upward trend initially, peaking around November 2025 at 0.0126 USD, before experiencing a slight pullback towards the end of the 12-month period. This suggests that the algorithm anticipates modest growth in the latter half of 2025, potentially driven by a recovering market sentiment or ongoing project developments. However, the subsequent minor dip towards June 2026 at 0.0114 USD indicates that sustained upward momentum might face resistance, possibly due to typical market corrections or profit-taking by short-term investors. Overall, the range of prices from 0.0112 USD to 0.0126 USD suggests a period of relative calm compared to the dramatic swings seen in the historical data, indicating a maturing asset finding its stability. This could be an attractive period for accumulation for long-term holders, or a time for active traders to capitalize on minor swings within the predicted range.

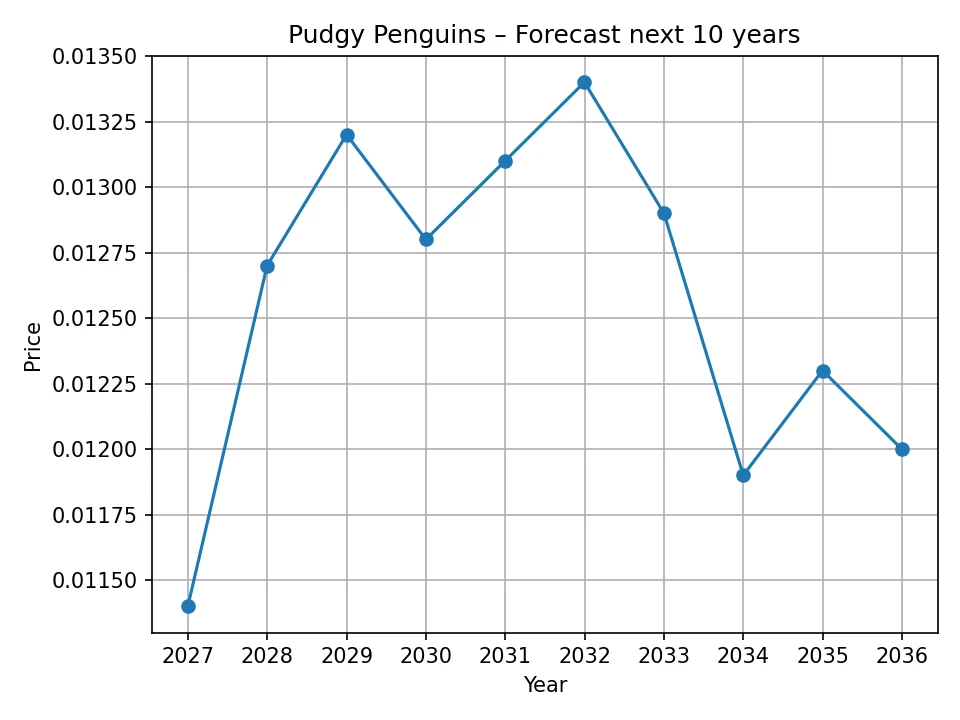

Pudgy Penguins Price Prediction: Annual Outlook (2026 – 2035)

Looking further into the future, the EchoPredict algorithm provides a 10-year annual price forecast for Pudgy Penguins, offering a glimpse into its potential long-term trajectory. This extended outlook suggests a path of gradual appreciation, albeit with some inherent volatility typical of the crypto market, rather than a rapid, exponential rise. The projections reflect the algorithm’s assessment of sustained utility, brand strength, and market evolution.

Here is the detailed annual forecast:

| Year | Predicted Price (USD) |

|---|---|

| 2026 | 0.0114 |

| 2027 | 0.0127 |

| 2028 | 0.0132 |

| 2029 | 0.0128 |

| 2030 | 0.0131 |

| 2031 | 0.0134 |

| 2032 | 0.0129 |

| 2033 | 0.0119 |

| 2034 | 0.0123 |

| 2035 | 0.0120 |

The long-term forecast indicates a generally positive, yet conservative, growth trajectory for Pudgy Penguins. Starting from an annual average of 0.0114 USD in 2026, the price is projected to experience a steady increase over the next few years, reaching a peak around 0.0134 USD in 2031. This gradual appreciation suggests that the algorithm anticipates continued development within the Pudgy Penguins ecosystem, potential further mainstream adoption, and a generally healthy, albeit not explosively bullish, crypto market environment. The rise could be fueled by ongoing utility development, successful expansion of the Pudgy Toys brand, and strengthening of the Pudgy World metaverse, attracting a wider user base and cementing its position as a leading digital brand.

However, the forecast also includes periods of slight regression, such as a dip to 0.0129 USD in 2032 and further to 0.0119 USD in 2033. These minor pullbacks are typical of long-term market cycles, reflecting potential profit-taking, shifts in investor sentiment, or broader market corrections that occur over multi-year horizons. The subsequent rebound to 0.0123 USD in 2034 and then a stabilization around 0.0120 USD in 2035 suggests that the project maintains its fundamental value and resilience. Even after minor corrections, the algorithm predicts that Pudgy Penguins will retain significant value, indicating a sustained presence and relevance in the digital asset space for the foreseeable future. This long-term stability, while not promising astronomical gains, points towards Pudgy Penguins evolving into a more mature, established digital asset, capable of holding and slowly appreciating its value over time, rather than remaining purely a speculative high-risk asset.

Key Considerations for Pudgy Penguins Investors

Investing in digital assets, especially NFTs, carries inherent risks and requires a nuanced understanding of market dynamics. For those considering Pudgy Penguins, several critical factors should inform their investment strategy.

Understanding Market Volatility

As evidenced by the historical data, the NFT market, including high-profile collections like Pudgy Penguins, is highly volatile. Prices can experience dramatic swings in short periods. While the monthly and annual forecasts suggest a period of relative stability and gradual growth, investors must be prepared for potential deviations from these predictions. Market sentiment, technological advancements, and regulatory changes can all introduce unforeseen volatility. It is crucial to approach such investments with a long-term perspective, recognizing that short-term fluctuations are a natural part of the asset class.

Importance of Due Diligence and Research

Before making any investment decisions, thorough due diligence is paramount. This goes beyond just looking at price predictions. Investors should deeply research the Pudgy Penguins project’s roadmap, team background, community strength, and partnerships. Understanding the utility being built (e.g., Pudgy Toys, Pudgy World) and the tangible progress made by the team is crucial. Evaluate the project’s ability to innovate and adapt to the evolving Web3 landscape. Diversifying one’s portfolio and not placing all capital into a single asset is also a prudent strategy.

Risk Management and Capital Allocation

Only invest what you can afford to lose. This golden rule is particularly pertinent in speculative markets like NFTs. Given the historical and projected volatility, capital allocated to Pudgy Penguins should be considered high-risk. Implementing a clear risk management strategy, such as setting stop-loss orders or determining a maximum percentage of your portfolio to allocate to such assets, can help mitigate potential losses. Avoid making emotional investment decisions based on hype or fear of missing out (FOMO).

Long-Term vs. Short-Term Perspective

The provided forecasts suggest a moderate long-term appreciation for Pudgy Penguins. For investors with a long-term horizon (several years), holding Pudgy Penguins might align with the projected gradual value increase, especially if the project continues to expand its ecosystem and brand reach. Short-term traders, on the other hand, might look for opportunities within the monthly predicted ranges, capitalizing on minor price swings. However, short-term trading is often riskier and requires more active market monitoring and a deep understanding of technical analysis. The project’s emphasis on building a sustainable brand through real-world utility tends to favor a long-term investment approach.

Ecosystem Developments and Competition

The NFT market is constantly evolving, with new projects and innovations emerging regularly. Investors should monitor ongoing developments within the Pudgy Penguins ecosystem, such as new product lines, metaverse integrations, or intellectual property partnerships. Simultaneously, it’s vital to be aware of competing NFT projects and their progress. The ability of Pudgy Penguins to maintain its relevance and competitive edge will be a significant factor in its long-term value retention and appreciation.

Conclusion

Pudgy Penguins have undeniably carved out a unique and influential position within the non-fungible token landscape. Moving beyond being merely digital collectibles, the project has demonstrated a remarkable commitment to building a brand with real-world utility and broad appeal, exemplified by the success of Pudgy Toys and the ongoing development of the Pudgy World metaverse. This strategic vision, coupled with a strong and engaged community, forms the fundamental pillars of its enduring value proposition.

The historical data over the past 12 months illustrates the inherent volatility of the NFT market, with Pudgy Penguins experiencing a significant downturn from highs of over 0.04 USD to lows around 0.004 USD, followed by a resilient recovery towards the 0.011 USD range. This journey underscores the project’s ability to weather market storms and rebound, a testament to its underlying brand strength and community support.

Looking ahead, the EchoPredict algorithm’s monthly forecast for July 2025 to June 2026 suggests a period of relative stability for Pudgy Penguins, with prices anticipated to fluctuate modestly between 0.0112 USD and 0.0126 USD. This indicates a potential consolidation phase, offering a more predictable environment compared to the dramatic swings of the past year. The annual forecast extending to 2035 paints a picture of gradual, sustained growth, projecting a peak around 0.0134 USD in 2031 before minor corrections, ultimately stabilizing around 0.0120 USD. This long-term outlook implies that Pudgy Penguins is poised to evolve into a more mature and established digital asset, capable of retaining and slowly appreciating its value over time, rather than being solely driven by speculative hype.

For investors, while the forecasts offer valuable insights, it is crucial to remember the high-risk nature of digital asset investments. Due diligence, understanding market volatility, employing sound risk management, and maintaining a clear investment horizon are paramount. The continued success of Pudgy Penguins will largely depend on the team’s ability to execute its ambitious roadmap, foster community engagement, and expand its brand into mainstream markets. As the Web3 space matures, projects like Pudgy Penguins, which successfully bridge the digital and physical worlds and build tangible utility, are likely to command sustained attention and value.

Disclaimer: The price predictions provided in this article are based on analyses performed by a proprietary algorithmic model, EchoPredict, as of the current date. These forecasts are speculative and should not be considered financial advice. The cryptocurrency and NFT markets are highly volatile, and actual prices may vary significantly from the projections due to various market, economic, regulatory, and project-specific factors. We are not responsible for any investment decisions made based on the information presented herein. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Maxwell Reed is the first editor of Cryptovista360. He loves technology and finance, which led him to crypto. With a background in computer science and journalism, he simplifies digital currency complexities with storytelling and humor. Maxwell began following crypto early, staying updated with blockchain trends. He enjoys coffee, exploring tech, and discussing finance’s future. His motto: “Stay curious and keep learning.” Enjoy the journey with us!