The dynamic world of cryptocurrency continues to captivate investors and enthusiasts alike, driven by rapid innovation, evolving market sentiment, and the emergence of unique digital assets. Among the myriad of tokens vying for attention, meme coins have carved out a distinctive niche, often characterized by their community-driven nature, viral appeal, and a volatility that presents both significant opportunities and considerable risks. One such asset gaining traction within the vibrant Solana ecosystem is Popcat (SOL). As of the current date, June 8, 2025, the cryptocurrency landscape is undergoing continuous shifts, making precise price predictions a complex but essential endeavor for those looking to understand potential future trajectories.

This comprehensive analysis aims to provide an in-depth price forecast for Popcat (SOL), leveraging extensive historical data spanning the past 12 months and incorporating projections generated by the proprietary FutureLens algorithm. While the absence of a stated current price necessitates a focus on historical trends and algorithmic forecasts, this article will meticulously examine the factors that influence Popcat’s market performance and offer a glimpse into its potential value in the short-term (12 months) and long-term (10 years). Investors are constantly seeking reliable insights to navigate the often-unpredictable crypto waters, and this report strives to offer a data-informed perspective on Popcat’s future.

Understanding Popcat (SOL) in the Solana Ecosystem

Popcat is more than just a cryptocurrency; it represents a cultural phenomenon within the digital asset space. Originating as an internet meme featuring a cat opening and closing its mouth in a “popping” motion, Popcat was translated into a digital token on the Solana blockchain. Its allure, typical of many successful meme coins, stems from its relatability, humor, and the strong, often passionate, community that rallies around it. Unlike traditional cryptocurrencies that may be built on complex technological innovations or real-world utility, meme coins like Popcat often derive their value from collective sentiment, social media trends, and the sheer enthusiasm of their holders.

The choice of the Solana blockchain as Popcat’s native network is a crucial aspect of its identity and operational efficiency. Solana has rapidly emerged as a formidable competitor to other layer-one blockchains, primarily due to its exceptional speed, low transaction costs, and impressive scalability. These attributes make Solana an ideal environment for meme coins, which often see high transaction volumes and require a network capable of handling rapid, frequent trades without incurring prohibitive fees. The robust infrastructure of Solana notTylko Popcat but also positions it within a thriving ecosystem that is continuously attracting new users, developers, and projects. This symbiotic relationship means that Popcat’s fortunes are, to some extent, intertwined with the broader success and growth of the Solana network itself. The ease of access, combined with Solana’s growing developer community and expanding decentralized applications (dApps) space, provides a fertile ground for meme tokens to flourish and maintain liquidity.

The Phenomenon of Meme Coins

The rise of meme coins is a testament to the power of internet culture and decentralized finance. These tokens, often created with humor and community engagement at their core, can achieve astonishing valuations driven purely by collective belief and viral marketing. While they might lack the inherent utility of foundational cryptocurrencies, their appeal lies in their accessibility, the sense of camaraderie they foster, and the potential for rapid, albeit high-risk, returns. Popcat exemplifies this trend, leveraging its meme status to build a dedicated following. The success of a meme coin heavily relies on its ability to maintain relevance, generate social media buzz, and continuously attract new participants to its community. This speculative nature means their price movements can be incredibly dramatic, subject to the whims of social media algorithms, celebrity endorsements, and broader market hype cycles.

Analysis of Popcat (SOL) Historical Price Data (Last 12 Months)

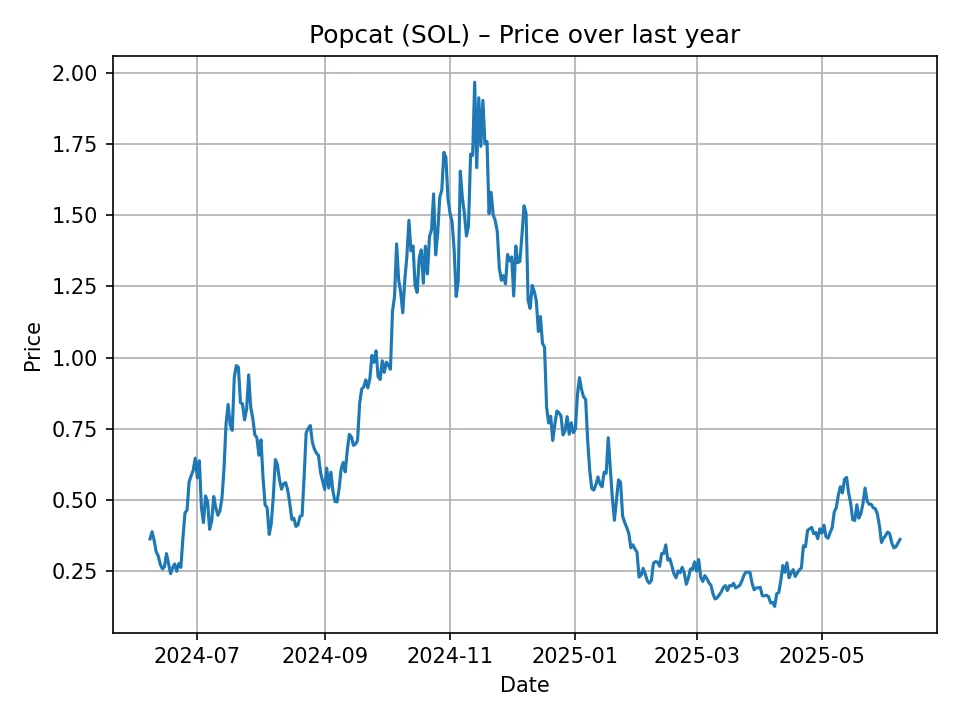

A thorough understanding of Popcat’s past performance is essential for any meaningful price prediction. The provided historical data for the last 12 months offers a valuable glimpse into its volatility, growth patterns, and periods of correction. Analyzing these daily price points reveals significant trends and turning points that have shaped Popcat’s journey on the Solana blockchain. While we do not have a specified “current price” as of June 8, 2025, the most recent data point in the provided historical sequence, which is 0.3605715334415436 USD, offers a contextual anchor for understanding the immediate past leading up to our prediction timeframe.

<

Key Observations from Historical Data

- Early Volatility and Initial Surge: The data begins with Popcat trading around the $0.36 USD mark, followed by an immediate period of fluctuating prices, dipping as low as $0.20 USD in the very early days of the recorded period, indicating a nascent or highly reactive market. However, there was a significant early surge, with prices quickly breaking past $0.50 USD and even nearing $1.00 USD within the first few months (e.g., reaching 0.9715399742126465 USD). This initial upward momentum suggests strong early interest and speculative buying.

- First Major Peak and Correction: Popcat experienced a notable peak around the $1.39 USD to $1.48 USD range (e.g., 1.482164978981018 USD), showcasing its ability to command significant value. This was often followed by natural market corrections, where prices would retrace significantly, sometimes by 20-30% or more, reflecting profit-taking and a return to more sustainable levels. For instance, after reaching highs above $1.40, the price would pull back to the $1.20-$1.30 range.

- Sustained Growth and Higher Peaks: Over the course of the 12-month period, Popcat demonstrated impressive resilience and a general upward trend, evidenced by subsequent peaks reaching even higher levels. The data shows prices breaking past $1.50 USD and even nearing $2.00 USD (e.g., 1.9676669836044312 USD). These sustained periods of growth often indicate increasing adoption, stronger community belief, and perhaps broader bullish sentiment in the crypto market.

- Periods of Consolidation and Dips: Interspersed with these rallies were periods of consolidation and significant dips. For example, after hitting a high, prices would often fall back to levels like $0.70 USD to $0.80 USD, and even lower to $0.50 USD or $0.40 USD. The lowest recorded price within this 12-month window appears to be around $0.12 USD to $0.13 USD, indicating moments of extreme selling pressure or broader market downturns impacting meme coins disproportionately. These dips are typical in volatile assets, offering potential entry points for new investors but also posing risks for existing holders.

- Recent Performance (Leading up to Forecast Date): Towards the end of the provided historical data, Popcat’s price appears to be in a consolidation phase, generally ranging between $0.30 USD and $0.40 USD, with the last recorded value being 0.3605715334415436 USD. This suggests a period of relative stability or perhaps a slight recovery after a more significant correction from its higher peaks. This recent performance sets the stage for the algorithmic predictions.

The historical data paints a picture of a highly dynamic asset. While prone to sharp corrections, Popcat has also demonstrated remarkable ability to recover and set new highs. This inherent volatility is a characteristic feature of meme coins and should be carefully considered when evaluating future projections.

Factors Influencing Popcat (SOL) Price Trajectory

Forecasting the price of a cryptocurrency, especially a meme coin like Popcat (SOL), involves considering a multitude of intertwined factors. These influences can range from broad macroeconomic trends to specific community dynamics, and understanding them is crucial for interpreting any price prediction.

- Overall Cryptocurrency Market Sentiment: Popcat’s price is heavily influenced by the general health and direction of the broader crypto market. When flagship cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) experience bullish runs, altcoins and meme coins often follow suit, benefiting from increased investor confidence and capital inflow. Conversely, a bearish market for BTC or ETH can trigger widespread sell-offs, impacting even strong meme coins. Macroeconomic factors such as inflation rates, interest rate decisions by central banks, and global economic stability can also dictate overall market sentiment, leading to either risk-on or risk-off investor behavior.

- Solana Ecosystem Growth and Adoption: As a token built on Solana, Popcat’s future is closely tied to the continuous development and adoption of the Solana blockchain itself. An increase in the number of users, decentralized applications (dApps), and institutional interest in Solana contributes to higher network activity and liquidity. This positive ecosystem growth can indirectly boost the value of tokens within it, including meme coins that benefit from enhanced visibility and ease of trading on the platform. Any significant technological upgrades, security enhancements, or partnerships within Solana could also positively impact Popcat.

- Meme Coin Hype Cycles and Virality: Meme coins are fundamentally driven by hype and community engagement. Their prices often experience parabolic growth during periods of heightened social media buzz, viral trends, or celebrity endorsements. However, these cycles can be short-lived, leading to rapid corrections once the hype subsides. For Popcat, sustained virality through new memes, community-driven marketing campaigns, and continued cultural relevance will be paramount to its long-term price stability and growth. The ability to continually capture public imagination is a unique, yet unpredictable, determinant of its value.

- Community Strength and Engagement: The backbone of any successful meme coin is its community. An active, engaged, and expanding community of holders, traders, and promoters can collectively drive interest, demand, and liquidity for Popcat. Strong social media presence on platforms like X (formerly Twitter), Telegram, and Discord, alongside community-organized events or initiatives, are vital for maintaining momentum and fostering a sense of collective ownership and purpose. A dwindling community, conversely, can lead to decreased interest and price stagnation or decline.

- Liquidity and Trading Volume: High liquidity and robust trading volume indicate a healthy and active market for Popcat. When a token can be easily bought and sold without significantly impacting its price, it attracts more traders and investors. Increased trading volume suggests strong market interest and demand, which can contribute to upward price pressure. Conversely, low liquidity can lead to higher volatility and make it difficult for large orders to be executed without substantial price slippage.

- Competition within the Meme Coin Sector: The meme coin landscape is highly competitive, with new tokens emerging regularly. Popcat faces competition from established giants like Dogecoin and Shiba Inu, as well as a constant stream of new Solana-based meme coins. The ability of Popcat to differentiate itself, maintain its community, and offer perceived value (even if purely speculative) in the face of this competition will be critical for its sustained performance. Market share and investor attention can shift quickly, posing a continuous challenge.

- Technological Development and Utility (if any): While primarily a meme coin, some meme coins eventually explore adding utility, such as integration into NFTs, decentralized applications, or staking mechanisms. Should Popcat’s developers or community decide to introduce such features, it could potentially provide a more fundamental basis for its value, attracting a different segment of investors beyond pure speculation. Even minor integrations could enhance its perceived longevity.

Considering these diverse factors, it becomes clear that Popcat’s price is a confluence of macro and microeconomic forces, alongside the unpredictable dynamics of internet culture and community enthusiasm. These elements form the context within which any price prediction, including those generated by algorithms, must be understood.

FutureLens Algorithm Methodology for Price Prediction

The price predictions presented for Popcat (SOL) in this article are derived from analyses performed by the proprietary FutureLens algorithm. It is important to understand that such an algorithm employs a sophisticated, multi-faceted approach to generate its forecasts, aiming to provide data-driven insights into potential future price movements.

At its core, the FutureLens algorithm processes vast amounts of historical data, including the daily price points for Popcat over the last 12 months, as provided. This historical data serves as the foundation upon which the algorithm builds its understanding of past market behavior, volatility, and trends. However, its capabilities extend far beyond simple extrapolation.

How FutureLens Generates Forecasts:

- Statistical Modeling: The algorithm utilizes advanced statistical models, such as time-series analysis (e.g., ARIMA, Prophet models), to identify patterns, seasonality, and correlations within the historical data. These models help in understanding how prices have reacted to various conditions in the past.

- Machine Learning (ML) Techniques: FutureLens likely incorporates various machine learning algorithms, including neural networks, to detect complex, non-linear relationships that might be missed by traditional statistical methods. ML models can learn from historical data to predict future values with higher accuracy, particularly in volatile markets like cryptocurrency.

- Trend Analysis: The algorithm identifies prevailing trends, momentum indicators, and potential reversal points. It assesses whether Popcat is currently in an accumulation phase, a distribution phase, or a period of strong upward or downward momentum.

- Volatility Assessment: Given the inherent volatility of cryptocurrencies, FutureLens rigorously measures and models price fluctuations. This helps in understanding the risk associated with future price movements and establishing reasonable projection ranges.

- Market Dynamics Integration: While precise external data inputs (like broader market sentiment, news events, or social media trends) are not explicitly stated, advanced algorithms often incorporate or infer such dynamics from price and volume data or through sentiment analysis. The algorithm’s ability to “learn” from how prices react to different market conditions is key.

- Pattern Recognition: It continuously scans for recurring patterns in price movements that might indicate future behavior. This can include anything from support and resistance levels to chart patterns that have historically preceded certain price actions.

The FutureLens algorithm, by leveraging these computational strengths, provides a probabilistic outlook on future price trajectories. It translates complex data into digestible future price points. However, it is crucial to understand that even the most sophisticated algorithms operate on assumptions derived from past data and current models. They do not account for unforeseen black swan events, sudden regulatory shifts, or entirely novel market dynamics that have no historical precedent. Therefore, these predictions should be viewed as informed estimates rather than guaranteed outcomes, serving as a valuable tool for analysis rather than definitive financial advice.

Popcat (SOL) Price Prediction: Short-Term Outlook (12 Months)

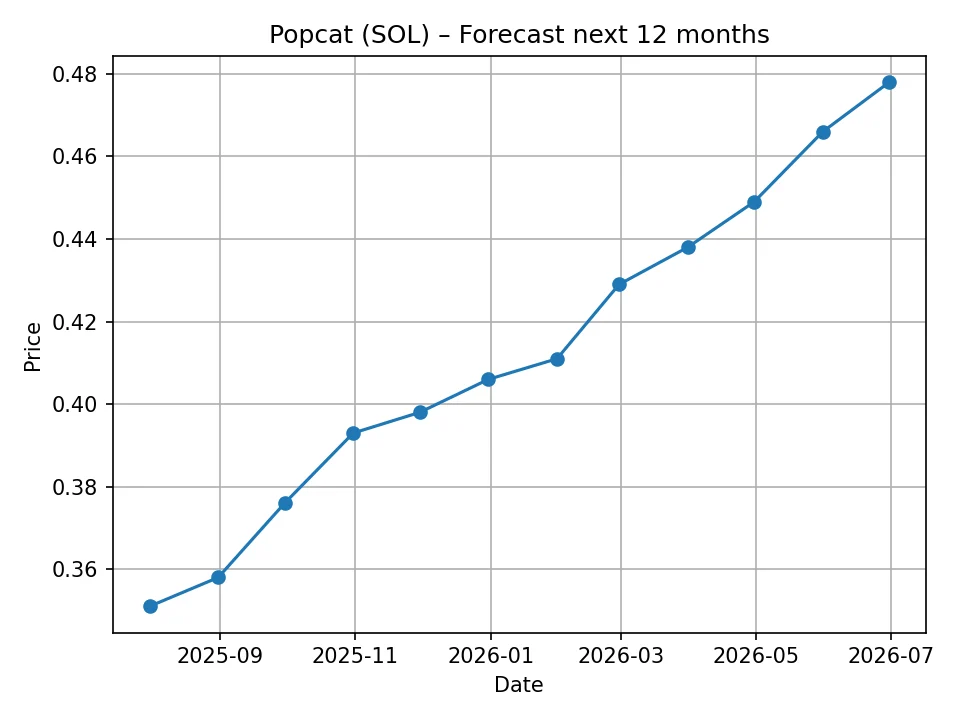

The short-term price forecast for Popcat (SOL) over the next 12 months, generated by the FutureLens algorithm, suggests a period of gradual yet steady appreciation. This forecast, spanning from July 2025 to June 2026, indicates a positive trajectory from the most recent historical data point around $0.36 USD.

According to the FutureLens projections, Popcat is anticipated to begin its short-term journey with a price of approximately $0.351 USD in July 2025. This initial figure is very close to the last historical data point, suggesting a period of stabilization before growth. As we move through the latter half of 2025, the algorithm predicts a consistent, albeit modest, upward trend. By December 2025, Popcat is projected to reach about $0.406 USD, indicating a steady increase of roughly 15% from the July 2025 estimate. This suggests that the algorithm anticipates building momentum and a positive sentiment leading into the new year.

Entering 2026, the upward momentum is expected to continue. The forecast shows a progressive increase month over month, with Popcat reaching $0.411 USD in January 2026 and climbing to $0.449 USD by April 2026. This consistent growth pattern implies a fundamental strengthening of Popcat’s position, potentially driven by sustained community engagement, positive Solana ecosystem developments, or a generally bullish crypto market. By June 2026, the end of the 12-month short-term forecast period, Popcat is projected to hit $0.478 USD. This represents a cumulative increase of approximately 36% from the July 2025 forecast, painting a picture of stable and encouraging growth rather than explosive, high-risk surges. Investors can interpret this short-term forecast as a period of consolidation and organic expansion, suggesting a more mature and predictable price movement compared to the extreme volatility sometimes seen in meme coins. However, it is vital to remember that even steady growth can be impacted by sudden market shifts.

Popcat (SOL) Monthly Price Forecast (July 2025 – June 2026)

| Month/Year | Projected Price (USD) |

|---|---|

| 2025-07 | 0.351 |

| 2025-08 | 0.358 |

| 2025-09 | 0.376 |

| 2025-10 | 0.393 |

| 2025-11 | 0.398 |

| 2025-12 | 0.406 |

| 2026-01 | 0.411 |

| 2026-02 | 0.429 |

| 2026-03 | 0.438 |

| 2026-04 | 0.449 |

| 2026-05 | 0.466 |

| 2026-06 | 0.478 |

Popcat (SOL) Price Prediction: Long-Term Outlook (10 Years)

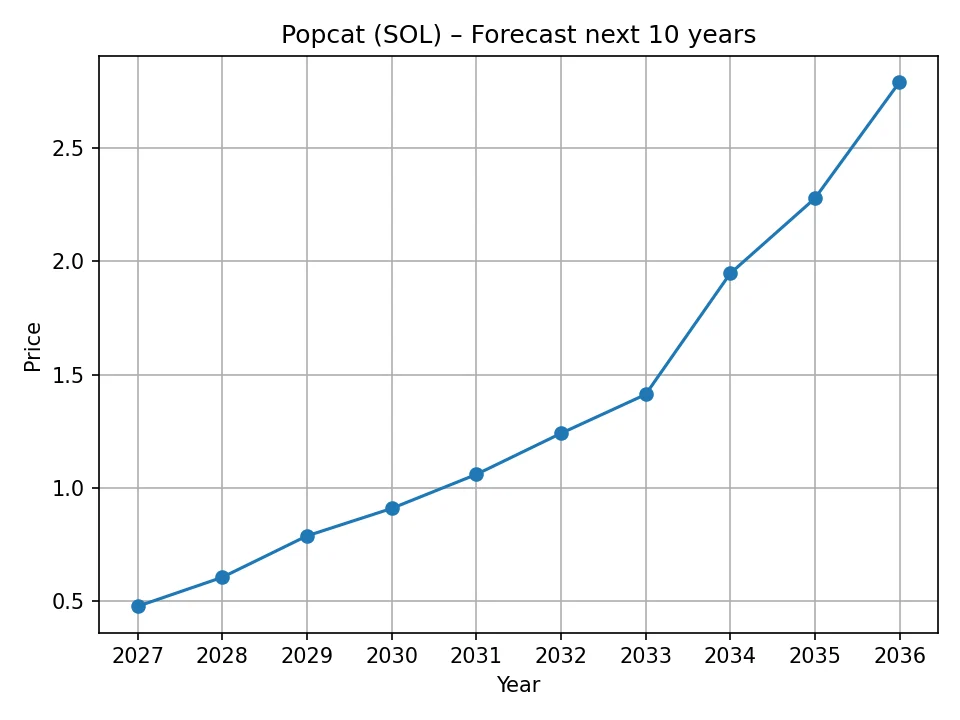

The long-term price forecast for Popcat (SOL), extending over the next decade from 2026 to 2035, presents a significantly more optimistic and ambitious outlook than its short-term counterpart. This extended projection by the FutureLens algorithm suggests that Popcat has substantial potential for exponential growth, potentially transforming from a niche meme coin into a more recognized asset within the broader cryptocurrency market. This long-term perspective is predicated on several underlying assumptions, including sustained market growth, continued adoption of the Solana ecosystem, and Popcat’s ability to maintain or enhance its relevance.

The forecast commences with a projected price of $0.478 USD for 2026, aligning perfectly with the conclusion of the 12-month monthly prediction. This serves as the baseline for the subsequent nine years of growth. A notable milestone is anticipated in 2027, with Popcat potentially reaching $0.606 USD, indicating a healthy upward trajectory from the previous year. This early acceleration suggests that the algorithm anticipates a favorable market environment and possibly increased mainstream awareness for Solana-based tokens.

As we move further into the forecast period, the growth becomes more pronounced. By 2028, Popcat is projected to hit $0.789 USD, bringing it tantalizingly close to the $1.00 USD psychological barrier. Breaking this barrier is a significant achievement for any token, and Popcat is predicted to do so by 2029, with a forecasted price of $0.91 USD, and then surpassing it definitively in 2030, reaching an impressive $1.06 USD. This steady climb past the dollar mark would signify a major maturity point for Popcat, potentially attracting a new wave of investors who are often drawn to assets trading above this threshold.

The latter half of the decade shows even more aggressive growth. For 2031, Popcat is predicted to reach $1.241 USD, followed by $1.413 USD in 2032. The most striking increases are projected towards the end of the forecast. By 2033, the price is anticipated to surge to $1.947 USD, positioning Popcat on the cusp of the $2.00 USD mark. This significant leap implies a period of heightened demand and perhaps a substantial increase in its market capitalization. The strong upward trend is expected to continue through 2034, with a projection of $2.278 USD, indicating that Popcat could firmly establish itself in the multi-dollar range.

Finally, by the end of the 10-year forecast period in 2035, the FutureLens algorithm predicts that Popcat (SOL) could reach an extraordinary price of $2.791 USD. This represents a remarkable long-term appreciation from its current historical values and the initial short-term forecasts. Such a substantial increase would be contingent on several factors, including the continued expansion of the cryptocurrency market, sustained innovation on the Solana network, enduring community support for Popcat, and potentially the development of new utilities or integrations that enhance its intrinsic value beyond its meme status. The long-term forecast suggests that if current trends and underlying market conditions remain favorable, Popcat has the potential to deliver significant returns for patient investors.

Popcat (SOL) Annual Price Forecast (2026 – 2035)

| Year | Projected Price (USD) |

|---|---|

| 2026 | 0.478 |

| 2027 | 0.606 |

| 2028 | 0.789 |

| 2029 | 0.910 |

| 2030 | 1.060 |

| 2031 | 1.241 |

| 2032 | 1.413 |

| 2033 | 1.947 |

| 2034 | 2.278 |

| 2035 | 2.791 |

Risks and Considerations for Popcat (SOL) Investment

While the price predictions for Popcat (SOL) offer an optimistic outlook, it is paramount for any potential investor to be acutely aware of the inherent risks and uncertainties associated with cryptocurrency investments, especially those pertaining to meme coins. The digital asset market is notoriously volatile, and factors can change rapidly, impacting even the most robust forecasts.

- Extreme Volatility: Cryptocurrencies, by their very nature, are highly volatile assets. Prices can fluctuate dramatically within short periods due to market sentiment, news, or large trading volumes. Meme coins amplify this volatility, as their value is often driven by speculative hype rather than fundamental utility. This means that while rapid gains are possible, equally rapid and significant losses are also a considerable risk.

- Meme Coin Specific Risks: Popcat, being a meme coin, carries unique risks. Its value is largely dependent on community enthusiasm, social media trends, and viral appeal. A sudden shift in public interest, the emergence of a new popular meme coin, or negative sentiment can quickly erode its value. Unlike projects with clear roadmaps or technological breakthroughs, meme coins may lack a tangible long-term development trajectory, making their sustained relevance more challenging.

- Market Competition: The cryptocurrency space, particularly the meme coin sector, is fiercely competitive. New meme coins are launched regularly, vying for investor attention and liquidity. Popcat must continuously maintain its unique appeal and community engagement to remain competitive and avoid being overshadowed by newer, trendier tokens.

- Regulatory Environment: The regulatory landscape for cryptocurrencies is still evolving globally. New laws or restrictions on digital assets, trading platforms, or specific types of tokens (like meme coins) could significantly impact Popcat’s accessibility, liquidity, and overall market value. Unfavorable regulatory decisions in major markets could trigger widespread price declines.

- Solana Network Risks: As a token on the Solana blockchain, Popcat is subject to any issues affecting the Solana network itself. While Solana is robust, potential network outages, security breaches, or significant technical vulnerabilities could disrupt operations, leading to decreased trust and a negative impact on all tokens built on it, including Popcat.

- Liquidity Risks: While Popcat has historical trading data, there is always a risk that liquidity could dry up, making it difficult to buy or sell significant amounts of the token without causing substantial price impact. Lower liquidity can exacerbate volatility and limit the ability of investors to enter or exit positions effectively.

- Algorithm Limitations: The FutureLens algorithm, while sophisticated, bases its predictions on historical data and current market models. It cannot foresee unforeseen geopolitical events, major technological disruptions, or drastic shifts in investor psychology that have no historical precedent. Algorithmic forecasts are projections, not guarantees, and should be treated as one tool among many in a comprehensive investment strategy.

Given these considerations, potential investors should conduct their own thorough due diligence, assess their risk tolerance, and consider consulting with a qualified financial advisor before making any investment decisions related to Popcat (SOL) or any other cryptocurrency. The high-risk, high-reward nature of meme coins necessitates a cautious and well-informed approach.

In conclusion, Popcat (SOL) presents an intriguing case study within the volatile yet opportunity-rich cryptocurrency market. Our analysis of its historical performance over the past 12 months reveals a pattern of significant price fluctuations, marked by notable surges and corrections, yet demonstrating an underlying resilience and a general upward trend over the longer historical period. The price points observed, from initial lows to peaks nearing $2.00 USD before recent consolidation around the $0.30-$0.40 USD range, underscore its dynamic nature driven by community sentiment and broader market forces on the Solana ecosystem.

The short-term forecast, spanning July 2025 to June 2026, projects a period of steady and moderate growth, with Popcat potentially increasing its value from around $0.35 USD to approximately $0.478 USD. This suggests a phase of building momentum and organic expansion. Looking further into the future, the long-term predictions from 2026 to 2035 paint a much more ambitious picture. With projections reaching nearly $2.80 USD by 2035, the FutureLens algorithm anticipates substantial appreciation, implying that if current trends and underlying market conditions remain favorable, Popcat could evolve significantly within the next decade.

However, it is crucial to reiterate that these forecasts are based on a proprietary algorithmic analysis and historical data, and the cryptocurrency market remains inherently unpredictable. Meme coins, in particular, are subject to extreme volatility and depend heavily on social and community-driven dynamics. While the potential for growth is evident, so too are the risks associated with market competition, regulatory changes, and broader economic conditions. Investors should approach Popcat (SOL) with a comprehensive understanding of these factors, perform their own extensive research, and align any investment decisions with their individual financial goals and risk tolerance.

Disclaimer: This article contains price predictions for Popcat (SOL) generated by a proprietary algorithm known as FutureLens. These predictions are based on historical data analysis and mathematical models. We are not responsible for the accuracy or reliability of these price forecasts, nor do we provide financial advice. Cryptocurrency investments are highly speculative and carry significant risks, including the potential loss of principal. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Maxwell Reed is the first editor of Cryptovista360. He loves technology and finance, which led him to crypto. With a background in computer science and journalism, he simplifies digital currency complexities with storytelling and humor. Maxwell began following crypto early, staying updated with blockchain trends. He enjoys coffee, exploring tech, and discussing finance’s future. His motto: “Stay curious and keep learning.” Enjoy the journey with us!