The cryptocurrency market continues to captivate investors with its unparalleled volatility and potential for significant returns. Within this dynamic landscape, Morpho has emerged as a notable player, carving out a niche in the decentralized finance (DeFi) sector. As of mid-2025, market participants are keenly observing its trajectory, seeking insights into its future price performance. This comprehensive analysis delves into Morpho’s fundamentals, historical price movements, and employs a sophisticated predictive algorithm, EdgePredict, to project its potential value in the coming months and years.

Understanding Morpho and its Core Value Proposition

To accurately forecast Morpho’s price, it is essential to first understand the project itself. Morpho refers to the token underpinning the Morpho protocol, a groundbreaking DeFi lending and borrowing platform. At its heart, Morpho aims to optimize existing DeFi lending protocols like Aave and Compound by providing enhanced capital efficiency and more competitive interest rates. It achieves this through a novel architecture that facilitates direct peer-to-peer (P2P) loans when possible, while seamlessly reverting to underlying pools (like Aave or Compound) if P2P matches are unavailable or less efficient.

This hybrid approach offers several distinct advantages. For lenders, Morpho often presents higher yields due to the reduced spread inherent in direct P2P interactions. Borrowers, conversely, can access lower interest rates. This optimization layer sits atop established protocols, leveraging their liquidity and security while introducing a more efficient matching engine. The Morpho token itself plays a crucial role in the protocol’s governance, allowing token holders to participate in decision-making processes related to protocol upgrades, parameter adjustments, and treasury management. This decentralized governance model is a cornerstone of the DeFi ethos, granting significant control to its community and fostering long-term alignment between the protocol’s success and its token holders’ interests.

The fundamental value of Morpho is therefore intrinsically linked to the continued growth and efficiency of the DeFi lending market. As decentralized finance expands, and more users seek optimized borrowing and lending solutions, Morpho’s unique architecture positions it as a compelling alternative or enhancement to traditional DeFi money markets. Its ability to aggregate liquidity and offer superior rates makes it an attractive proposition for both institutional and retail participants looking to maximize their capital’s utility within the crypto ecosystem. Furthermore, continuous development and strategic partnerships are key drivers for its utility and adoption, which in turn directly influence its market valuation. Morpho’s design also minimizes reliance on external oracle networks for interest rate determination, reducing potential attack vectors and increasing overall system resilience. This robust design, combined with its focus on capital efficiency, appeals to a wide range of DeFi users, from individual liquidity providers seeking optimal returns to institutional entities navigating the complexities of decentralized finance. The evolution of Morpho’s roadmap, including potential expansion to other blockchain networks or the introduction of new financial primitives, will undoubtedly play a significant role in its future market performance and its ability to capture a larger share of the burgeoning DeFi landscape.

Morpho’s Historical Price Performance: A Glimpse into Volatility and Growth

Analyzing historical price data provides invaluable context for understanding Morpho’s market behavior and resilience. Over the past 12 months, Morpho’s price has experienced significant fluctuations, reflecting the inherent volatility of the broader cryptocurrency market, alongside project-specific developments.

Looking back at the daily historical data, Morpho commenced its journey around the $1.52 mark. Over the past year, we have observed periods of both rapid ascent and sharp corrections. For instance, early in the provided dataset, the price saw a notable surge from around $1.64 to peaks nearing $2.36-$2.46, and even breaking past $2.95 at one point. This initial upward momentum suggests strong market interest or positive developments surrounding the protocol during those periods. Subsequent to these highs, the price experienced pullbacks, as is common in highly speculative markets, consolidating around the $2.00 to $2.80 range for a period. These early movements highlighted the market’s initial enthusiasm for Morpho’s innovative approach, yet also underscored the quick profit-taking tendencies prevalent in the crypto space.

A more pronounced upward trend was observed later, with prices reaching significant highs, such as $3.47, $3.57, and even touching approximately $3.92. These peaks indicate moments of strong bullish sentiment, potentially driven by major protocol updates, increased Total Value Locked (TVL), strategic partnerships, or a general bullish phase in the altcoin market. For example, a significant increase in TVL or the announcement of a new feature could have fueled these rallies, demonstrating Morpho’s capacity to attract substantial capital and user engagement when its value proposition resonates strongly with the market. These periods of peak performance highlight Morpho’s potential for rapid appreciation when market conditions are favorable and investor confidence is high.

However, the journey has not been without its challenges. Following these peaks, Morpho experienced corrections, at times falling below $2.00, and even dipping to lows around $0.90 to $0.85. These downturns underscore the speculative nature of crypto assets, where market-wide corrections, profit-taking, or specific FUD (Fear, Uncertainty, Doubt) related to the DeFi space can lead to significant price depreciation. Factors such as broader market downturns, increased regulatory scrutiny on DeFi, or even general investor fatigue could have contributed to these declines. Despite these troughs, the historical data shows instances of recovery, demonstrating a certain level of underlying support and investor belief in the project’s long-term viability. The most recent data point indicates a price of approximately $1.58, suggesting that Morpho has stabilized somewhat after its previous volatility, finding a range that reflects current market sentiment and project maturity. This pattern of significant highs followed by corrections and subsequent recoveries is typical for promising yet still developing cryptocurrency projects, indicating both strong growth potential and the risks associated with early-stage investments. The resilience shown during these pullbacks suggests a committed community and a solid fundamental basis that prevents catastrophic collapses.

The journey through these price points illustrates Morpho’s sensitivity to market cycles and its own developmental milestones. The periods of strong growth align with increased adoption of DeFi protocols and potentially Morpho’s specific advancements in optimizing lending. Conversely, dips often coincide with broader market downturns or profit-taking events. Understanding this historical context is crucial, as it informs the realistic expectations for future price movements, acknowledging both the upside potential and the inherent risks. Analyzing the volume alongside these price movements would further enhance this historical review, as high volume during upward trends signals strong conviction, while high volume during downward trends might indicate capitulation or significant selling pressure.

Key Factors Influencing Morpho’s Price Dynamics

Several critical factors interplay to shape Morpho’s price trajectory. A holistic understanding of these influences is vital for any comprehensive price prediction.

Overall Cryptocurrency Market Sentiment

The price of Morpho, like most altcoins, is significantly influenced by the broader cryptocurrency market. Bitcoin’s performance often acts as a barometer for the entire market; a bullish Bitcoin trend tends to lift altcoins, while a bearish trend can trigger widespread sell-offs. Ethereum’s performance is also particularly relevant for Morpho, given its foundation on the Ethereum blockchain and its deep integration with Ethereum-based DeFi protocols. Positive developments in the DeFi sector as a whole, such as increased institutional adoption, technological breakthroughs, or favorable regulatory clarity, can also positively impact Morpho’s valuation. Conversely, general market FUD, security breaches on other major protocols, or significant regulatory crackdowns can exert downward pressure across the entire crypto ecosystem, inevitably affecting Morpho. The cyclical nature of crypto markets, often characterized by distinct bull and bear phases, means that even fundamentally strong projects like Morpho are subject to broader market forces.

Morpho Protocol Development and Adoption

The fundamental strength of the Morpho protocol is arguably the most impactful long-term price driver. Key developments include:

- Technological Upgrades: Continuous innovation, such as improvements to the matching engine, enhanced security features, or new integrations with other DeFi protocols, can increase user confidence and attract more capital. For instance, the introduction of Morpho Blue, a generalized lending primitive, significantly expands the protocol’s flexibility and potential market reach.

- User Growth and TVL: The number of users interacting with Morpho and the Total Value Locked (TVL) on its platform are direct indicators of its utility and adoption. As more users flock to Morpho seeking optimized rates, the demand for the underlying token (for governance, staking, or liquidity provision incentives) could naturally increase. A growing TVL not only reflects liquidity but also trust and utility, which are crucial for a DeFi protocol’s long-term health.

- Partnerships and Integrations: Collaborations with other prominent DeFi projects, Layer 2 solutions, or even traditional financial institutions can significantly expand Morpho’s reach and utility, bringing new users and capital into its ecosystem. Cross-chain compatibility or integrations with stablecoin issuers could particularly drive adoption.

- Ecosystem Expansion: The development of new products or features built around the Morpho protocol, or incentives for developers to build on top of it, can create a vibrant ecosystem that reinforces its value proposition. This includes initiatives like grant programs or hackathons designed to attract builders.

- Security Audits and Resilience: Regular and successful security audits, alongside a transparent approach to any vulnerabilities, build user trust, which is paramount in DeFi. The robustness of its smart contracts and its ability to withstand market shocks are critical.

Competition in the DeFi Lending Space

The DeFi lending market is highly competitive, with established players like Aave and Compound, as well as emerging innovators that offer specialized solutions. Morpho’s ability to maintain its competitive edge by consistently offering superior rates, enhanced capital efficiency, and a secure platform is crucial. Any significant competitive threat, or a failure to innovate at pace, could impact its market share and, consequently, its token price. Differentiation through unique features, superior user experience, or novel risk management frameworks will be key to long-term success.

Regulatory Environment

The evolving global regulatory landscape for cryptocurrencies and DeFi poses both opportunities and risks. Clear and supportive regulations could foster mainstream adoption and bring more institutional capital into the space, benefiting protocols like Morpho. Conversely, restrictive or uncertain regulations could stifle innovation, increase compliance costs, or even lead to bans in certain jurisdictions, negatively impacting demand and accessibility for Morpho. Regulatory clarity around DeFi’s legal status, taxation, and consumer protection will significantly influence investor confidence and institutional participation.

Macroeconomic Factors

Broader macroeconomic conditions, such as inflation rates, interest rates, global economic stability, and investor risk appetite, also play a role. During periods of high inflation or economic uncertainty, investors might seek alternative assets like cryptocurrencies, or conversely, retreat to safer havens. Changes in traditional finance interest rates can directly influence the attractiveness of DeFi yields; if traditional rates rise significantly, the yield premium offered by DeFi might narrow, potentially reducing demand for lending protocols. Global recessions or geopolitical tensions can lead to capital flight from speculative assets, impacting Morpho’s valuation.

Tokenomics and Supply Dynamics

The tokenomics of Morpho, including its total supply, circulating supply, vesting schedules for team and early investors, and any token burning or staking mechanisms, can influence its scarcity and demand. A well-designed tokenomic model that incentivizes long-term holding and participation is generally more supportive of price stability and growth. Transparent communication regarding token distribution and release schedules is also vital to manage market expectations and prevent sudden supply shocks. The utility of the token within the protocol, such as for fee discounts or enhanced governance rights, directly contributes to its intrinsic value.

Understanding these multifaceted factors allows for a more nuanced interpretation of price predictions, acknowledging that while algorithms can detect patterns, real-world events are often unpredictable. Investors must perform diligent research into each of these areas to form a comprehensive view of Morpho’s potential.

Morpho Price Prediction: Short-Term Outlook (12 Months)

Our proprietary EdgePredict algorithm, specifically designed for cryptocurrency market analysis, offers a granular look at Morpho’s potential price movements over the next 12 months. This model considers historical price trends, volatility metrics, market cycles, and other relevant data points to generate its forecasts.

As of June 12, 2025, the short-term forecast suggests a gradual yet steady upward trajectory for Morpho. The algorithm predicts a continuation of the recovery seen in recent periods, with prices slowly climbing from their current levels. This outlook implies increasing stability and a growing confidence among investors in Morpho’s value proposition within the DeFi ecosystem. The projected monthly increases, while modest, suggest a healthy accumulation phase rather than rapid speculative pumps, which could be indicative of organic growth and fundamental strength. The EdgePredict model identifies underlying bullish momentum that is expected to carry Morpho’s value higher, assuming no major unforeseen market disruptions. This steady climb could be attributed to ongoing development milestones, increasing adoption rates, and a strengthening of the overall DeFi market.

Here is the detailed monthly price prediction for Morpho, as forecasted by the EdgePredict algorithm:

| Month/Year | Projected Price (USD) |

|---|---|

| July 2025 | $1.61 |

| August 2025 | $1.55 |

| September 2025 | $1.59 |

| October 2025 | $1.61 |

| November 2025 | $1.69 |

| December 2025 | $1.71 |

| January 2026 | $1.79 |

| February 2026 | $1.80 |

| March 2026 | $1.86 |

| April 2026 | $1.81 |

| May 2026 | $1.87 |

| June 2026 | $1.92 |

The monthly forecast indicates a positive trend, with Morpho potentially reaching approximately $1.92 by June 2026. This modest but consistent growth could be attributed to several factors. In the short term, market sentiment, ongoing protocol updates, and potential new partnerships might contribute to this upward movement. The crypto market often experiences seasonal patterns or reacts to major industry conferences and announcements, which could influence these monthly fluctuations. For investors, this short-term outlook suggests a period of potential accumulation, where consistent, albeit small, gains could be realized. It also implies that Morpho is expected to maintain its relevance and utility in the competitive DeFi landscape over the coming year, steadily building value. The slight dips in August and April could represent minor corrections or profit-taking periods that are quickly absorbed by sustained buying interest, reinforcing the overall upward trend. This pattern is often observed in assets that are consolidating gains while building momentum for larger moves.

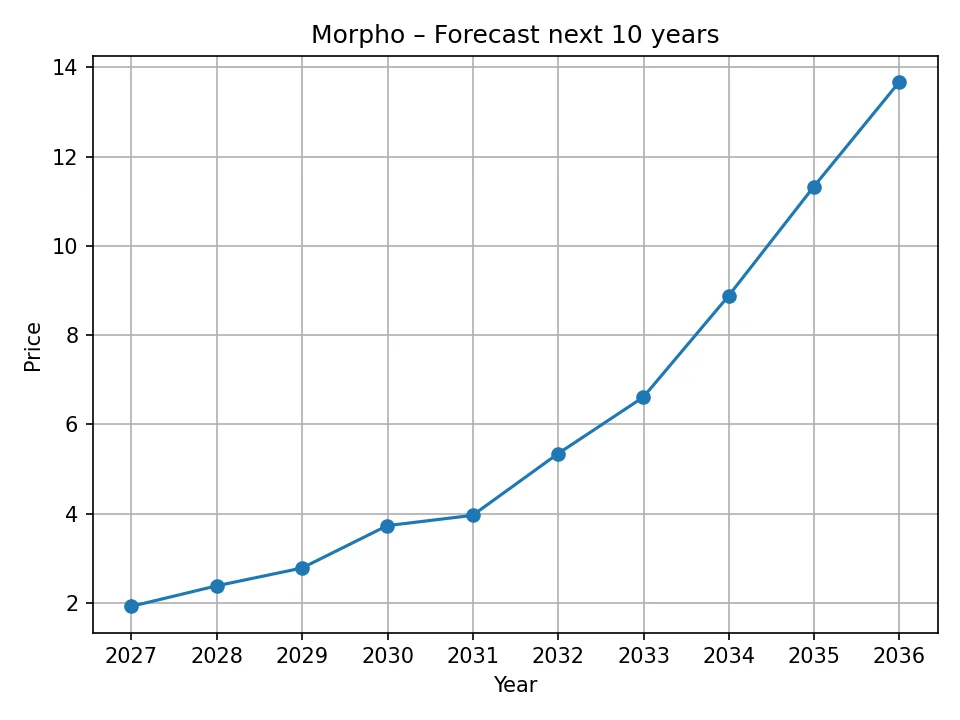

Morpho Price Prediction: Long-Term Vision (10 Years)

Beyond the immediate horizon, understanding Morpho’s long-term potential requires a broader perspective, factoring in the maturation of the DeFi space, technological advancements, and Morpho’s evolving role within it. The EdgePredict algorithm projects a significantly more bullish trajectory for Morpho over the next decade, reflecting a potential for substantial growth, assuming favorable market conditions and continued innovation. This long-term outlook is based on the premise that Morpho will continue to innovate and adapt, maintaining its competitive edge in a dynamic market.

The long-term forecast anticipates that Morpho will not only solidify its position but also expand its influence within the decentralized finance sector. This growth would be driven by sustained adoption of DeFi, increased demand for capital-efficient lending solutions, and Morpho’s ability to adapt and scale. The predicted exponential growth implies that the algorithm foresees Morpho becoming a critical infrastructure layer in the future of finance, with its token accruing considerable value as its utility and ecosystem expand. This aligns with the broader narrative of DeFi evolving from a niche crypto application to a more integral part of the global financial system. The substantial increase projected over this ten-year period indicates that EdgePredict identifies Morpho as a protocol with significant disruptive potential, capable of capturing a large segment of the future financial market.

Here is the detailed annual price prediction for Morpho, as forecasted by the EdgePredict algorithm:

| Year | Projected Price (USD) |

|---|---|

| 2026 | $1.92 |

| 2027 | $2.38 |

| 2028 | $2.78 |

| 2029 | $3.73 |

| 2030 | $3.96 |

| 2031 | $5.34 |

| 2032 | $6.61 |

| 2033 | $8.88 |

| 2034 | $11.33 |

| 2035 | $13.67 |

The annual predictions paint a compelling picture of long-term appreciation. From an estimated $1.92 in 2026, the price is projected to rise steadily, reaching $3.96 by 2030, and then accelerating further to an impressive $13.67 by 2035. This forecast suggests that the algorithm anticipates Morpho to capitalize on the increasing mainstream adoption of DeFi, its continued technological advancements, and its potential to attract a larger user base. Such long-term growth would likely be fueled by factors such as:

- Mass Adoption of DeFi: As decentralized finance solutions become more user-friendly, secure, and integrated with traditional finance, protocols like Morpho are likely to see exponential growth in users and capital. The global shift towards digital economies and blockchain-based financial systems will create a fertile ground for DeFi protocols.

- Technological Superiority: Morpho’s ability to consistently offer optimized lending rates and capital efficiency could solidify its position as a preferred platform, drawing liquidity away from less efficient protocols. Continued innovation in its matching engine and risk management frameworks will be paramount.

- Scalability Solutions: Integration with Layer 2 scaling solutions or future advancements in blockchain technology could significantly reduce transaction costs and increase throughput, making Morpho more accessible and attractive to a broader audience, including institutional players.

- Regulatory Clarity: Favorable regulatory frameworks globally could unlock massive institutional capital, which would likely seek out established and efficient DeFi protocols like Morpho. Clear guidelines reduce uncertainty and foster a more stable environment for growth.

- Robust Governance and Community: A strong and engaged community, actively participating in governance, can ensure the protocol adapts effectively to market changes and competitive pressures, fostering long-term resilience and sustained development. This decentralized decision-making process builds a more robust and adaptable project.

- Interoperability and Cross-Chain Expansion: Morpho’s ability to operate across multiple blockchain networks or integrate with various DeFi ecosystems would significantly broaden its reach and utility, tapping into diverse liquidity pools and user bases beyond Ethereum.

This long-term outlook, while highly optimistic, hinges on Morpho’s continued innovation, the broader growth of the DeFi sector, and the evolution of the regulatory landscape. Investors considering a long-term position in Morpho should evaluate these macro trends and the project’s ability to maintain its competitive edge. The projections signify a belief in Morpho’s foundational strength and its potential to thrive within an increasingly decentralized financial future.

In-depth Analysis and Future Outlook

Synthesizing the historical performance with the EdgePredict algorithm’s forecasts, Morpho presents an intriguing investment profile with significant upside potential, alongside the inherent risks of the cryptocurrency market.

The Bullish Case for Morpho

The bullish scenario for Morpho is predicated on its innovative core technology and the explosive growth potential of the DeFi sector. If Morpho continues to deliver on its promise of superior capital efficiency and optimized interest rates, it could capture a significant market share within the rapidly expanding DeFi lending space. Its unique P2P matching mechanism, which reduces interest rate spreads and improves capital utilization for both lenders and borrowers, is a powerful differentiator. Key drivers for a bullish run would include:

- Increasing TVL and User Base: Consistent growth in Total Value Locked (TVL) and active users would directly translate into higher demand for the Morpho token, both for governance and potentially for liquidity incentives. As more users realize the benefits of optimized lending, Morpho’s network effects could accelerate.

- Successful Protocol Upgrades: Implementing new features, improving user experience, and expanding integrations (e.g., cross-chain capabilities, new asset support, or sophisticated risk management tools like Morpho Blue) would enhance its utility and attractiveness. These upgrades demonstrate a commitment to innovation and adaptability.

- Favorable Regulatory Environment: Should global regulations become more supportive of DeFi, institutional investors could pour significant capital into the ecosystem, benefiting established protocols like Morpho that offer robust and efficient financial primitives. Regulatory clarity provides a safer environment for large-scale adoption.

- Overall Crypto Market Bull Run: A resurgence or continuation of a strong bull market, particularly one led by Ethereum (given Morpho’s base on the Ethereum blockchain), would naturally lift many high-quality altcoins, including Morpho, as liquidity flows across the ecosystem.

- Defensive Niche: In an environment where traditional interest rates remain low, or even in a fluctuating economic climate, the appeal of potentially higher, optimized DeFi yields could draw more capital to platforms like Morpho, positioning it as a competitive alternative to traditional financial instruments.

- Strong Community and Development Team: A vibrant, engaged community and a dedicated, skilled development team are crucial for long-term project health. Their ability to respond to market changes, innovate, and ensure security will underpin sustained growth.

Under these conditions, Morpho could not only meet but potentially exceed the optimistic long-term price targets, becoming a leading protocol in the DeFi lending landscape and attracting significant capital from both crypto-native and traditional financial participants.

The Bearish Case for Morpho

Despite the promising outlook, it is crucial to consider the potential headwinds that could impede Morpho’s growth. The bearish scenario is typically driven by factors inherent to the volatile crypto market and specific challenges within the DeFi space:

- Intensified Competition: The DeFi lending market is fiercely competitive. New protocols with even more innovative solutions, or established players significantly upgrading their offerings to match Morpho’s efficiency, could erode Morpho’s market share. A failure to continuously innovate could see its competitive advantage diminish.

- Security Vulnerabilities: Smart contract exploits or hacks, unfortunately, remain a persistent risk in DeFi. A major security breach, particularly one leading to significant loss of user funds, could severely damage trust, lead to capital flight, and devastate token price, regardless of prior audits.

- Regulatory Crackdown: Onerous or unclear regulations in key jurisdictions could hinder DeFi adoption, force protocols to de-list or restrict services, thereby reducing Morpho’s addressable market and accessibility. Uncertainty discourages both retail and institutional participation.

- Broader Market Downturns: A prolonged bear market in the overall cryptocurrency space, triggered by macroeconomic factors (e.g., global recession, high inflation leading to liquidity crunch), geopolitical events, or widespread negative sentiment, would likely drag Morpho’s price down irrespective of its fundamentals.

- Tokenomics Concerns: Large unlocks of tokens from vesting schedules for team members or early investors, if not managed transparently and strategically, could flood the market and depress prices due to increased selling pressure.

- Reduced Demand for DeFi Lending: A significant shift in user behavior away from DeFi, or if traditional finance offers increasingly competitive rates and more accessible lending options, could reduce the overall demand for decentralized lending solutions, impacting Morpho’s core utility.

- Technological Obsolescence: Rapid advancements in blockchain technology could lead to new paradigms that render current DeFi architectures less efficient or secure, posing a threat to Morpho if it cannot adapt or integrate with emerging technologies.

Prudent investors must weigh these risks carefully and acknowledge that the crypto market is highly susceptible to rapid, unpredictable changes. A thorough risk assessment, including scenario planning for these bearish factors, is essential for informed investment decisions.

Strategic Considerations for Investors

Given the analysis, potential investors in Morpho should consider a long-term perspective, aligning with the projected growth outlined by the EdgePredict algorithm. However, this does not negate the importance of continuous monitoring. Staying informed about Morpho’s development roadmap, community engagement, TVL statistics, security audit results, and the broader DeFi market trends is crucial. Understanding the team’s ability to execute on their vision and adapt to market changes is paramount. Diversifying portfolios across different asset classes and within the crypto space, and investing only what one can afford to lose, are fundamental principles in such a high-risk, high-reward environment. The utility and governance aspects of the Morpho token underscore its intrinsic value, differentiating it from purely speculative assets. Its continued ability to innovate and attract users by offering superior rates in a competitive lending market will be key to its sustained success. Furthermore, investors should monitor the macroeconomic landscape, as global financial conditions can significantly influence the liquidity and risk appetite within the crypto market.

Conclusion

Morpho stands as a compelling project within the decentralized finance ecosystem, offering an innovative approach to optimizing lending and borrowing. Its historical price data reveals periods of significant growth and characteristic crypto market volatility, demonstrating both its potential and the inherent risks. While the past is not indicative of future performance, it provides valuable context for understanding Morpho’s resilience and potential to recover from market downturns.

The EdgePredict algorithm offers a cautiously optimistic short-term outlook, predicting a steady, gradual increase for Morpho over the next 12 months, reaching approximately $1.92 by June 2026. This reflects a period of anticipated stabilization and incremental growth. The long-term forecast paints a significantly more bullish picture, envisioning substantial growth to $13.67 by 2035. This long-term projection is grounded in the anticipated maturation of the DeFi sector, Morpho’s unique technological advantage, and its potential to become a cornerstone of future decentralized financial infrastructure. The algorithm’s confidence in Morpho’s long-term trajectory suggests a strong belief in its fundamental value proposition and its ability to adapt and thrive.

However, it is imperative for all market participants to approach these predictions with a clear understanding of the inherent risks. The cryptocurrency market is notoriously unpredictable, influenced by a myriad of factors ranging from global economic conditions and regulatory shifts to specific project developments and unforeseen events. While Morpho’s fundamental value proposition is strong, its journey through the coming years will undoubtedly involve challenges and opportunities that will test its adaptability and resilience. Thorough research, strategic planning, and a diversified investment approach remain paramount for anyone considering exposure to Morpho or the broader crypto market. The future of decentralized finance is bright, and Morpho is positioned to be a significant player, but careful navigation of its complexities is advised.

Disclaimer: The price predictions presented in this article are based on data analyzed by our proprietary EdgePredict algorithm and should not be considered financial advice. The cryptocurrency market is highly volatile, and actual prices may vary significantly from these forecasts. Investing in cryptocurrencies carries substantial risk, and individuals should conduct their own thorough research and consult with a qualified financial advisor before making any investment decisions. We are not responsible for any investment outcomes based on the information provided herein.

Maxwell Reed is the first editor of Cryptovista360. He loves technology and finance, which led him to crypto. With a background in computer science and journalism, he simplifies digital currency complexities with storytelling and humor. Maxwell began following crypto early, staying updated with blockchain trends. He enjoys coffee, exploring tech, and discussing finance’s future. His motto: “Stay curious and keep learning.” Enjoy the journey with us!