Gala (GALA) stands at the intersection of blockchain technology and entertainment, aiming to revolutionize how digital content is created, owned, and distributed. As a foundational layer for the Gala Games ecosystem, which has expanded to include Gala Music and Gala Film, GALA is designed to empower users, creators, and developers by providing true digital ownership and an innovative play-to-earn model. In an ever-evolving cryptocurrency landscape, understanding the potential future trajectory of assets like GALA is crucial for participants looking to navigate the complexities of digital markets. This comprehensive analysis delves into Gala’s underlying fundamentals, examines its historical price movements, explores the multifaceted factors that influence its value, and presents algorithmic price predictions for both the short and long term.

Understanding Gala (GALA) and Its Ecosystem

Gala is more than just a cryptocurrency; it is the native utility token that powers the extensive Gala ecosystem. Initially launched as a platform for blockchain gaming, Gala Games quickly gained traction by offering players genuine ownership of in-game assets as NFTs, allowing them to trade, sell, or utilize these assets across different games within the ecosystem. This fundamental shift from traditional gaming models, where assets are controlled by centralized entities, resonated strongly with the blockchain community and gamers seeking more control over their digital properties.

The utility of the GALA token is diverse and integral to the functioning of its ecosystem. It serves as the primary medium of exchange for purchasing NFTs, including characters, skins, virtual land, and other in-game items from the Gala store. Beyond gaming, GALA facilitates transactions within Gala Music, a decentralized music platform where artists can release music as NFTs, and fans can own a share of their favorite tracks or support their preferred artists directly. Similarly, Gala Film is emerging as a Web3-powered film studio, leveraging blockchain to fund, distribute, and enable ownership of cinematic content. The GALA token is the key to accessing these diverse entertainment verticals.

Another critical aspect of the Gala ecosystem is its decentralized network, primarily supported by GALA Node operators. These operators run nodes that help secure the network, validate transactions, and contribute to the overall stability and growth of the ecosystem. In return for their contributions, node operators are rewarded with GALA tokens and other ecosystem assets, creating a robust and incentivized community-driven infrastructure. This decentralized approach enhances security, transparency, and censorship resistance, embodying the core principles of Web3.

The visionary leadership behind Gala, including co-founder Eric Schiermeyer (co-founder of Zynga), brings significant experience from the traditional gaming industry, lending credibility and strategic direction to the project. This blend of blockchain innovation with seasoned industry expertise positions Gala uniquely within the competitive crypto and entertainment sectors. As the ecosystem continues to expand with new game releases, music artists joining, and film projects developing, the demand and utility for the GALA token are intrinsically linked to the overall success and adoption of these ventures.

Historical Price Performance of GALA

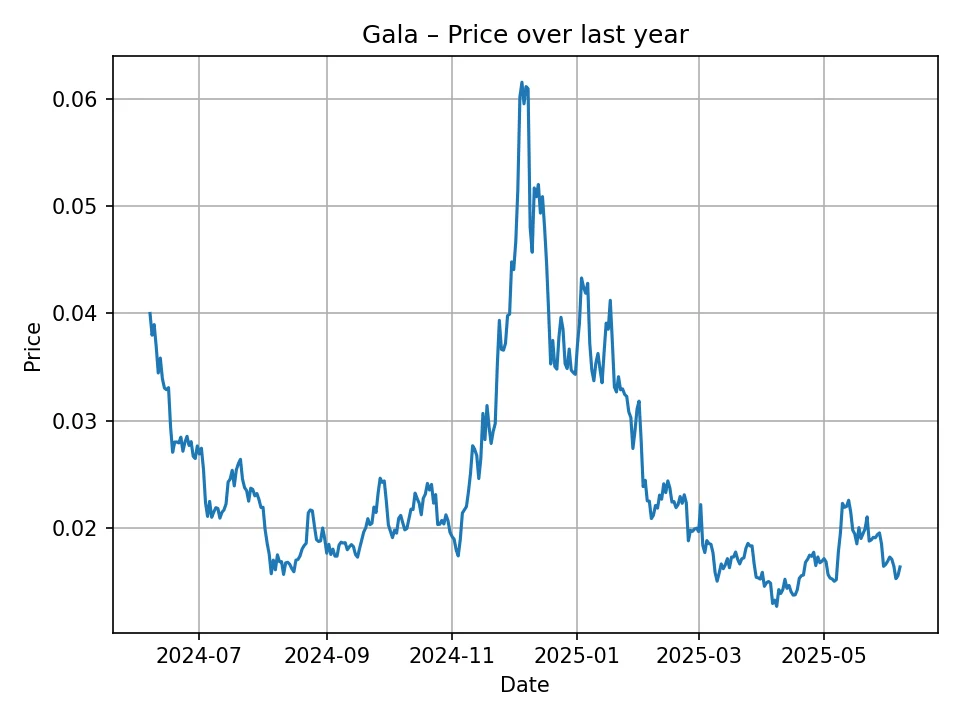

Analyzing the historical price data for Gala provides critical insights into its market behavior, volatility, and past investor sentiment. Over the past 12 months, GALA has experienced significant fluctuations, characteristic of the broader cryptocurrency market. The token embarked on this period trading at approximately $0.0399 USD. This initial price point set the stage for a period marked by both notable gains and considerable drawdowns, reflecting the dynamic nature of digital asset valuations.

Following its initial position, GALA saw a general downtrend, with its price gradually receding into the $0.02 to $0.025 USD range. This phase was likely influenced by broader market corrections or specific developments within the Gala ecosystem. However, mirroring the cyclical patterns often observed in crypto, GALA then demonstrated remarkable resilience and growth. Mid-period, the token experienced a significant upward swing, reaching its peak within this 12-month window at over $0.0615 USD. This impressive surge could be attributed to a confluence of factors, including positive market sentiment, major announcements from the Gala team (such as new game launches, partnerships, or expansions into Gala Music/Film), or a general bullish trend across the altcoin market.

The peak, however, proved to be a temporary high. Following this rapid ascent, GALA began a pronounced corrective phase. The price steadily declined, losing a significant portion of its gains. This retracement brought GALA back into the $0.03-$0.04 USD range, and further down to the $0.015-$0.02 USD territory. The final recorded price in the provided historical data is approximately $0.0163 USD. This suggests that as of early June 2025, GALA is trading significantly lower than its peak and also below its starting point from a year ago, indicating a net bearish trend over the full 12-month period despite intermittent rallies.

This historical pattern highlights several key characteristics of GALA’s market performance:

First, volatility is a defining feature. GALA’s price movements are not linear; they are subject to sharp increases and decreases, demanding careful consideration from investors. Second, market sentiment plays a crucial role. Periods of exuberance can drive prices up quickly, while periods of FUD (fear, uncertainty, doubt) or broader market downturns can lead to significant corrections. Third, the link to ecosystem developments is strong. The success or delays of Gala’s various projects, particularly new game releases and platform expansions, directly impact investor confidence and, consequently, the token’s value. The journey from $0.0399 down to $0.0163, with a peak at $0.0615 in between, underscores the importance of a nuanced understanding of both macro crypto trends and micro Gala-specific events when evaluating its investment potential.

Key Factors Influencing GALA’s Price Trajectory

The price of GALA, like any other cryptocurrency, is influenced by a complex interplay of internal and external factors. Understanding these drivers is essential for forming a comprehensive view of its potential future performance.

- Gala Ecosystem Growth and Adoption: This is arguably the most significant factor. The success of Gala Games, Gala Music, and Gala Film directly correlates with the utility and demand for the GALA token.

- New Game Launches and Popularity: The release of highly anticipated and successful games within the Gala Games platform can significantly boost GALA’s price. A game that attracts a large player base and generates substantial in-game economic activity increases the demand for GALA for purchasing NFTs and facilitating transactions.

- User Acquisition and Engagement: Growth in the number of active users across all Gala platforms (gaming, music, film) naturally increases the utility and demand for GALA. More users translate to more transactions, more NFT purchases, and greater overall ecosystem activity.

- Artist and Filmmaker Adoption: For Gala Music and Gala Film, attracting prominent artists and filmmakers to release their content on the decentralized platforms would lend immense credibility and drive user engagement, thus impacting GALA’s value.

- Tokenomics and Utility: The design and implementation of GALA’s tokenomics play a vital role.

- Supply and Demand Dynamics: The total supply of GALA tokens, coupled with its distribution and any burning mechanisms, directly influences its scarcity. If demand outstrips supply, the price tends to rise.

- Node Operations: The continuous operation of GALA nodes, which secure the network and are rewarded in GALA, creates a consistent demand for the token among those looking to participate in the network’s infrastructure.

- Staking and Governance: If GALA introduces or expands staking mechanisms or provides significant governance rights to token holders, it could incentivize holding and reduce circulating supply, potentially leading to price appreciation.

- Broader Cryptocurrency Market Trends: GALA’s price rarely moves in isolation.

- Bitcoin (BTC) Performance: Bitcoin, as the market leader, often dictates the overall sentiment and direction for altcoins. A strong bull run in Bitcoin typically pulls altcoins like GALA higher, while a significant drop can trigger widespread sell-offs.

- Altcoin Market Cycles: Beyond Bitcoin, the general health and trends within the altcoin market, particularly GameFi and Web3 sectors, directly impact GALA.

- Regulatory Landscape: Global cryptocurrency regulations, or the lack thereof, can introduce significant uncertainty or, conversely, provide clarity and foster adoption. Favorable regulations could positively impact GALA, while restrictive measures could pose challenges.

- Technological Developments and Innovation:

- Blockchain Upgrades: Enhancements to the underlying blockchain technology (e.g., improved scalability, security, or interoperability) can boost confidence in the ecosystem and GALA’s long-term viability.

- Cross-Chain Capabilities: The ability for GALA and its NFTs to seamlessly operate across different blockchain networks could expand its reach and utility.

- Partnerships and Collaborations: Strategic alliances with established gaming studios, entertainment companies, technology providers, or other blockchain projects can bring new users, resources, and innovation to the Gala ecosystem, positively influencing GALA’s market perception and value.

- Competitor Landscape: The GameFi and metaverse sectors are becoming increasingly competitive. The emergence of new, innovative projects that offer superior experiences or tokenomics could divert attention and investment away from Gala, posing a challenge to GALA’s price appreciation.

- Investor Sentiment and Media Coverage: Social media trends, news headlines, and endorsements from influential figures can rapidly shift investor sentiment, leading to speculative buying or selling pressure. Positive narratives surrounding Gala’s development and achievements can foster bullish sentiment.

Each of these factors contributes to the volatile and often unpredictable nature of GALA’s price. Investors must consider a holistic view, balancing the inherent risks with the potential for innovation and growth that Gala represents in the evolving Web3 entertainment landscape.

Understanding the QuantumCast Prediction Model

The price predictions presented in this article are generated by “QuantumCast,” a proprietary algorithmic forecasting model. This advanced analytical tool is designed to process vast amounts of historical data, identify complex patterns, and project potential future price movements for cryptocurrencies like Gala (GALA). While the exact mechanics of QuantumCast are confidential due to its proprietary nature, it typically incorporates a sophisticated blend of methodologies commonly found in cutting-edge financial modeling.

Generally, such algorithms analyze various data points, including:

- Historical Price and Volume Data: This forms the core of the analysis, recognizing trends, volatility, support, and resistance levels.

- Technical Indicators: Mathematical calculations based on price, volume, or open interest, such as moving averages, relative strength index (RSI), and Bollinger Bands, which help identify momentum, overbought/oversold conditions, and potential trend reversals.

- Market Sentiment Analysis: While more challenging for algorithms, advanced models may attempt to gauge sentiment from social media, news, and other public sources, often using natural language processing (NLP) to detect bullish or bearish trends.

- On-Chain Metrics: Data directly from the blockchain, such as active addresses, transaction volumes, network hash rates, and token distribution among holders, can offer insights into network health and adoption.

- Macroeconomic Factors: Broader economic indicators, inflation rates, interest rate changes, and global financial market stability can indirectly influence crypto valuations.

QuantumCast synthesizes these diverse inputs using complex machine learning algorithms, deep learning neural networks, or other statistical methods to create a probability-based forecast. It aims to identify the most likely price paths given the current market conditions and historical precedents. It’s important to remember that while sophisticated, algorithms are models based on past data and assumptions; they cannot predict unforeseen black swan events or completely capture the irrationality of human market behavior.

GALA Price Prediction: The Next 12 Months (2025-2026)

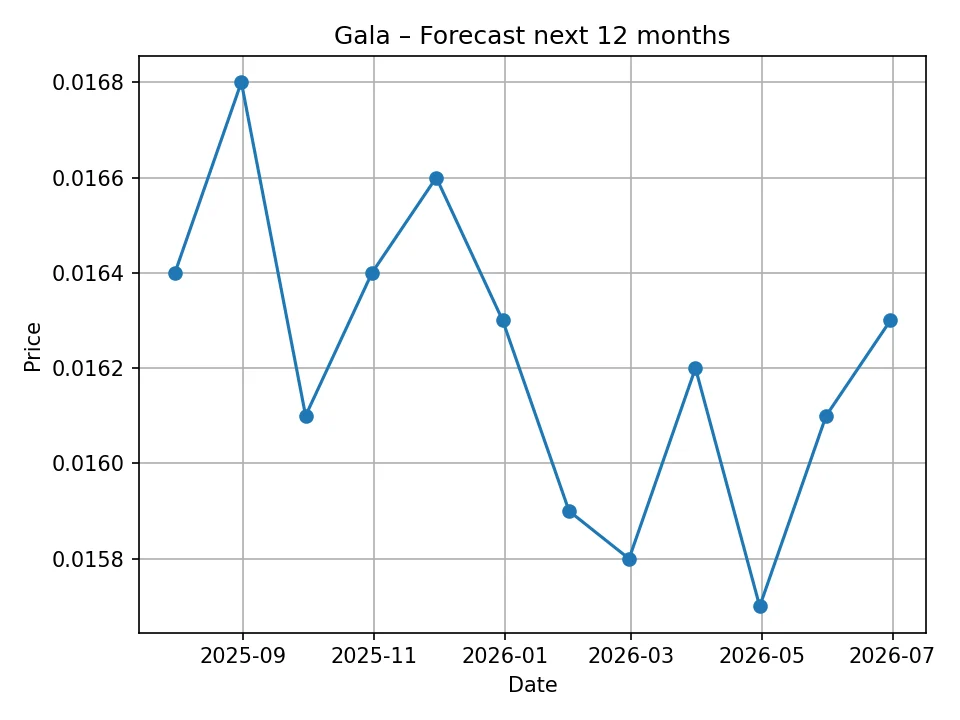

Based on the QuantumCast algorithmic analysis, the short-to-medium term outlook for Gala (GALA) over the next 12 months appears to be characterized by a period of relative stability, with the algorithm predicting a narrow trading range. The forecast suggests that GALA may consolidate around its current levels, experiencing minimal significant price swings during this period.

Here is the monthly breakdown from July 2025 to June 2026:

| Month | Predicted Price (USD) |

|---|---|

| July 2025 | $0.0164 |

| August 2025 | $0.0168 |

| September 2025 | $0.0161 |

| October 2025 | $0.0164 |

| November 2025 | $0.0166 |

| December 2025 | $0.0163 |

| January 2026 | $0.0159 |

| February 2026 | $0.0158 |

| March 2026 | $0.0162 |

| April 2026 | $0.0157 |

| May 2026 | $0.0161 |

| June 2026 | $0.0163 |

The QuantumCast algorithm anticipates GALA to hover predominantly between $0.0157 USD and $0.0168 USD. This remarkably narrow range suggests that, based on the historical data and patterns identified by the model, there are no immediate catalysts or major headwinds expected to cause significant deviation from its current price point. The forecast implies a period of consolidation, where GALA might trade sideways, potentially building a base before a more decisive move.

From a technical perspective, such a flat prediction could indicate that the algorithm identifies strong support and resistance levels around these prices, or that prevailing market conditions do not suggest a breakout in either direction. For investors, this might translate into a period of low volatility, where trading opportunities based on large price swings are limited, and accumulation strategies might be considered for those with a longer-term outlook.

It’s crucial to acknowledge that while algorithmic predictions are data-driven, the cryptocurrency market is highly susceptible to sudden shifts due to news, regulatory changes, technological breakthroughs, or broader market sentiment. For GALA specifically, any major game launch, a significant partnership announcement for Gala Film or Music, or an unexpected development in its node network could introduce new variables that might not be fully captured by historical data-driven models. Conversely, broader market downturns or project-specific setbacks could also lead to deviations from this predicted stability.

GALA Price Prediction: Long-Term Outlook (2026-2035)

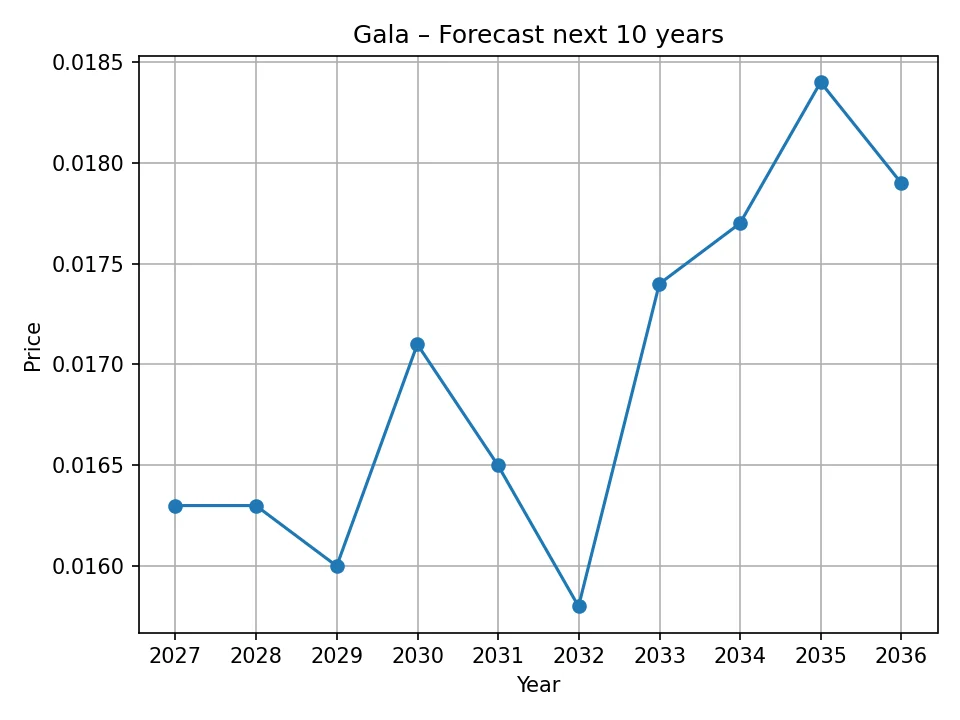

Extending the horizon to a decade, the QuantumCast algorithm provides a long-term price forecast for Gala (GALA) that continues to reflect a cautious and relatively stable outlook. Unlike the often-speculative parabolic growth projections common in the crypto space, this model predicts GALA will remain within a contained price range, indicating a period of sustained consolidation or slow, steady growth rather than explosive appreciation.

Here is the yearly breakdown from 2026 to 2035:

| Year | Predicted Price (USD) |

|---|---|

| 2026 | $0.0163 |

| 2027 | $0.0163 |

| 2028 | $0.0160 |

| 2029 | $0.0171 |

| 2030 | $0.0165 |

| 2031 | $0.0158 |

| 2032 | $0.0174 |

| 2033 | $0.0177 |

| 2034 | $0.0184 |

| 2035 | $0.0179 |

The long-term forecast suggests GALA will primarily trade within the range of $0.0158 USD to $0.0184 USD over the next ten years. This indicates that the QuantumCast model does not foresee a dramatic increase in GALA’s valuation based on its current inputs. While there are slight upticks predicted in years like 2029, 2032, 2033, and 2034, these movements are modest and do not deviate significantly from the overall flat trajectory.

Such a conservative long-term prediction could imply several things from the algorithm’s perspective:

- Maturity and Consolidation: The algorithm might be predicting that GALA, having gone through early volatile growth cycles, will enter a more mature phase where its price movements are less erratic and more aligned with the intrinsic growth of its ecosystem.

- Market Efficiency: It could suggest that the algorithm believes the market has largely priced in Gala’s known potential and challenges, leading to a more efficient and less speculative valuation.

- Lack of Exponential Catalysts: The model might not detect, or cannot quantify, the likelihood of truly game-changing catalysts that would propel GALA to significantly higher price points, such as widespread mainstream adoption of blockchain gaming, or a major technological breakthrough that fundamentally alters its value proposition.

- Supply/Demand Balance: It could indicate that the algorithm forecasts a relatively balanced supply and demand dynamic for GALA, preventing sustained periods of either massive accumulation or sell-offs.

For long-term investors, this forecast presents a unique perspective. It challenges the “get rich quick” narrative often associated with crypto and instead points towards an asset that might offer stability rather than explosive returns over a decade. This type of prediction necessitates a different investment thesis, focusing on the utility and ongoing development of the Gala ecosystem rather than purely speculative price appreciation.

However, it is paramount to remember that long-term predictions in the cryptocurrency space are inherently challenging due to rapid technological advancements, evolving regulatory environments, and unforeseen market shifts. A project like Gala, which is actively building in the nascent Web3 entertainment space, has the potential for unexpected breakthroughs (e.g., a viral blockchain game, a major Hollywood partnership, or a global regulatory framework that favors Web3 content) that could significantly alter its trajectory from any algorithmic prediction. Conversely, intense competition, security vulnerabilities, or a failure to execute on its ambitious roadmap could also lead to outcomes different from these forecasts. Therefore, continuous monitoring of Gala’s fundamental developments and broader market conditions remains essential for any long-term investment strategy.

Risks and Opportunities in the GALA Ecosystem

Investing in GALA, like any cryptocurrency, comes with a distinct set of risks and opportunities. Understanding these dynamics is crucial for making informed decisions.

Opportunities:

- Pioneering Web3 Entertainment: Gala is at the forefront of decentralizing entertainment through gaming, music, and film. If the broader Web3 trend continues to gain momentum, Gala is well-positioned to capture significant market share, potentially leading to increased GALA utility and demand.

- Robust Ecosystem Development: The continuous development of new games, the expansion of Gala Music and Gala Film with compelling content, and strategic partnerships can drive massive user adoption. Each successful venture within the ecosystem adds intrinsic value to the GALA token.

- True Digital Ownership: The core appeal of Gala lies in offering true digital ownership via NFTs. As more users and creators recognize the value of this paradigm shift, Gala’s appeal could broaden significantly.

- Community-Driven Network: The reliance on node operators creates a strong, engaged community that is invested in the network’s success. This decentralized infrastructure enhances resilience and fosters organic growth.

- Potential for Mainstream Adoption: With leadership experienced in mainstream entertainment, Gala has the potential to bridge the gap between traditional entertainment consumers and Web3, leading to exponential growth if successful.

Risks:

- Intense Competition: The GameFi and metaverse sectors are highly competitive, with many projects vying for attention and investment. New and innovative platforms could emerge, challenging Gala’s position.

- Regulatory Uncertainty: The cryptocurrency and NFT markets operate in a largely unregulated environment. Potential future regulations could impact Gala’s operations, tokenomics, or the legality of its offerings in various jurisdictions.

- Market Volatility: Cryptocurrencies are inherently volatile. GALA’s price is subject to rapid and unpredictable swings influenced by global macroeconomic factors, broader crypto market sentiment, and speculative trading.

- Execution Risk: The success of Gala hinges on its ability to consistently deliver high-quality games, music, and films. Delays, technical issues, or a failure to attract top-tier talent could hinder adoption and negatively impact token value.

- Security Concerns: Like any blockchain project, Gala is susceptible to security breaches, hacks, or smart contract vulnerabilities, which could lead to loss of funds or assets and damage to reputation.

- Dependence on Node Operators: While a strength, the decentralized nature also means a reliance on a robust and incentivized network of node operators. Any issues affecting node participation could impact network stability.

Navigating the GALA market requires a keen awareness of these opportunities and risks. While the algorithmic predictions suggest a period of stability, the inherent dynamism of the crypto space means that external events and internal developments can always lead to outcomes that diverge from forecasted paths. Investors should conduct thorough due diligence, understand their risk tolerance, and consider GALA as part of a diversified portfolio.

Conclusion

Gala (GALA) stands as a prominent figure in the evolving Web3 entertainment landscape, aiming to redefine digital ownership and content distribution across gaming, music, and film. Its innovative ecosystem, supported by a decentralized network of node operators and driven by the utility of the GALA token, presents a compelling vision for the future of digital interaction and ownership.

Historical data reveals GALA’s inherent volatility, characterized by significant price swings over the past year, reflecting both periods of strong growth and sharp corrections. This demonstrates the dynamic nature of the cryptocurrency market and the impact of both broader market trends and specific project developments on GALA’s valuation. The factors influencing GALA’s price are multifaceted, ranging from the growth and adoption of its diverse ecosystem and the effectiveness of its tokenomics to overarching cryptocurrency market trends, regulatory shifts, and the competitive landscape.

The price predictions generated by the QuantumCast algorithm offer a distinct perspective. Both the 12-month and 10-year forecasts suggest a period of relative stability for GALA, with the token largely consolidating within a narrow price range between approximately $0.015 USD and $0.018 USD. This conservative outlook, derived from sophisticated data analysis, implies that the algorithm does not anticipate explosive parabolic growth based on current information and historical patterns. Instead, it points towards a potential era of maturation, where GALA’s value might align more closely with the incremental, fundamental growth of its ecosystem rather than speculative surges.

While algorithmic predictions provide valuable insights, it is crucial to reiterate that the cryptocurrency market remains highly speculative and unpredictable. The future trajectory of Gala, and the GALA token, will ultimately be shaped by the successful execution of its ambitious roadmap, its ability to attract and retain a large user base across its entertainment verticals, favorable regulatory developments, and the broader sentiment of the digital asset market. Investors must remain vigilant, conducting continuous research and understanding the inherent risks associated with such investments.

***

Disclaimer: The price predictions provided in this article are based on data generated by a proprietary algorithmic forecasting model, “QuantumCast.” These predictions are for informational purposes only and should not be construed as financial advice. The cryptocurrency market is highly volatile and unpredictable. Investing in cryptocurrencies, including GALA, carries significant risk, and you could lose all of your invested capital. We are not responsible for any investment decisions made based on the information presented herein. Always conduct your own thorough research and consult with a qualified financial advisor before making any investment decisions.

Maxwell Reed is the first editor of Cryptovista360. He loves technology and finance, which led him to crypto. With a background in computer science and journalism, he simplifies digital currency complexities with storytelling and humor. Maxwell began following crypto early, staying updated with blockchain trends. He enjoys coffee, exploring tech, and discussing finance’s future. His motto: “Stay curious and keep learning.” Enjoy the journey with us!