The cryptocurrency market, a dynamic and often unpredictable landscape, continues to capture the attention of investors worldwide. Within this innovative realm, certain digital assets emerge from unique origins, evolving far beyond their initial perceived purpose. One such asset is FLOKI, a cryptocurrency that began as a meme-inspired coin but has since forged a path toward building a robust and utility-driven ecosystem. As of June 6, 2025, the digital asset sphere buzzes with anticipation, prompting a deeper dive into the potential trajectory of FLOKI’s price.

Understanding the potential future value of a cryptocurrency like FLOKI requires a multifaceted approach. It involves examining its foundational principles, analyzing its historical performance, understanding the broader market dynamics, and leveraging advanced predictive models. This article aims to provide a comprehensive price prediction for FLOKI, drawing upon historical data and an sophisticated algorithm, NovaCast, to shed light on its potential future in USD.

The Genesis and Evolution of FLOKI

FLOKI was initially conceived as a meme coin, drawing inspiration from Elon Musk’s Shiba Inu dog named Floki. However, unlike many meme coins that rely solely on viral hype, FLOKI quickly pivoted towards a vision of becoming a serious player in the decentralized finance (DeFi) and metaverse space. This strategic shift is crucial for its long-term viability and differentiates it from its purely meme-driven counterparts.

At its core, FLOKI is a decentralized, community-driven project that operates across multiple blockchains, including Ethereum and BNB Chain. Its mission extends beyond being just a digital currency; it aims to build an entire ecosystem that provides real utility to its holders. The FLOKI ecosystem is multifaceted, encompassing several key pillars:

- Valhalla: This is FLOKI’s flagship metaverse game, an NFT gaming metaverse that aims to provide an immersive play-to-earn experience. Valhalla is envisioned as a central hub where users can interact, earn rewards, and own digital assets. Its development signifies FLOKI’s commitment to the burgeoning metaverse sector.

- FlokiFi: A suite of decentralized finance products designed to empower users with various financial tools. The most prominent product within FlokiFi is the FlokiFi Locker, a decentralized locker protocol that allows users to lock liquidity pool (LP) tokens, NFTs, and fungible tokens, ensuring long-term security and trust for various crypto projects.

- FlokiPlaces: An NFT and merchandise marketplace that facilitates the buying and selling of digital and physical goods. This platform aims to create a vibrant economy around FLOKI, providing tangible use cases for its token.

- University of Floki: An educational platform dedicated to crypto education. By providing resources and knowledge to its community, the University of Floki aims to foster a more informed and empowered user base, contributing to the broader adoption of blockchain technology.

This concerted effort to build a utility-rich ecosystem is a significant factor in FLOKI’s appeal and its potential for sustained growth. It demonstrates a commitment to long-term value creation rather than short-lived speculative pumps.

Factors Influencing FLOKI’s Price Dynamics

The price of any cryptocurrency, especially one like FLOKI that straddles the line between meme and utility, is influenced by a complex interplay of various factors. Understanding these elements is paramount to grasping the potential scope of its price movements.

Broader Cryptocurrency Market Trends

The overall health and direction of the cryptocurrency market, particularly the performance of Bitcoin (BTC) and Ethereum (ETH), profoundly impact FLOKI’s price. During bull markets, when confidence and investment pour into the crypto space, altcoins like FLOKI often see substantial gains. Conversely, bear markets or periods of consolidation tend to depress prices across the board. Bitcoin’s halving events, often precursors to bull runs, and major regulatory news can send ripple effects through the entire market.

FLOKI’s Utility and Ecosystem Development

The continued development and adoption of FLOKI’s core utility products are critical. The progress of Valhalla, the success of FlokiFi products like the FlokiFi Locker, and the growth of FlokiPlaces directly contribute to the token’s intrinsic value. Delays in roadmap delivery or failure to gain traction in these areas could negatively impact price, while successful launches and increased user engagement could drive significant appreciation. Partnerships with established brands or integration into larger blockchain ecosystems would further validate its utility.

Community Strength and Marketing Efforts

FLOKI prides itself on its robust and dedicated community, often referred to as “Floki Vikings.” A strong, engaged, and expanding community is vital for a project that originated as a meme coin. Active social media presence, viral marketing campaigns, and community-led initiatives can generate hype and attract new investors. Aggressive marketing strategies, including real-world advertising and sports sponsorships, have also been a hallmark of FLOKI’s approach, expanding its reach beyond typical crypto enthusiasts.

Tokenomics and Supply Dynamics

Understanding FLOKI’s tokenomics, including its total supply, circulating supply, and any burning mechanisms, is important. While FLOKI does not have a fixed maximum supply, it implements burning mechanisms tied to the utility of its ecosystem. For instance, transactions within FlokiFi Locker contribute to FLOKI token burns, which reduces the circulating supply over time, potentially creating scarcity and upward price pressure if demand increases.

Exchange Listings and Accessibility

Listings on major cryptocurrency exchanges (e.g., Binance, Coinbase, Kraken) significantly enhance FLOKI’s liquidity, visibility, and accessibility to a broader investor base. Each new listing can trigger a price surge due to increased demand and easier access for retail and institutional investors. Conversely, delistings, though rare for established projects, could have a detrimental effect.

Regulatory Environment

The evolving global regulatory landscape for cryptocurrencies poses both opportunities and risks. Clear and favorable regulations could foster broader adoption and legitimacy, attracting more institutional investment. Conversely, restrictive or uncertain regulations could hinder growth, potentially impacting FLOKI’s operations or market sentiment.

Macroeconomic Factors

Broader economic conditions, such as inflation rates, interest rate decisions by central banks, and geopolitical events, can influence investor appetite for risk assets like cryptocurrencies. During periods of economic uncertainty, investors may flock to safer assets, while a more stable or expansionary environment could encourage greater crypto investment.

Technological Advancements and Competition

The blockchain space is constantly evolving, with new technologies and projects emerging regularly. FLOKI faces competition not only from other meme coins striving for utility but also from established utility tokens and layer-one blockchains. Its ability to innovate, adapt to new technological trends, and maintain a competitive edge will be crucial for its sustained growth.

Historical Price Analysis of FLOKI (Last 12 Months)

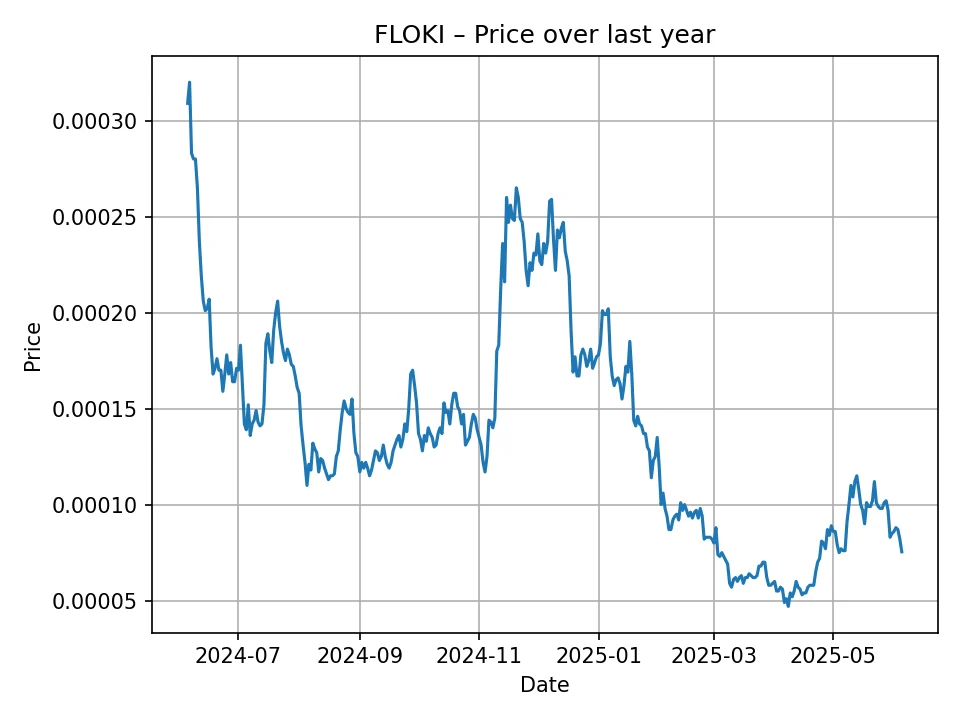

Analyzing FLOKI’s historical price data over the past 12 months provides valuable context for its current position and future potential. The provided daily data points, spanning from June 2024 to June 2025, showcase a journey marked by significant volatility, typical of meme coins striving for mainstream utility.

The data reveals a price range from a high of approximately 0.00032 USD down to a low of about 0.000049 USD. This wide fluctuation underscores the inherent risk and reward associated with investing in FLOKI.

Let’s examine the key phases observed in the historical data:

- Early Period (June – July 2024): The prices started relatively high in the provided dataset, around 0.000308 USD, and experienced a significant downward trend, dropping sharply to levels around 0.00012 USD by mid-July. This indicates a period of strong bearish pressure or market correction following a previous peak.

- Period of Consolidation and Gradual Decline (August – November 2024): Following the initial sharp decline, FLOKI entered a phase of consolidation, often trading within the 0.00012 USD to 0.00018 USD range. There were brief attempts at recovery, but these were often met with resistance, leading to further declines. By late November, the price had fallen below 0.0001 USD, signaling persistent bearish sentiment.

- Low Point and Subsequent Recovery Attempts (December 2024 – February 2025): The price reached its lowest point in the provided dataset, touching approximately 0.000049 USD in early December. This period represented a significant downturn, likely influenced by broader market conditions or specific FLOKI-related news. However, this low was followed by a notable recovery throughout January and February, pushing the price back above 0.0001 USD and even nearing 0.0002 USD. This recovery suggests renewed interest and possibly positive developments within the FLOKI ecosystem or a general uplift in market sentiment.

- Renewed Volatility and Moderate Recovery (March – May 2025): After the strong rebound, FLOKI experienced another period of volatility. While it maintained levels generally higher than its December lows, it saw significant swings, oscillating between 0.00016 USD and 0.00026 USD. This indicates a tug-of-war between buyers and sellers, reflecting uncertainty but also a foundational support level forming above the deepest lows.

- Recent Trends (Late May – Early June 2025): The most recent data points show prices around 0.000075 USD. This suggests a recent downward correction from the recovery highs seen earlier in the year. This could be due to profit-taking, broader market adjustments, or a temporary cooling of enthusiasm.

In summary, the last 12 months for FLOKI have been a rollercoaster, showcasing the high volatility inherent in meme coins and emerging utility projects. The journey from initial highs, through significant lows, to a period of recovery and subsequent correction highlights the dynamic nature of its price action. The average price over this period would be relatively low due to the prolonged dips, but the ability to rebound from severe corrections demonstrates underlying community support and potential for future movements.

FLOKI Price Prediction Methodology: NovaCast Algorithm

Predicting cryptocurrency prices is inherently challenging due to the multitude of influencing factors and the speculative nature of the market. To provide a data-driven outlook, we utilize the NovaCast algorithm, a sophisticated predictive model designed for financial market analysis.

The NovaCast algorithm operates by analyzing extensive historical data, identifying complex patterns, trends, and correlations that might not be immediately apparent through simple observation. While the exact proprietary details of NovaCast remain confidential, such algorithms typically incorporate:

- Time Series Analysis: Examining past price movements over time to identify cyclical patterns, seasonality, and long-term trends. This often involves statistical models like ARIMA, Exponential Smoothing, or Prophet.

- Technical Indicators: Incorporating common technical analysis metrics such as moving averages, Relative Strength Index (RSI), MACD, Bollinger Bands, and trading volumes to gauge market momentum, overbought/oversold conditions, and potential reversal points.

- Machine Learning Models: Employing advanced machine learning techniques (e.g., neural networks, random forests, support vector machines) to learn from historical data and make more accurate forward-looking projections. These models can identify non-linear relationships and adapt to changing market conditions.

- Volatility Analysis: Assessing historical volatility to estimate future price swings and potential risk.

- Volume Analysis: Studying trading volumes to confirm price trends and assess market participation.

It is crucial to understand that while NovaCast is a powerful tool based on rigorous statistical and computational methods, it generates predictions, not guarantees. The cryptocurrency market is subject to rapid changes due to unforeseen events, regulatory shifts, technological breakthroughs, and shifts in investor sentiment. Therefore, these predictions should be viewed as probabilities derived from data analysis, serving as an informative guide rather than definitive financial advice.

FLOKI Price Prediction: Monthly Outlook (June 2025 – May 2026)

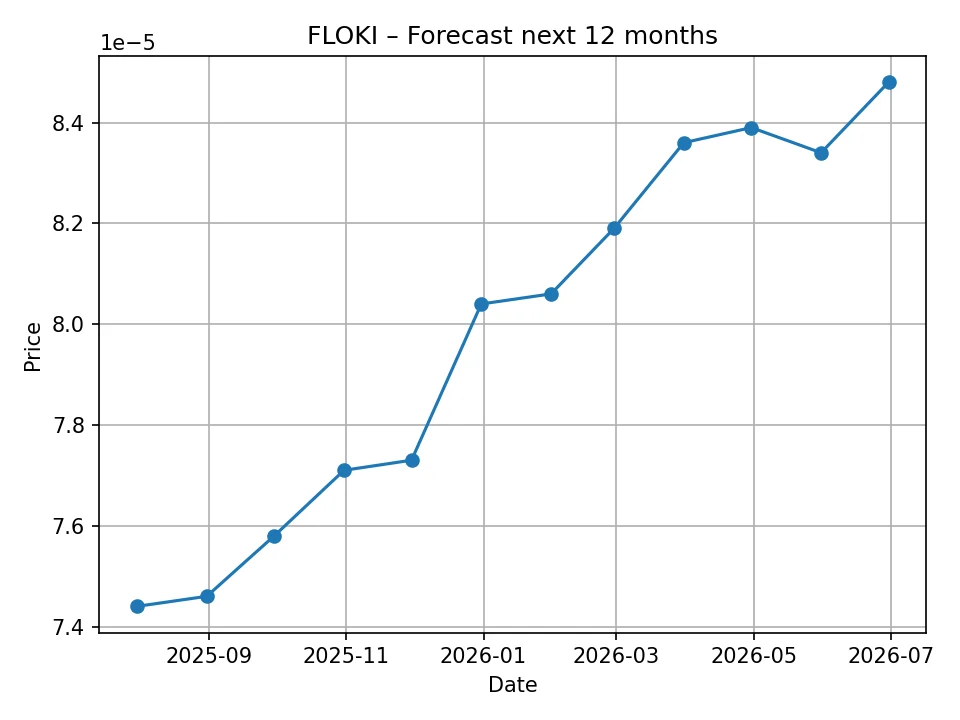

Based on the analysis performed by the NovaCast algorithm, here is the projected monthly price for FLOKI over the next 12 months, expressed in USD:

| Month/Year | Predicted Price (USD) |

|---|---|

| July 2025 | 0.0000744 |

| August 2025 | 0.0000746 |

| September 2025 | 0.0000758 |

| October 2025 | 0.0000771 |

| November 2025 | 0.0000773 |

| December 2025 | 0.0000804 |

| January 2026 | 0.0000806 |

| February 2026 | 0.0000819 |

| March 2026 | 0.0000836 |

| April 2026 | 0.0000839 |

| May 2026 | 0.0000834 |

| June 2026 | 0.0000848 |

Analysis of Monthly Predictions

The NovaCast algorithm predicts a generally stable to slowly appreciating trend for FLOKI over the next 12 months. Starting from a predicted price of 0.0000744 USD in July 2025, the forecast shows a gradual, albeit modest, increase, reaching 0.0000848 USD by June 2026.

This consistent, upward creep suggests that the algorithm anticipates a period of consolidation and slow growth for FLOKI, rather than explosive rallies or sharp declines. This could be interpreted as:

- Building Foundation: FLOKI might be establishing stronger support levels, attracting steady, long-term investors rather than short-term speculators.

- Ecosystem Maturity: As Valhalla progresses and FlokiFi tools gain adoption, the intrinsic value of the token could slowly be recognized by the market, leading to a steady price increase.

- Stable Market Conditions: The prediction might assume a relatively stable cryptocurrency market environment without major bullish surges or bearish crashes, allowing FLOKI to grow organically based on its own merits.

The relatively small increments month-over-month indicate that significant immediate catalysts are not strongly factored into this short-term predictive model, or that their impact is expected to be gradual. Investors should monitor FLOKI’s development updates, community engagement, and broader market sentiment, as these factors could always influence the actual price movement beyond algorithmic predictions.

FLOKI Price Prediction: Yearly Outlook (2026 – 2035)

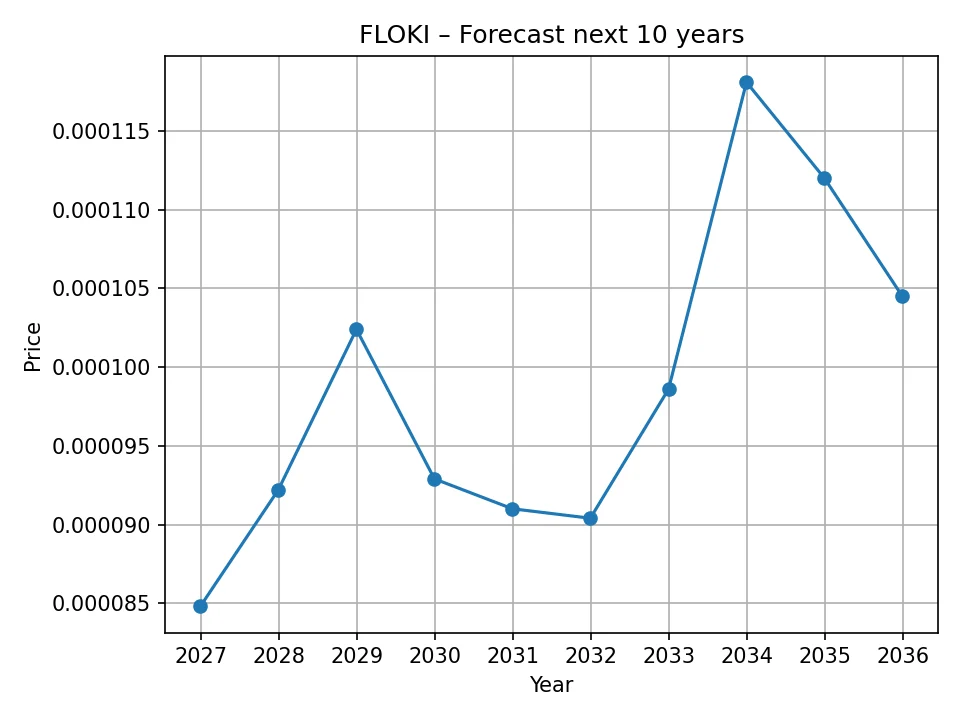

Extending the predictive horizon, the NovaCast algorithm provides a 10-year outlook for FLOKI’s price. This long-term forecast offers insights into the potential trajectory of the asset over a more extended period.

| Year | Predicted Price (USD) |

|---|---|

| 2026 | 0.0000848 |

| 2027 | 0.0000922 |

| 2028 | 0.0001024 |

| 2029 | 0.0000929 |

| 2030 | 0.0000910 |

| 2031 | 0.0000904 |

| 2032 | 0.0000986 |

| 2033 | 0.0001181 |

| 2034 | 0.0001120 |

| 2035 | 0.0001045 |

Analysis of Yearly Predictions

The long-term forecast for FLOKI paints a more complex picture than the monthly outlook, reflecting potential market cycles and shifts in project development over a decade.

- Initial Growth (2026-2028): The algorithm projects a continued upward trend from 0.0000848 USD in 2026 to a peak of 0.0001024 USD in 2028. This suggests that the early years could see FLOKI capitalizing on its developing ecosystem, potentially attracting new users and investors as its utility platforms mature. Reaching a five-figure value (0.0001 USD) would be a significant milestone for FLOKI, indicating sustained growth and increasing market confidence.

- Mid-Term Correction/Consolidation (2029-2031): Interestingly, the forecast indicates a slight correction or period of consolidation after 2028, with prices dipping to 0.0000929 USD in 2029, 0.0000910 USD in 2030, and 0.0000904 USD in 2031. This could reflect potential market-wide bear cycles, increased competition, or simply a period where FLOKI’s growth stabilizes after an initial boom, allowing for further development and refinement of its offerings. Such phases are common in long-term asset trajectories.

- Renewed Long-Term Growth (2032-2035): Following the mid-term dip, NovaCast predicts another period of strong recovery and growth, with the price climbing to 0.0000986 USD in 2032 and reaching a new high of 0.0001181 USD in 2033. This suggests that FLOKI’s utility and ecosystem could gain significant traction in the later part of the decade, driving substantial demand. The slight dip to 0.0001120 USD in 2034 and 0.0001045 USD in 2035 could again represent minor corrections or the natural ebb and flow of long-term market cycles.

Overall, the 10-year prediction suggests that FLOKI has the potential for long-term appreciation, though it will likely experience periods of volatility and consolidation. Its ability to deliver on its ambitious roadmap for Valhalla, FlokiFi, and other initiatives will be paramount to achieving these projected values. The long-term success hinges on sustained development, expanding adoption, and its ability to adapt to the evolving crypto landscape.

Potential Scenarios for FLOKI’s Future Performance

While algorithmic predictions provide a statistical framework, the real-world performance of cryptocurrencies is shaped by a multitude of unpredictable events. Here, we outline potential bullish, bearish, and neutral scenarios for FLOKI.

Bullish Scenario: FLOKI Takes Flight

In a highly optimistic scenario, FLOKI could significantly outperform the NovaCast predictions, potentially revisiting or even surpassing its past all-time highs. This would be driven by a confluence of favorable conditions:

- Crypto Bull Run: A major bull market, perhaps fueled by a new Bitcoin halving cycle or institutional adoption, would lift the entire crypto market, with altcoins like FLOKI experiencing amplified gains.

- Valhalla Dominance: If Valhalla becomes a leading metaverse game, attracting millions of players and generating substantial revenue, the demand for FLOKI (used for in-game transactions, NFTs, and governance) would skyrocket. This would be a game-changer for its utility.

- FlokiFi Ecosystem Growth: Widespread adoption of FlokiFi products, particularly the FlokiFi Locker, cementing its position as a go-to DeFi protocol for liquidity locking. Increased transaction volume through these utilities would contribute to token burns, further reducing supply.

- Major Exchange Listings: Landing listings on top-tier exchanges like Coinbase or an expanded presence on Binance would significantly increase liquidity and exposure to a vast pool of new investors, pushing prices upward.

- Strategic Partnerships: Collaborations with major traditional companies or Web2 giants could bring FLOKI into mainstream consciousness and provide real-world utility, attracting significant investment.

- Regulatory Clarity: Favorable global regulations for cryptocurrencies could reduce uncertainty and attract institutional capital into the ecosystem.

- Community Virality: Renewed viral marketing campaigns, celebrity endorsements (similar to earlier meme coin trends), or significant social media traction could reignite mass retail interest.

Under such a scenario, FLOKI could potentially shed another zero or two, moving from fractions of a cent to potentially fractions of a dollar, far exceeding the NovaCast algorithm’s conservative long-term projections.

Bearish Scenario: Downward Pressure

Conversely, FLOKI could face significant downward pressure, falling below the predicted values. This scenario could unfold if:

- Prolonged Crypto Bear Market: A severe and extended bear market, possibly triggered by global economic recession, major geopolitical conflicts, or a significant loss of confidence in the crypto space, would drag down all digital assets, including FLOKI.

- Development Delays/Failures: Significant delays in the development of Valhalla or other core ecosystem components, or if these products fail to gain substantial user adoption, could erode investor confidence.

- Increased Competition: The emergence of more innovative or better-funded meme/utility coin projects could divert attention and investment away from FLOKI. The metaverse and DeFi sectors are highly competitive.

- Regulatory Crackdowns: Adverse regulatory actions, such as bans on certain crypto activities or stringent taxation, could severely impact FLOKI’s operations or its ability to attract users.

- Loss of Community Interest: A decline in community engagement, marketing effectiveness, or perceived relevance could lead to reduced trading volume and price stagnation or decline.

- Security Vulnerabilities: Any major hacks, exploits, or technical vulnerabilities within the FLOKI ecosystem could severely damage its reputation and lead to a significant price drop.

In a bearish scenario, FLOKI could retest its historical lows or even fall further, struggling to regain momentum for an extended period.

Neutral/Consolidation Scenario: Steady Path

This scenario aligns more closely with the NovaCast algorithm’s predictions, suggesting a period of steady, modest growth with intermittent corrections.

- Gradual Ecosystem Adoption: Valhalla and FlokiFi tools continue to develop and gain users, but at a measured pace, rather than explosive growth.

- Market Stability: The broader crypto market experiences periods of stability or slow growth, without extreme bull or bear cycles. Bitcoin and Ethereum maintain their current trajectories.

- Consistent Development: FLOKI developers continue to deliver on their roadmap, but perhaps without groundbreaking innovations that capture widespread attention.

- Community Maintenance: The “Floki Vikings” community remains active and supportive, providing a stable foundation, but without significant new viral growth.

In this scenario, FLOKI’s price movements would largely mirror the algorithmic predictions, showing slow appreciation over time with minor fluctuations. Investors looking for slow, long-term gains based on fundamental utility might find this scenario appealing.

Risks and Important Considerations

Investing in cryptocurrencies, especially those like FLOKI that combine meme appeal with utility aspirations, comes with inherent risks. It is crucial for potential investors to be aware of these considerations:

- High Volatility: As seen in its historical data, FLOKI is highly volatile. Prices can swing dramatically in short periods due to market sentiment, news, or even social media trends. This volatility presents both opportunities for quick gains and significant risks of rapid losses.

- Meme Coin Nature: While FLOKI is building utility, its origins as a meme coin mean it can still be susceptible to the “hype cycle” mentality, where prices are driven more by speculation and social media trends than by fundamental value. This can lead to unsustainable pumps followed by sharp corrections.

- Competition: The cryptocurrency space is fiercely competitive. FLOKI faces rivals not only from other meme coins (like Dogecoin and Shiba Inu) but also from established gaming metaverses, DeFi protocols, and educational platforms. Its ability to differentiate and sustain competitive advantage is key.

- Market Cap: While growing, FLOKI’s market capitalization is relatively small compared to industry giants. This makes it more susceptible to large price swings from significant buy or sell orders, and potentially more vulnerable to market manipulation.

- Regulatory Risks: The regulatory environment for cryptocurrencies is still evolving globally. New regulations or government crackdowns could negatively impact FLOKI’s operations, its ability to list on exchanges, or even its legal status in certain jurisdictions.

- Development and Adoption Risks: The success of FLOKI’s ecosystem (Valhalla, FlokiFi, etc.) is not guaranteed. Delays, technical issues, or a lack of user adoption for these utilities could undermine the project’s long-term viability and price potential.

- Liquidity: While FLOKI has decent liquidity, sudden large sell-offs could still lead to significant price drops, especially on smaller exchanges.

Given these risks, investors should approach FLOKI with caution, conduct thorough due diligence, and only invest capital they can afford to lose. Diversification across various assets is also a prudent strategy to mitigate risk.

Conclusion

FLOKI, a cryptocurrency that transcended its meme coin origins to become a utility-driven project, stands at an interesting juncture in the evolving digital asset landscape. Its ambitious ecosystem, encompassing the Valhalla metaverse, FlokiFi DeFi products, and educational initiatives, positions it uniquely among its peers.

The historical data over the past 12 months illustrates FLOKI’s inherent volatility, characterized by significant price swings and periods of both sharp decline and robust recovery. This rollercoaster ride is a testament to the dynamic nature of the cryptocurrency market and FLOKI’s own journey of development and adoption.

Looking ahead, the NovaCast algorithm provides a data-backed perspective. The monthly prediction suggests a period of gradual, modest appreciation for FLOKI over the next year, indicating a phase of consolidation and steady growth. The 10-year yearly forecast paints a more nuanced picture, projecting initial growth, followed by a mid-term correction, and then renewed, stronger growth in the later years of the decade. This suggests that while FLOKI may experience intermittent market cycles, its long-term potential, driven by utility and adoption, remains evident.

Ultimately, FLOKI’s future trajectory will be influenced by its continued development, the success of its ecosystem projects, the strength of its community, broader market trends, and the ever-changing regulatory landscape. While it has demonstrated resilience and ambition, the path forward is not without its challenges.

It is crucial for any potential investor to understand that while price predictions offer valuable insights, they are not infallible. The cryptocurrency market is subject to rapid, unforeseen changes, and past performance is not indicative of future results. Therefore, this article’s predictions should be regarded as probabilities based on sophisticated algorithmic analysis. We are not financial advisors, and any investment decisions should be made after thorough personal research and consideration of your own financial circumstances and risk tolerance. The price predictions presented herein are generated by our proprietary NovaCast algorithm and do not constitute financial advice.

Maxwell Reed is the first editor of Cryptovista360. He loves technology and finance, which led him to crypto. With a background in computer science and journalism, he simplifies digital currency complexities with storytelling and humor. Maxwell began following crypto early, staying updated with blockchain trends. He enjoys coffee, exploring tech, and discussing finance’s future. His motto: “Stay curious and keep learning.” Enjoy the journey with us!