The current date is June 11, 2025. This article provides a comprehensive price prediction for BitTorrent (New) (BTT), analyzed through historical data, fundamental factors, and advanced algorithmic forecasting. Understanding the nuances of low-value cryptocurrencies like BTT requires a deep dive into their underlying technology, market dynamics, and the broader trends shaping the digital asset landscape. While the cryptocurrency market is notoriously volatile, this analysis aims to offer informed perspectives on BTT’s potential trajectory over the coming months and years.

Understanding BitTorrent (New) (BTT)

BitTorrent, a pioneering peer-to-peer (P2P) file-sharing protocol, revolutionized digital content distribution long before the advent of blockchain technology. Acquired by Tron Foundation in 2018, the project embarked on a new journey, integrating blockchain capabilities to enhance its decentralized ecosystem. This transformation led to the introduction of BitTorrent (New), often referred to by its ticker BTTC (BitTorrent Chain Token), a native cryptocurrency designed to incentivize and power various aspects of the BitTorrent Chain ecosystem.

The core utility of BTT lies in its role within the BitTorrent Chain, a heterogeneous cross-chain interoperability protocol. This blockchain-powered iteration extends BitTorrent’s original vision by enabling faster downloads, offering decentralized storage solutions, and facilitating a platform for decentralized applications (dApps). Users can earn BTT by seeding files or providing storage, and conversely, they can spend BTT to gain premium features such as faster download speeds or access to decentralized storage services. This economic model aims to create a self-sustaining ecosystem where participants are rewarded for their contributions, fostering a more robust and efficient network.

BTT’s technical foundation is deeply intertwined with the TRON ecosystem. As a TRC-20 token, it benefits from TRON’s high transaction throughput and low fees, making it suitable for micro-transactions inherent in file sharing and content delivery. The token’s substantial supply is a deliberate design choice, reflecting the large potential user base and the micro-transactional nature of its utility. This high supply, combined with its very low per-token value, places BTT in the category of “penny cryptos” or “micro-cap tokens,” which often exhibit unique price dynamics compared to higher-priced digital assets.

The journey from the original BTT to BitTorrent (New) (BTTC) involved a significant redenomination and migration event, aiming to increase the total supply and provide more liquidity and accessibility at a lower unit price. This strategic move was intended to make the token more approachable for everyday use cases within the BitTorrent ecosystem, including the BitTorrent File System (BTFS) for decentralized storage and DLive for live streaming.

Key Features and Use Cases of BitTorrent (New)

BitTorrent (New) is not just a cryptocurrency; it’s an integral part of a broader decentralized infrastructure. Its primary features and use cases include:

- Decentralized File Sharing: The foundational utility, enhanced with incentives for faster downloads and prolonged seeding.

- BitTorrent File System (BTFS): A decentralized storage system that allows users to store and retrieve files without reliance on centralized servers. BTT tokens are used for payments within BTFS.

- BitTorrent Chain (BTTC): A cross-chain scaling solution that facilitates interoperability between TRON, Ethereum, and BSC, enabling seamless asset transfers and smart contract interactions across these networks.

- Staking: Users can stake BTT to participate in network governance and earn rewards, contributing to the security and decentralization of the BitTorrent Chain.

- DApp Development: Developers can build and deploy decentralized applications on the BitTorrent Chain, leveraging its infrastructure for various Web3 initiatives.

These functionalities highlight BTT’s ambition to be a foundational layer for decentralized data and content distribution in the Web3 era, moving beyond simple file sharing to a comprehensive decentralized internet infrastructure.

Historical Price Analysis of BitTorrent (New) (BTT)

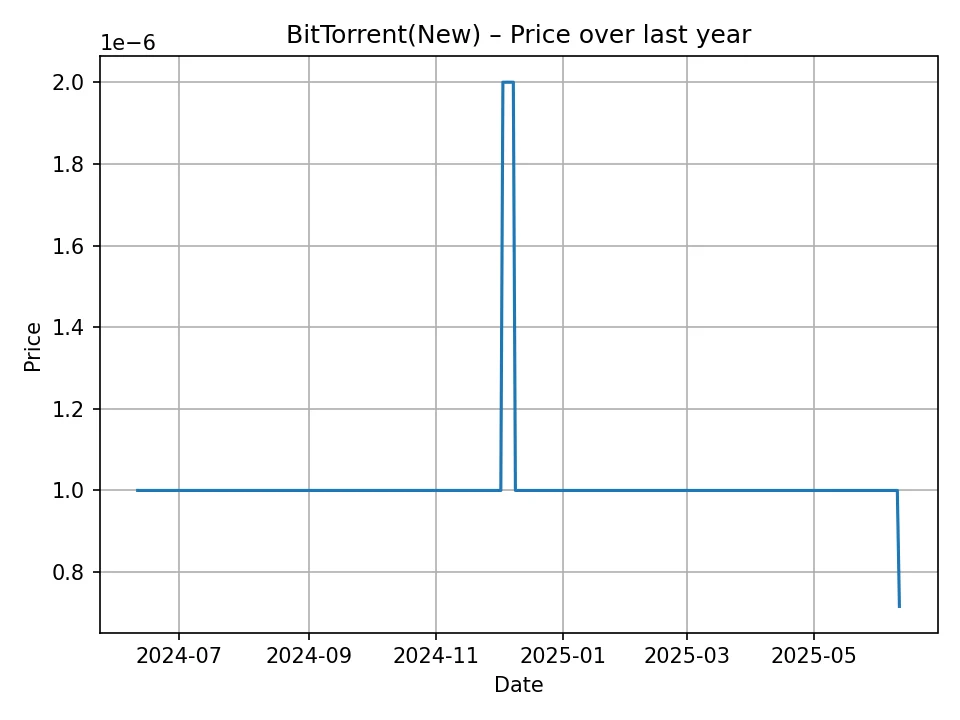

Analyzing the historical price data for BitTorrent (New) reveals a token that has largely maintained an extremely low valuation over the past year, reflecting its high supply and specific market niche. Over the last 12 months, the price of BTT has predominantly hovered around $0.000001 USD, with occasional, brief upward movements. This stability at such a low price point is a defining characteristic of BTT’s market behavior during this period.

Specifically, for a significant portion of the last year, BTT traded consistently at approximately $0.000001 USD. There was a notable, albeit brief, period where the price saw a slight increment to roughly $0.000002 USD. This modest spike, while doubling its value from its typical trading range, still positions BTT as a micro-value asset. Following this brief surge, the price reverted to its lower range, and the most recent historical data point indicates a value of approximately $0.000000716 USD. This recent dip suggests that BTT has continued to consolidate at the lower end of its spectrum, reflecting persistent selling pressure or a lack of significant bullish momentum in the short term.

The historical price performance of BTT is critical for understanding its potential future. Cryptocurrencies that trade at such minimal values often face unique challenges and opportunities. On one hand, small percentage gains can lead to significant multiples on investment for early adopters if the token gains widespread adoption. On the other hand, the extremely high supply means that achieving even a fraction of a cent per token requires a massive influx of capital, market capitalization, and sustained demand.

The largely flat trajectory, punctuated by minor fluctuations, suggests that BTT has not been significantly influenced by major bullish cycles that might have impacted other, higher-cap cryptocurrencies in the same period. This could indicate either:

- Mature Market Segment: BitTorrent’s core file-sharing utility is well-established, and perhaps its blockchain integration is still seeking broader adoption beyond its initial user base.

- Tokenomics Impact: The sheer volume of BTT tokens in circulation naturally keeps the per-token price low, requiring substantial catalysts for significant price appreciation.

- Investor Sentiment: Investors may view BTT as a long-term infrastructure play rather than a short-term speculative asset, leading to less volatile trading.

This historical behavior sets the stage for our predictions, indicating that any significant price movements for BTT will likely be driven by fundamental shifts in its utility, adoption, or broader market sentiment towards decentralized storage and content delivery solutions. The fact that the most recent price is even lower than the primary historical average suggests that the path to recovery and growth may be slow but potentially steady if fundamental improvements are realized.

Factors Influencing BitTorrent (New) (BTT) Price

The price of BitTorrent (New) (BTT), like any other cryptocurrency, is subject to a complex interplay of various factors. For a token with such a low per-unit value and high supply, these influences are particularly pronounced. Understanding these drivers is crucial for interpreting past performance and anticipating future movements.

1. Broader Cryptocurrency Market Trends

The overall health and sentiment of the cryptocurrency market, often dictated by Bitcoin (BTC) and Ethereum (ETH) performance, profoundly impact altcoins like BTT. During bull markets, capital tends to flow from Bitcoin into altcoins, potentially lifting even micro-cap tokens. Conversely, bear markets can exert significant downward pressure across the board. Given BTT’s historical stability at low values, its sensitivity to these broader trends might be dampened compared to more volatile assets, yet a strong market upturn could still provide tailwinds. The current date being mid-2025 places us in a period often characterized by post-halving dynamics for Bitcoin, which historically can lead to broader market rallies.

2. Technological Developments and Ecosystem Growth

The continuous evolution of the BitTorrent Chain and its associated products is a primary driver. Upgrades to the BTTC protocol, improvements in cross-chain interoperability, and the launch of new features (e.g., enhanced decentralized storage solutions, new dApp integrations, improved staking mechanisms) can increase BTT’s utility and attractiveness. Strong development activity signals a healthy and forward-looking project. The success of initiatives like BitTorrent File System (BTFS) and the adoption of its decentralized storage solution will directly translate into demand for BTT.

3. Adoption and Utility

The real value of BTT is derived from its actual use. An increase in the number of users leveraging BitTorrent for file sharing, utilizing BTFS for storage, or participating in the BitTorrent Chain ecosystem (e.g., through staking or dApp interactions) will drive demand for the token. Metrics such as daily active users, network transaction volume, and the amount of data stored on BTFS are crucial indicators of BTT’s organic adoption and, consequently, its price potential. Growth in the number of dApps built on or integrated with BTTC will also enhance its utility.

4. Partnerships and Integrations

Strategic collaborations with other blockchain projects, traditional tech companies, or content creators can significantly expand BTT’s reach and use cases. New integrations that bring BTT’s functionality to a wider audience or solve real-world problems could trigger substantial demand. For instance, partnerships with major media companies or cloud storage providers could validate BTFS and boost BTT’s profile.

5. Regulatory Environment

The evolving global regulatory landscape for cryptocurrencies poses both opportunities and risks. Clear and favorable regulations could foster institutional adoption and wider mainstream acceptance, benefiting BTT. Conversely, restrictive or uncertain regulations could hinder growth, particularly for decentralized technologies that might face scrutiny over content distribution or data sovereignty. Being part of the TRON ecosystem, BTT is also indirectly affected by regulations concerning TRON.

6. Tokenomics and Supply Dynamics

BTT’s tokenomics, particularly its exceptionally high circulating supply (hundreds of trillions of tokens), is a fundamental factor dictating its per-unit price. While a high supply contributes to its low price, it also allows for micro-transactions, making it suitable for its intended use cases. Any future token burning mechanisms, changes in staking rewards, or adjustments to its distribution model could impact supply-demand dynamics and, consequently, price. Currently, the sheer volume means significant capital is required to move the needle substantially on a per-token basis.

7. Competition

BitTorrent (New) operates in a competitive landscape. Decentralized storage solutions (e.g., Filecoin, Arweave, Storj) and other content delivery networks are constantly evolving. BTT’s ability to innovate, maintain a competitive edge, and attract users over rivals will be crucial for its long-term success and price appreciation. Its legacy as a dominant file-sharing protocol gives it a unique advantage, but it must continue to adapt to new Web3 demands.

Considering these multifaceted factors, BTT’s price trajectory will be a function of its ongoing development, its ability to attract and retain users, and the broader market’s appetite for decentralized infrastructure solutions.

BitTorrent (New) (BTT) Price Prediction Methodology

Our price predictions for BitTorrent (New) (BTT) are generated using FutureLens, a proprietary algorithmic forecasting model. This advanced algorithm leverages a comprehensive dataset that includes historical price movements, trading volumes, market capitalization data, and relevant on-chain metrics for BTT. Beyond raw historical figures, FutureLens integrates machine learning techniques to identify complex patterns and correlations within the data, accounting for the inherent volatility and unique characteristics of cryptocurrency markets.

The model also considers a range of macro-economic indicators and general crypto market sentiment, though its primary focus remains on the asset-specific data. For a low-value, high-supply token like BTT, the algorithm places particular emphasis on volume trends and network adoption metrics where available, alongside a sophisticated analysis of past price behavior, even if largely stable. It’s designed to extrapolate potential future price paths based on statistical probabilities and identified trends, rather than subjective human interpretation alone.

It is important to emphasize that while algorithmic predictions provide a data-driven perspective, they are not infallible. The cryptocurrency market is influenced by numerous unpredictable factors, including geopolitical events, technological breakthroughs, regulatory shifts, and sudden changes in market sentiment. Therefore, these predictions should be viewed as probabilities derived from complex computational analysis, serving as a guide rather than definitive financial advice.

BitTorrent (New) (BTT) Monthly Price Prediction: June 2025 – June 2026

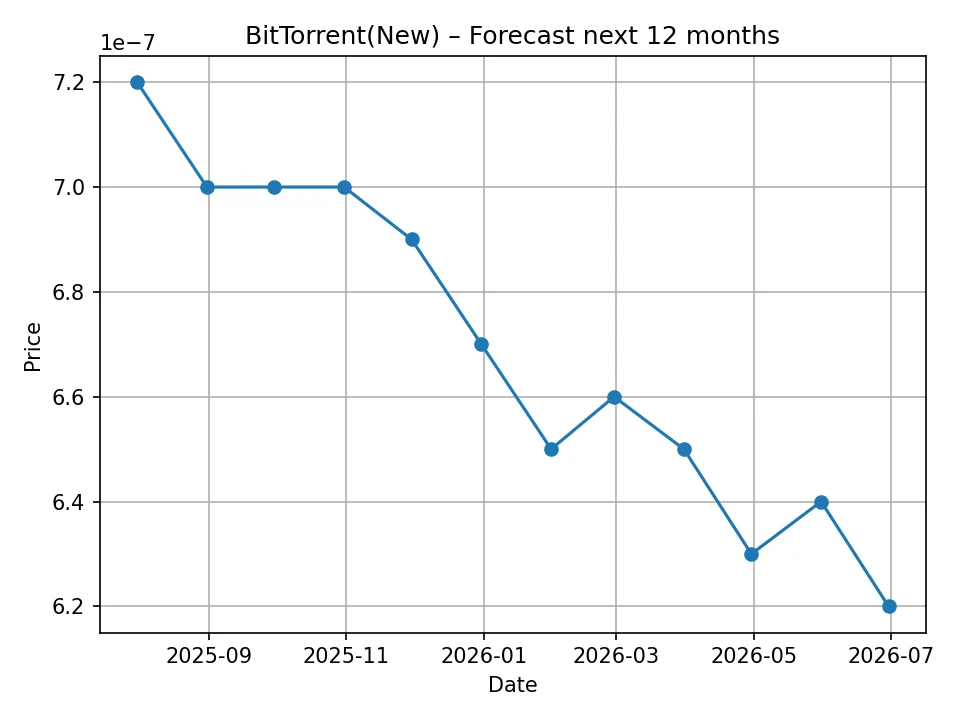

Based on the analysis performed by our FutureLens algorithm, the monthly price forecast for BitTorrent (New) (BTT) suggests a slight downward trend over the next 12 months from the current inferred valuation. The historical data concluded with BTT at approximately $0.000000716 USD. The monthly projections indicate that BTT may experience minor fluctuations, generally consolidating at a slightly lower range before potentially stabilizing.

This short-term outlook could be attributed to several factors:

- Market Consolidation: After any minor market movements, tokens like BTT often undergo periods of consolidation where prices stabilize or slightly decrease as trading volume adjusts.

- Profit-Taking: Even marginal price increases can lead to profit-taking among short-term traders, contributing to slight dips.

- Lag in Ecosystem Growth: While the BitTorrent Chain ecosystem is developing, widespread adoption and the full realization of its utility might take time, leading to subdued price action in the immediate future.

Despite the minor forecasted decline, the values remain within a very tight range, reinforcing BTT’s status as a micro-value asset. Investors should note that even small percentage shifts at this price point represent minimal absolute changes in dollar value.

Here is the detailed monthly price prediction for BitTorrent (New) (BTT):

| Month/Year | Predicted Price (USD) |

|---|---|

| July 2025 | $0.00000072 |

| August 2025 | $0.00000070 |

| September 2025 | $0.00000070 |

| October 2025 | $0.00000070 |

| November 2025 | $0.00000069 |

| December 2025 | $0.00000067 |

| January 2026 | $0.00000065 |

| February 2026 | $0.00000066 |

| March 2026 | $0.00000065 |

| April 2026 | $0.00000063 |

| May 2026 | $0.00000064 |

| June 2026 | $0.00000062 |

The forecast indicates a very slight dip in the short term, with the price potentially settling around $0.00000062 by June 2026. This period might be seen as a phase of modest recalibration, reflecting the token’s current market position and the ongoing development trajectory within the BitTorrent ecosystem.

BitTorrent (New) (BTT) Annual Price Prediction: 2026 – 2035

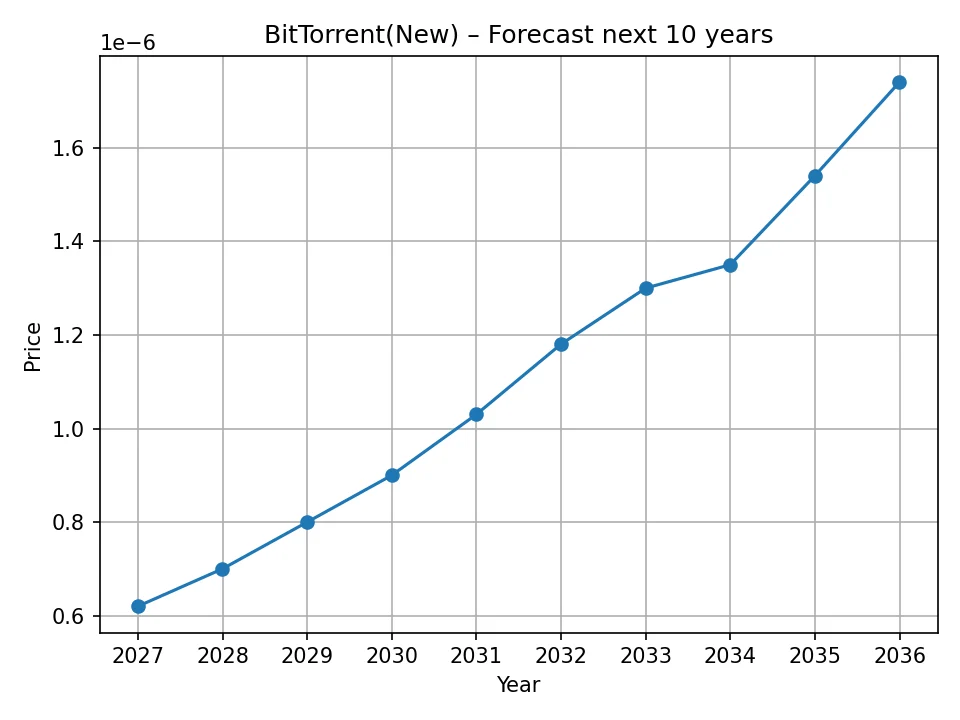

Looking at the longer-term horizon, our FutureLens algorithm projects a more optimistic outlook for BitTorrent (New) (BTT) over the next decade. While the immediate 12-month forecast indicates a slight consolidation or decline, the annual predictions suggest a gradual, yet significant, appreciation in BTT’s value from 2027 onwards, building upon its projected price in 2026. This long-term growth trajectory implies that the underlying utility and adoption of the BitTorrent Chain and its decentralized services may start to gain more traction over time.

The initial forecast for 2026 aligns with the end of our monthly prediction, showing the price around $0.00000062 USD. However, from 2027, the predictions show a consistent, albeit slow, upward movement. This long-term trend could be fueled by several macro factors:

- Increased Web3 Adoption: As the internet transitions towards a more decentralized Web3 architecture, the demand for decentralized storage and content delivery solutions, which BitTorrent Chain provides, is likely to surge.

- Technological Maturity and Scalability: Over time, the BitTorrent Chain is expected to mature, offering enhanced scalability, security, and user experience, making it more attractive for developers and users.

- Growing Data Needs: The exponential growth of digital data globally will drive the need for efficient and decentralized storage solutions, positioning BTFS (BitTorrent File System) as a viable option.

- Strategic Ecosystem Expansion: Continuous innovation, strategic partnerships, and new use cases within the TRON and BitTorrent ecosystems could create sustained demand for BTT.

- Supply Dynamics: While the supply is currently high, future token burning events or increasing utility could absorb more tokens from the market, leading to price appreciation.

It is crucial to remember that long-term predictions are inherently more speculative due to the vast number of variables that can influence the market over extended periods. However, the consistent growth projected by FutureLens suggests a belief in the fundamental utility and long-term relevance of the BitTorrent Chain.

Here is the detailed annual price prediction for BitTorrent (New) (BTT) for the next 10 years:

| Year | Predicted Price (USD) |

|---|---|

| 2026 | $0.00000062 |

| 2027 | $0.00000070 |

| 2028 | $0.00000080 |

| 2029 | $0.00000090 |

| 2030 | $0.00000103 |

| 2031 | $0.00000118 |

| 2032 | $0.00000130 |

| 2033 | $0.00000135 |

| 2034 | $0.00000154 |

| 2035 | $0.00000174 |

The forecast indicates that BTT could reach a value of approximately $0.00000174 USD by 2035. While this still represents a very low per-token price, it signifies a substantial percentage increase from its current and near-term projected values. This projected growth suggests a slow but steady accumulation of value as the BitTorrent ecosystem expands and decentralization becomes more integral to internet infrastructure. The increase from six zeros after the decimal point to eventually reaching the vicinity of one millionth of a dollar or more (from $0.00000062 to $0.00000174) represents a significant relative gain, even if the absolute values remain small.

Long-Term Outlook and Potential Use Cases for BTT

The long-term viability and potential for BitTorrent (New) (BTT) hinges on its ability to carve out a significant niche in the burgeoning Web3 space, particularly in decentralized storage, content delivery, and cross-chain interoperability. While its historical price action has been modest, the inherent utility of the BitTorrent protocol combined with blockchain incentives offers a compelling narrative for future growth.

Future Relevance in Web3

As the internet evolves towards Web3, characterized by decentralization, user ownership, and enhanced privacy, the demand for underlying infrastructure like decentralized storage (BTFS) and efficient content delivery (BitTorrent P2P network) is expected to grow exponentially. BTT is positioned to be a key facilitator in this transition. Use cases could expand to:

- NFT Storage: Secure and immutable storage for NFTs and their associated metadata, addressing concerns about centralized storage failures.

- Decentralized Social Media: Enabling users to host and distribute content on decentralized platforms, resistant to censorship and single points of failure.

- Gaming Assets: Storing in-game assets and user-generated content on a decentralized network.

- Data Archiving and Backup: Providing a robust and cost-effective solution for large-scale data archiving for enterprises and individuals.

- Streaming and Media Distribution: Facilitating decentralized live streaming (e.g., DLive) and media distribution, reducing reliance on centralized servers and improving efficiency.

The success of these applications will directly translate into increased demand for BTT as the medium of exchange and incentive mechanism within the BitTorrent Chain ecosystem.

Challenges and Opportunities

Despite its potential, BTT faces significant challenges:

- Competition: The decentralized storage and content delivery markets are becoming increasingly competitive. BTT must continuously innovate to stay ahead of rivals like Filecoin, Arweave, and Storj.

- User Adoption: Converting the vast existing BitTorrent user base to actively use BTT within the blockchain ecosystem requires effective onboarding and a seamless user experience.

- Scalability: Ensuring the BitTorrent Chain can handle a massive volume of transactions and data transfers without compromising speed or cost.

- Regulatory Uncertainty: The evolving regulatory landscape for cryptocurrencies and decentralized services could impact BTT’s operations and market acceptance.

- Maintaining Relevance: Adapting to new technological paradigms and market demands in the rapidly evolving crypto space.

However, BTT also possesses distinct opportunities:

- Established Brand: The legacy of BitTorrent as a widely recognized file-sharing protocol provides a significant brand advantage and a massive existing user base.

- TRON Ecosystem Support: Being a core part of the TRON ecosystem provides BTT with robust developer support, technical resources, and cross-chain capabilities.

- Focus on Real Utility: Unlike many speculative tokens, BTT has clear, tangible utility within its ecosystem, which can drive organic demand.

- High Supply for Micro-transactions: The large token supply makes it ideal for micropayments in a P2P environment, allowing for very granular economic incentives.

If BitTorrent (New) can effectively navigate these challenges and capitalize on its opportunities, its long-term outlook appears cautiously optimistic, as reflected in the algorithmic forecast. The path to sustained growth will be dependent on consistent development, strategic partnerships, and increasing real-world utility that translates into tangible demand for the BTT token.

Conclusion

BitTorrent (New) (BTT) stands as a unique cryptocurrency that bridges the legacy of decentralized file sharing with the innovations of blockchain technology. Our analysis, leveraging the FutureLens algorithmic model, paints a picture of a token currently operating at an extremely low price point, with historical data showing relative stability punctuated by minor fluctuations.

The short-term monthly price prediction for 2025-2026 suggests a period of slight consolidation or minor decline, with BTT’s price potentially settling around $0.00000062 USD by June 2026. This immediate outlook indicates that significant short-term bullish momentum may be limited, reflecting ongoing market adjustments or a gradual pace of ecosystem adoption.

However, the longer-term annual price prediction for 2026-2035 offers a more encouraging perspective. Following an initial dip, BTT is forecasted to experience gradual yet consistent growth, potentially reaching approximately $0.00000174 USD by 2035. This projected appreciation suggests that over a broader horizon, the BitTorrent Chain’s utility, particularly in decentralized storage and content delivery within the evolving Web3 landscape, could gain significant traction, driving demand for the BTT token.

Factors such as technological advancements within the BitTorrent Chain, increasing adoption of decentralized storage solutions like BTFS, strategic partnerships, and the overall trajectory of the broader cryptocurrency market will be pivotal in shaping BTT’s future. While its high token supply naturally keeps its per-unit price low, even modest absolute gains represent substantial relative returns from its current micro-valuation.

As with all cryptocurrency investments, the path ahead for BitTorrent (New) is fraught with volatility and uncertainty. Investors should exercise extreme caution, conduct thorough personal research, and understand that price predictions are speculative and subject to rapid change. The BTT ecosystem’s success hinges on its ability to deliver on its ambitious vision for a decentralized internet infrastructure.

Disclaimer: The price predictions provided in this article are based on analysis performed by a proprietary algorithmic forecasting model, FutureLens, and should not be considered financial advice. The cryptocurrency market is highly volatile and speculative, and past performance is not indicative of future results. Investing in cryptocurrencies carries significant risks, and individuals should only invest what they can afford to lose. We are not responsible for any investment decisions made based on the information presented herein.

Maxwell Reed is the first editor of Cryptovista360. He loves technology and finance, which led him to crypto. With a background in computer science and journalism, he simplifies digital currency complexities with storytelling and humor. Maxwell began following crypto early, staying updated with blockchain trends. He enjoys coffee, exploring tech, and discussing finance’s future. His motto: “Stay curious and keep learning.” Enjoy the journey with us!