Bitcoin SV (BSV) emerged from a hard fork of Bitcoin Cash (BCH) in November 2018, positioning itself as the true heir to Satoshi Nakamoto’s original Bitcoin vision. Proponents of BSV, led by nChain’s Chief Scientist Dr. Craig Wright, advocate for massive on-chain scaling, focusing on transaction throughput, stability, and utility for enterprise applications. The project aims to restore the original Bitcoin protocol as described in the whitepaper, emphasizing a stable protocol for developers and businesses to build upon, without constant changes or arbitrary limits on block size. This core philosophy differentiates BSV from many other cryptocurrencies, which often prioritize decentralization through smaller block sizes or experimental technical upgrades. For investors and enthusiasts alike, understanding the potential price trajectory of BSV involves navigating its unique technological roadmap, controversial public image, and the broader dynamics of the cryptocurrency market.

The cryptocurrency market is inherently volatile, and assets like Bitcoin SV are no exception. Price movements are influenced by a complex interplay of factors, including technological advancements, regulatory developments, market sentiment, and macroeconomic conditions. While the long-term vision of BSV hinges on its ability to support high transaction volumes and real-world applications, its short-to-medium-term price performance can be significantly impacted by immediate market trends and specific project developments. This article delves into an analysis of BSV’s historical price performance over the last 12 months and presents price predictions generated by the proprietary EdgePredict algorithm, offering insights into its potential future value in USD.

Understanding Bitcoin SV (BSV) Fundamentals

At its heart, Bitcoin SV stands for “Satoshi’s Vision,” reflecting its commitment to the original Bitcoin protocol. The project’s primary technical distinction is its emphasis on unlimited block sizes, allowing for vast amounts of transactions to be processed on-chain. This approach starkly contrasts with Bitcoin (BTC) and Bitcoin Cash (BCH), which maintain stricter limits on block sizes, often advocating for off-chain scaling solutions like the Lightning Network. BSV’s proponents argue that large blocks are crucial for achieving the throughput necessary for global adoption and enterprise-level use cases, transforming Bitcoin into a truly peer-to-peer electronic cash system as originally intended.

The philosophical underpinnings of BSV also dictate a focus on protocol stability. Unlike many evolving blockchains, BSV aims to maintain a fixed protocol, providing a reliable foundation for businesses and developers to build applications without concerns about breaking changes. This stability is intended to foster a robust ecosystem of services, applications, and smart contracts, leveraging the unique capabilities of a scalable public ledger. Key use cases envisioned for BSV include micropayments, data integrity services, tokenization, supply chain management, and enterprise-grade blockchain solutions that require high data throughput and low transaction fees.

Despite its technical ambitions, Bitcoin SV has faced significant challenges, particularly regarding its public perception and association with Dr. Craig Wright’s controversial claims of being Satoshi Nakamoto. These controversies, along with delistings from major exchanges, have often overshadowed its technical progress and adoption efforts, impacting investor confidence and market liquidity. However, the project continues to develop its ecosystem, with ongoing efforts to onboard new users and build applications that leverage its unique scaling capabilities. The success of these efforts will be paramount in determining BSV’s long-term viability and price appreciation.

Historical Price Analysis: The Past 12 Months (June 2024 – June 2025)

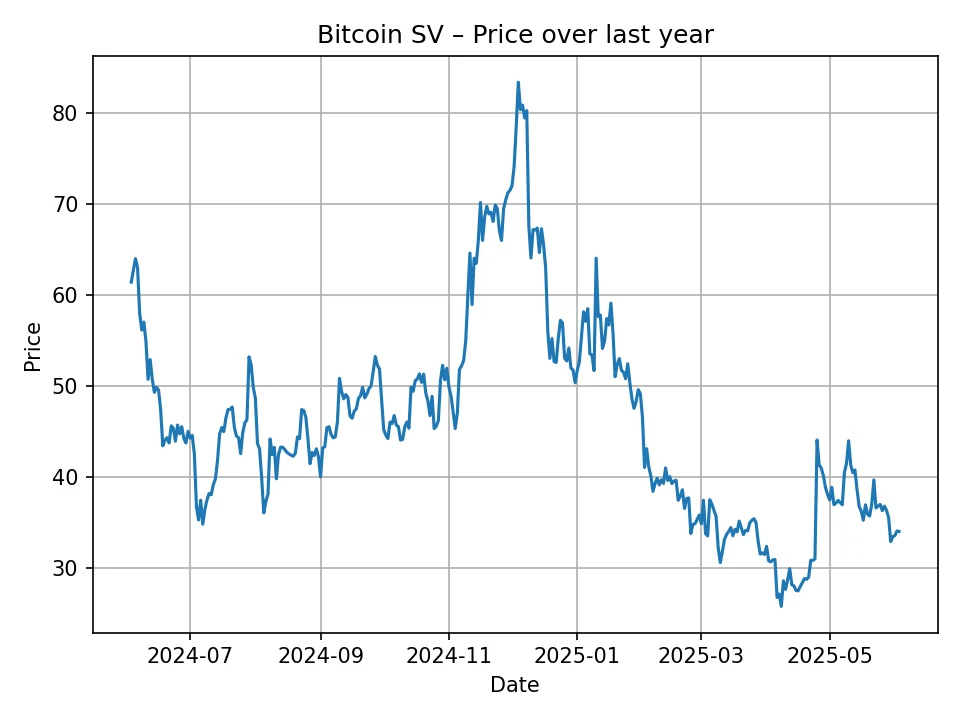

Analyzing Bitcoin SV’s price performance over the past 12 months provides crucial context for its future outlook. As of June 4, 2025, the latest available historical data indicates a closing price of approximately $33.97 USD. Looking back over the provided daily historical data, BSV has experienced significant volatility and a notable downtrend during this period.

The historical data begins around $61.40 and fluctuates, initially seeing some peaks. For instance, in late 2024 / early 2025, BSV managed to climb from the mid-$40s to a high of approximately $83.37, demonstrating its capacity for rapid upward movement driven by market dynamics or specific news. However, this surge was followed by a substantial correction, bringing the price back down. The latter half of the 12-month period shows BSV largely trading in the $30-$50 range, with several dips below $30 in the recent months. The lowest point observed in the data was around $25.74, illustrating the significant bearish pressure it has faced.

This decline contrasts with the broader crypto market’s sometimes bullish tendencies during the same period, suggesting that BSV’s price movements are not solely tethered to the general market but also significantly influenced by internal project developments, community sentiment, and ongoing controversies. The consistent downward pressure reflects potential investor apprehension, possibly due to legal proceedings involving Dr. Wright, delistings, or a perceived lack of significant mainstream adoption compared to other major cryptocurrencies. Understanding this historical performance is key to evaluating the credibility of future price predictions, as it highlights both the inherent volatility and the specific challenges BSV has encountered.

Key Factors Influencing Bitcoin SV’s Price

The future price of Bitcoin SV, like any other cryptocurrency, is shaped by a confluence of internal and external factors. Investors and analysts must consider these elements when forming their own outlook:

1. Technological Advancements and Scaling Milestones: BSV’s core value proposition lies in its ability to scale. Successful implementation of larger blocks, demonstrating consistently high transaction throughput, and attracting developers to build new applications are crucial. Any technical breakthroughs or significant network upgrades that enhance its capacity and efficiency could positively impact its price. Conversely, technical glitches or failures to meet scaling targets could lead to price stagnation or decline.

2. Enterprise Adoption and Use Cases: The BSV ecosystem’s growth is heavily reliant on real-world utility and adoption by businesses. Partnerships with established companies, the launch of significant applications leveraging BSV’s capabilities (e.g., for data integrity, supply chain, or micropayments), and increased transaction volume from such uses would signal genuine demand and drive price appreciation. The ability of BSV to capture a niche in the enterprise blockchain space is a primary long-term driver.

3. Regulatory Environment: The evolving global regulatory landscape for cryptocurrencies poses both opportunities and risks. Clear, favorable regulations could provide certainty and encourage institutional investment, benefiting BSV. However, restrictive regulations, or those specifically targeting assets with certain characteristics (e.g., those associated with legal disputes), could negatively impact its accessibility and market liquidity.

4. Market Sentiment and Broader Cryptocurrency Trends: The price of Bitcoin SV often moves in correlation with the overall cryptocurrency market, particularly with Bitcoin (BTC). A general bullish trend in the crypto space, often fueled by institutional interest or positive macroeconomic indicators, can lift BSV’s price. Conversely, a bearish market sentiment can drag it down. Investor confidence in the broader digital asset ecosystem plays a significant role.

5. Public Perception and Legal Controversies: Bitcoin SV’s association with Dr. Craig Wright and the ongoing legal battles surrounding his claims of being Satoshi Nakamoto continue to significantly influence its public image and investor sentiment. Positive resolutions to these legal disputes, or a shift in public perception towards BSV’s technical merits, could alleviate some of the existing market pressure. Conversely, unfavorable legal outcomes or continued controversy could further deter adoption and investment.

6. Exchange Listings and Liquidity: Delistings from major exchanges in the past have reduced BSV’s accessibility and liquidity, impacting its price. Future relistings on prominent platforms, or increased trading volumes on existing exchanges, could improve its market reach and provide more robust price discovery mechanisms.

7. Competition: The blockchain space is highly competitive, with numerous projects vying for market share in scaling, enterprise solutions, and dApp development. BSV must continually demonstrate its superiority and unique advantages over competitors to attract developers, users, and investors. Failure to innovate or differentiate effectively could limit its growth potential.

Each of these factors can exert considerable influence on BSV’s market valuation, making its price prediction a complex endeavor.

Price Prediction Methodology: EdgePredict Algorithm

The price predictions presented in this article are generated using a proprietary algorithm named EdgePredict. This advanced analytical model leverages comprehensive historical price data, volume trends, and various technical indicators to forecast future price movements. While the exact internal mechanics of EdgePredict are proprietary, such algorithms typically employ a combination of machine learning techniques, statistical analysis, and pattern recognition to identify potential trends and price targets. It analyzes past performance, volatility, and market cycles to project probable future values under prevailing conditions. It is important to note that all algorithmic predictions are based on historical patterns and computational models, and therefore do not account for unforeseen ‘black swan’ events or sudden, drastic shifts in market sentiment or regulatory environments.

Bitcoin SV (BSV) Monthly Price Prediction (July 2025 – June 2026)

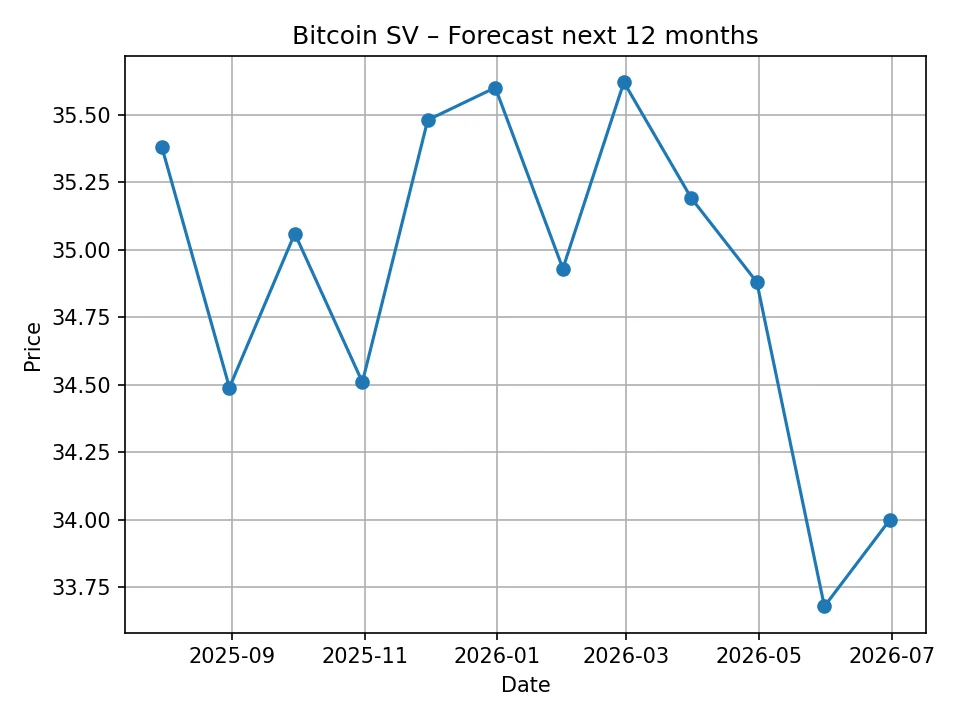

The EdgePredict algorithm has provided a 12-month monthly price forecast for Bitcoin SV, indicating a relatively stable but slightly fluctuating period ahead. The predictions suggest that BSV might hover around its current levels, with some minor variations month-to-month. This forecast could imply a period of consolidation following the recent downturn, where the asset finds a new support level before potentially attempting any significant upward movement.

Here is the detailed monthly forecast:

| Month | Predicted Price (USD) |

|---|---|

| 2025-07 | $35.38 |

| 2025-08 | $34.49 |

| 2025-09 | $35.06 |

| 2025-10 | $34.51 |

| 2025-11 | $35.48 |

| 2025-12 | $35.60 |

| 2026-01 | $34.93 |

| 2026-02 | $35.62 |

| 2026-03 | $35.19 |

| 2026-04 | $34.88 |

| 2025-05 | $33.68 |

| 2026-06 | $34.00 |

The forecast suggests that BSV will generally remain within the $33 to $36 range for the next twelve months. There isn’t a clear upward or downward trend indicated within this short-term horizon, but rather a pattern of slight oscillations around a central value. This kind of movement often characterizes a market that is either finding its footing after a significant move or awaiting new catalysts. Investors might interpret this as a period of accumulation for those who believe in BSV’s long-term vision, or a signal of continued uncertainty for those looking for quick returns.

Bitcoin SV (BSV) Annual Price Prediction (2026 – 2035)

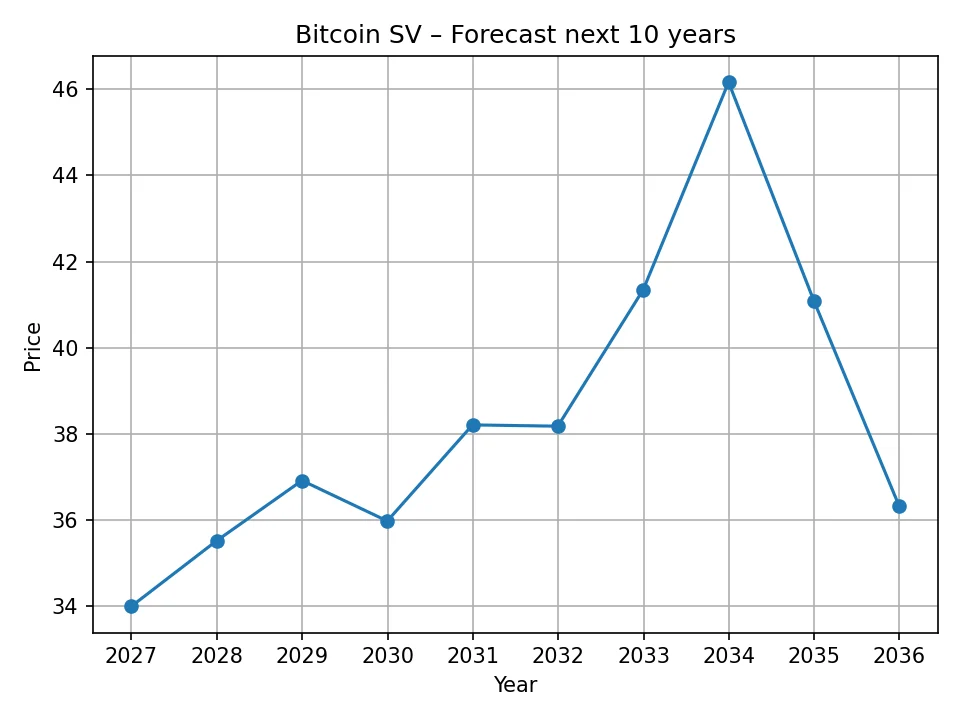

For a longer-term perspective, the EdgePredict algorithm has projected BSV’s price annually over the next decade. This 10-year outlook provides a broader view of potential trends and sustained growth or decline, factoring in more macro-level market dynamics and the long-term impact of BSV’s fundamental developments. The annual forecast indicates a generally positive, albeit modest, growth trajectory over the decade, suggesting that the algorithm anticipates some level of increased adoption or market recognition over time.

Here is the detailed annual forecast:

| Year | Predicted Price (USD) |

|---|---|

| 2026 | $34.00 |

| 2027 | $35.52 |

| 2028 | $36.92 |

| 2029 | $35.98 |

| 2030 | $38.21 |

| 2031 | $38.18 |

| 2032 | $41.35 |

| 2033 | $46.16 |

| 2034 | $41.09 |

| 2035 | $36.33 |

The annual prediction suggests a gradual upward trend for BSV, with the price potentially reaching into the mid-$40s by 2033, before experiencing a slight pullback. Starting from a projected average of $34.00 in 2026, the price is predicted to slowly climb, indicating incremental growth over the years. The peak in 2033 suggests a period where the algorithm foresees conditions most favorable for BSV’s appreciation. However, the subsequent dip in 2034 and 2035 indicates that this growth might not be linear or without corrections. This long-term forecast implies that while significant parabolic growth might not be anticipated by the algorithm, there is a belief in BSV’s ability to maintain and slightly increase its value over an extended period, possibly as its use cases become more established or as the broader market matures. It reinforces the idea that BSV investment may be more suited for those with a long-term perspective, banking on its foundational principles and scaling efforts.

Risks and Opportunities for BSV

Investing in Bitcoin SV, like any cryptocurrency, comes with inherent risks and potential opportunities. Understanding these can help investors make informed decisions.

Risks:

- Legal and Reputational Issues: The ongoing legal battles and controversies surrounding Dr. Craig Wright and his claims about Satoshi Nakamoto continue to cast a shadow over BSV. Negative legal outcomes or sustained public scrutiny could further damage investor confidence and hinder adoption.

- Exchange Delistings and Liquidity: Past delistings from major exchanges have impacted BSV’s liquidity and accessibility. While it remains tradable on several platforms, further delistings or a lack of new major listings could limit its market reach and price discovery.

- Competition: The blockchain space is fiercely competitive. Numerous other projects are also focused on scalability, enterprise solutions, and smart contracts. BSV must continually prove its technical superiority and demonstrate compelling use cases to maintain relevance and attract investment.

- Market Volatility: The entire cryptocurrency market is subject to extreme price swings. Macroeconomic factors, regulatory news, and shifts in investor sentiment can lead to rapid and unpredictable price movements, making BSV a high-risk asset.

- Adoption Challenges: Despite its focus on enterprise solutions, widespread adoption of BSV for real-world applications is still in its early stages. If businesses and developers do not embrace the platform as anticipated, its long-term value proposition could diminish.

Opportunities:

- Massive On-Chain Scaling Success: If BSV successfully demonstrates unparalleled on-chain scaling capabilities, handling millions or billions of transactions per second with low fees, it could attract significant enterprise and developer interest, validating its core thesis and driving substantial price appreciation.

- Resolution of Legal Disputes: A definitive and positive resolution to the legal disputes surrounding Dr. Craig Wright could remove a major cloud over BSV, potentially restoring investor confidence, improving its public image, and encouraging new exchange listings.

- Increased Enterprise Adoption: Significant partnerships with large corporations, the launch of widely used applications, or government interest in leveraging BSV for national digital infrastructure could create a powerful network effect, leading to exponential growth in demand and value.

- Innovation in Layer 2 Solutions: While BSV focuses on Layer 1 scaling, innovative Layer 2 solutions built on top of BSV could further enhance its capabilities and utility, opening up new avenues for adoption and usage.

- Broader Crypto Market Bull Run: A general bull market across the cryptocurrency space, driven by increased institutional investment or wider mainstream adoption, could lift all assets, including BSV, potentially pushing its price beyond algorithmic predictions.

Investors should carefully weigh these risks and opportunities against their own investment goals and risk tolerance before considering an investment in Bitcoin SV.

In conclusion, Bitcoin SV (BSV) stands as a unique proposition in the cryptocurrency landscape, firmly committed to Satoshi Nakamoto’s original vision of a massively scalable blockchain for global enterprise and daily transactions. Its historical price action over the past year highlights significant volatility and a challenging market environment, punctuated by periods of both sharp increases and notable declines. The EdgePredict algorithm’s forecast for the next 12 months suggests a period of relative price stability around current levels, with minor fluctuations. The 10-year annual prediction, while not indicating explosive growth, projects a gradual increase in value, peaking in 2033 before a slight correction, implying a long-term, incremental appreciation should its fundamental value proposition gain traction.

However, it is crucial to remember that these forecasts are based on algorithmic analysis of historical data and current trends. The cryptocurrency market remains highly unpredictable, influenced by a myriad of factors including regulatory changes, technological breakthroughs, shifts in investor sentiment, and ongoing legal developments specific to Bitcoin SV. Therefore, all investments in cryptocurrencies, including Bitcoin SV, carry substantial risk. Prospective investors should conduct thorough due diligence, understand the associated risks, and consider their own financial situation before making any investment decisions. The information provided in this article should not be construed as financial advice.

Disclaimer: Please be aware that the price forecasts provided in this article are generated by a proprietary algorithm called EdgePredict and are for informational purposes only. We are not responsible for any investment decisions made based on these predictions. Cryptocurrency investments are highly speculative and involve substantial risk, including the potential loss of principal. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Maxwell Reed is the first editor of Cryptovista360. He loves technology and finance, which led him to crypto. With a background in computer science and journalism, he simplifies digital currency complexities with storytelling and humor. Maxwell began following crypto early, staying updated with blockchain trends. He enjoys coffee, exploring tech, and discussing finance’s future. His motto: “Stay curious and keep learning.” Enjoy the journey with us!