The cryptocurrency market, known for its dynamic and often unpredictable movements, continues to capture the attention of investors worldwide. Within this volatile landscape, Cardano (ADA) stands out as a blockchain platform built on a research-first approach, emphasizing scalability, security, and sustainability through its unique proof-of-stake consensus mechanism, Ouroboros. As of June 11, 2025, the digital asset sphere is in constant flux, with a myriad of factors influencing the valuation of cryptocurrencies like ADA. Understanding these influences and leveraging data-driven insights are crucial for forming a comprehensive outlook on future price trajectories.

This detailed analysis aims to provide an in-depth price prediction for Cardano, drawing upon its historical performance, fundamental technological strengths, prevailing market trends, and a forward-looking perspective generated by a proprietary forecasting algorithm. While past performance does not guarantee future results, a thorough examination of these elements offers valuable context for potential price movements in the coming months and years.

Cardano’s Journey: A Look Back at Historical Performance

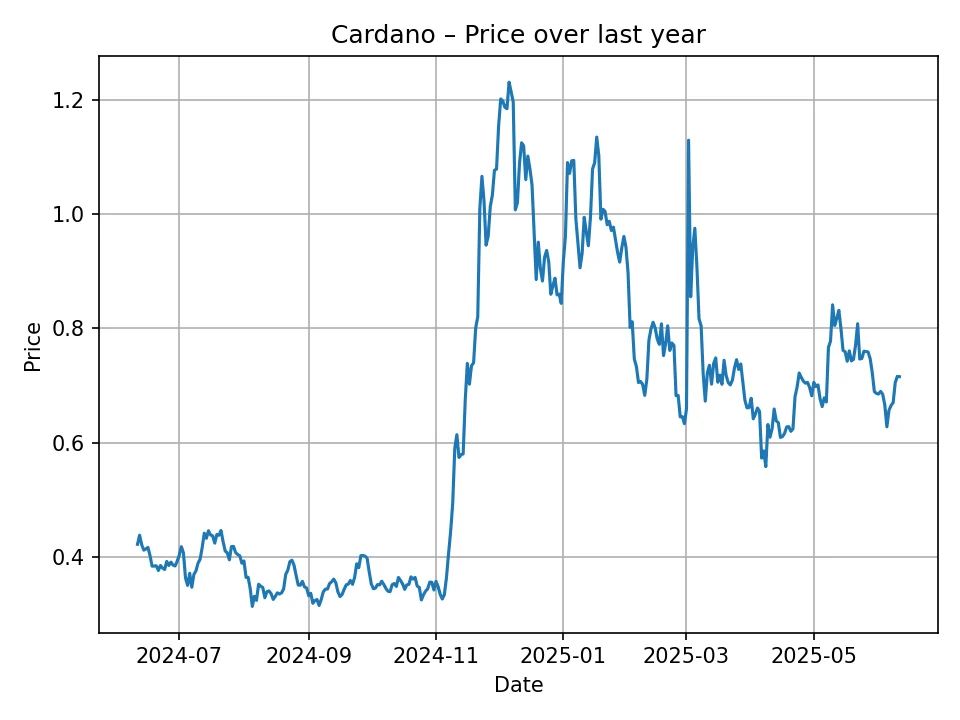

Over the past twelve months, Cardano’s price has experienced significant fluctuations, reflecting the broader volatility inherent in the cryptocurrency market. Analyzing the provided historical data, which spans from approximately June 2024 to June 2025, reveals a narrative of both resilience and substantial growth.

The lowest point observed in this period was approximately $0.31 USD, reached during a phase of broader market consolidation or bearish sentiment. Conversely, Cardano demonstrated remarkable upward momentum, peaking at around $1.23 USD. This represents a substantial percentage increase from its lows, highlighting ADA’s capacity for rapid appreciation when market conditions are favorable or when specific positive developments within the Cardano ecosystem catalyze investor interest.

The average price over this twelve-month period hovered around $0.66 USD. This average provides a baseline for understanding ADA’s typical trading range during this time. Early in the period, prices generally ranged from $0.30 to $0.45, characterized by relative stability with intermittent dips and minor recoveries. A notable shift occurred towards the end of 2024 and early 2025, when Cardano, alongside other major cryptocurrencies, experienced a significant bullish surge. This period saw ADA break past key resistance levels, climbing steadily from the $0.40-$0.50 range to surpass $0.70, then $0.80, and eventually breaching the $1.00 mark. The peak at $1.23 USD represented a strong conviction among investors regarding Cardano’s long-term potential or a reaction to specific market events.

Following this peak, the price saw a correction, which is typical after significant rallies. ADA consolidated, demonstrating healthy retracements as some investors took profits, but largely held above its pre-surge levels. This historical context underscores Cardano’s sensitivity to market cycles and its ability to participate in and benefit from bullish trends, while also exhibiting periods of price discovery and adjustment. Understanding these past movements is crucial for contextualizing any future price predictions.

Understanding Cardano: The Core Fundamentals

Cardano is often hailed as a third-generation blockchain platform, built to address the scalability, interoperability, and sustainability issues that plague earlier blockchain iterations like Bitcoin and Ethereum. Founded by Ethereum co-founder Charles Hoskinson, Cardano distinguishes itself through its commitment to academic peer review and evidence-based development, a philosophy that underpins every aspect of its protocol.

The core of Cardano’s innovation lies in its unique Proof-of-Stake (PoS) consensus mechanism, Ouroboros. Unlike Proof-of-Work (PoW) systems that consume vast amounts of energy, Ouroboros allows network participants to validate transactions and create new blocks based on the amount of ADA they stake, leading to significantly lower energy consumption and faster transaction finality. This mechanism is designed to be highly secure, sustainable, and scalable.

Cardano’s architecture is divided into two layers: the Cardano Settlement Layer (CSL), which handles ADA transactions, and the Cardano Computation Layer (CCL), which supports smart contracts and decentralized applications (dApps). This layered approach enhances flexibility and allows for upgrades without disrupting the base ledger.

Key developmental milestones, known as “eras,” define Cardano’s roadmap:

* Byron (Foundation): The initial launch, focused on the fundamental infrastructure.

* Shelley (Decentralization): Enabled staking and increased decentralization.

* Goguen (Smart Contracts): Introduced smart contract capabilities via the Plutus platform, allowing developers to build dApps. This was a pivotal moment, opening Cardano to a vast ecosystem of decentralized finance (DeFi), non-fungible tokens (NFTs), and Web3 applications.

* Basho (Scaling): Focuses on enhancing scalability and interoperability through solutions like Hydra, a layer-2 scaling solution, and sidechains.

* Voltaire (Governance): Aims to create a self-sustaining system through on-chain governance, allowing ADA holders to vote on network upgrades and proposals.

Advantages of Cardano:

- Scalability: Through Ouroboros and future Layer-2 solutions like Hydra, Cardano aims to achieve high transaction throughput, crucial for mass adoption.

- Sustainability: Its PoS mechanism is environmentally friendly, a growing concern for investors and regulators. The treasury system under Voltaire also ensures continuous funding for development.

- Security and Reliability: The academic, peer-reviewed approach to development reduces vulnerabilities and enhances the protocol’s robustness.

- Interoperability: Cardano is designed to seamlessly interact with other blockchains, fostering a more connected Web3 ecosystem.

- Active Development and Community: A dedicated team of researchers and developers, alongside a vibrant global community, consistently pushes for innovation and adoption.

Challenges and Risks:

- Competition: The blockchain space is highly competitive, with established players like Ethereum and newer “Ethereum killers” vying for market share.

- Adoption Rate: While smart contract capabilities are live, attracting a significant number of dApp developers and users to rival other ecosystems remains a challenge.

- Regulatory Uncertainty: The evolving global regulatory landscape for cryptocurrencies could impact Cardano’s operations and market acceptance.

- Market Sentiment: As with all cryptocurrencies, ADA’s price is heavily influenced by overall market sentiment, which can be unpredictable.

- Technical Delays: Despite its rigorous approach, complex technological advancements can sometimes face delays, impacting investor confidence.

Despite these challenges, Cardano’s fundamental strengths, including its unique development philosophy, strong technical foundation, and clear roadmap, position it as a significant contender in the decentralized future. Its emphasis on a scientific approach to blockchain development continues to attract those seeking a robust and reliable platform for building innovative applications.

Key Factors Influencing Cardano’s Price Movements

The price of Cardano (ADA), like any other cryptocurrency, is subject to a complex interplay of various factors. These can be broadly categorized into macroeconomic trends, broader cryptocurrency market dynamics, specific Cardano ecosystem developments, and regulatory shifts. A comprehensive understanding of these influences is vital for any price projection.

Macroeconomic Factors:

- Inflation and Interest Rates: High inflation often prompts central banks to raise interest rates, which can make riskier assets like cryptocurrencies less attractive compared to traditional investments yielding higher returns. Conversely, periods of low inflation or accommodative monetary policies may encourage investment in crypto.

- Global Economic Stability: Economic downturns or geopolitical instability can lead to a risk-off sentiment, causing investors to pull capital from volatile assets. Conversely, periods of economic growth may see increased speculative investment.

- USD Strength: As the primary trading pair for most cryptocurrencies, the strength or weakness of the US Dollar can significantly influence ADA’s price. A stronger USD can put downward pressure on crypto prices, while a weaker USD can act as a tailwind.

Broader Cryptocurrency Market Trends:

- Bitcoin’s Influence: Bitcoin (BTC) often acts as the bellwether for the entire crypto market. Significant movements in Bitcoin’s price typically ripple across altcoins, including Cardano. A strong Bitcoin bull run often signals an “altcoin season,” where capital flows into other digital assets.

- Overall Market Capitalization and Sentiment: The total market capitalization of cryptocurrencies and prevailing sentiment (bullish, bearish, or neutral) heavily impact individual asset prices. Fear, Uncertainty, and Doubt (FUD) or positive news cycles can trigger broad market reactions.

- Halving Events: While not directly tied to Cardano, Bitcoin halving events often lead to increased market awareness and can precede bull runs across the entire crypto space, benefiting ADA.

Cardano-Specific Developments:

- Protocol Upgrades: Successful implementation of major upgrades, such as the Hydra scaling solution, Mithril for faster chain synchronization, or further advancements in the Voltaire era for governance, can significantly boost investor confidence and utility, driving demand for ADA.

- dApp Growth and Adoption: The number and quality of decentralized applications (dApps) built on Cardano, coupled with user adoption rates (measured by active addresses, transaction volume, TVL in DeFi protocols), are critical indicators of network utility and value.

- Developer Activity: A vibrant and growing developer community signals innovation and long-term viability. Metrics like GitHub commits, new developer onboarding, and project launches are important.

- Partnerships and Institutional Adoption: Collaborations with enterprises, governments, or major financial institutions can lend credibility and open up new use cases for Cardano, attracting institutional capital.

- Tokenomics and Supply/Demand: The fixed supply of ADA (45 billion tokens), coupled with demand generated by staking, dApp usage, and speculative investment, dictates its scarcity and potential for price appreciation.

Regulatory Environment:

- Global Crypto Regulations: Clarity or stricter regulations from major economic blocs (e.g., US, EU, Asia) regarding cryptocurrencies can either foster institutional adoption or create headwinds for the market.

- Specific Country Stances: Individual countries adopting favorable or restrictive policies towards crypto assets can impact market access and investor sentiment.

- Classification of Cryptocurrencies: How ADA is classified by regulators (e.g., security vs. commodity) can have significant implications for its trading, listing on exchanges, and overall legal standing.

Considering these multifaceted factors, any price prediction for Cardano is not a certainty but rather an informed projection based on the most probable outcomes of these influences. The inherent volatility of the crypto market means that unforeseen events can rapidly alter price trajectories.

The PriceCast Algorithm: A Predictive Model

The price predictions presented in this analysis are generated using a proprietary algorithm, referred to as “PriceCast.” This advanced forecasting model leverages a combination of historical price data, volume trends, market sentiment indicators, and various on-chain metrics specific to the Cardano network. By analyzing complex patterns and relationships within these diverse datasets, PriceCast aims to identify potential future price movements.

It’s important to understand that no forecasting model can guarantee perfect accuracy, especially in the highly unpredictable cryptocurrency market. PriceCast, like all predictive tools, operates on probabilities and historical correlations. It continuously learns and adapts to new data, striving to provide the most informed projections possible within the confines of market volatility and external influencing factors. The algorithm’s strength lies in its data-driven approach, minimizing human bias and providing a systematic framework for long-term and short-term price discovery.

Cardano Price Prediction: The Next 12 Months (Monthly Forecast)

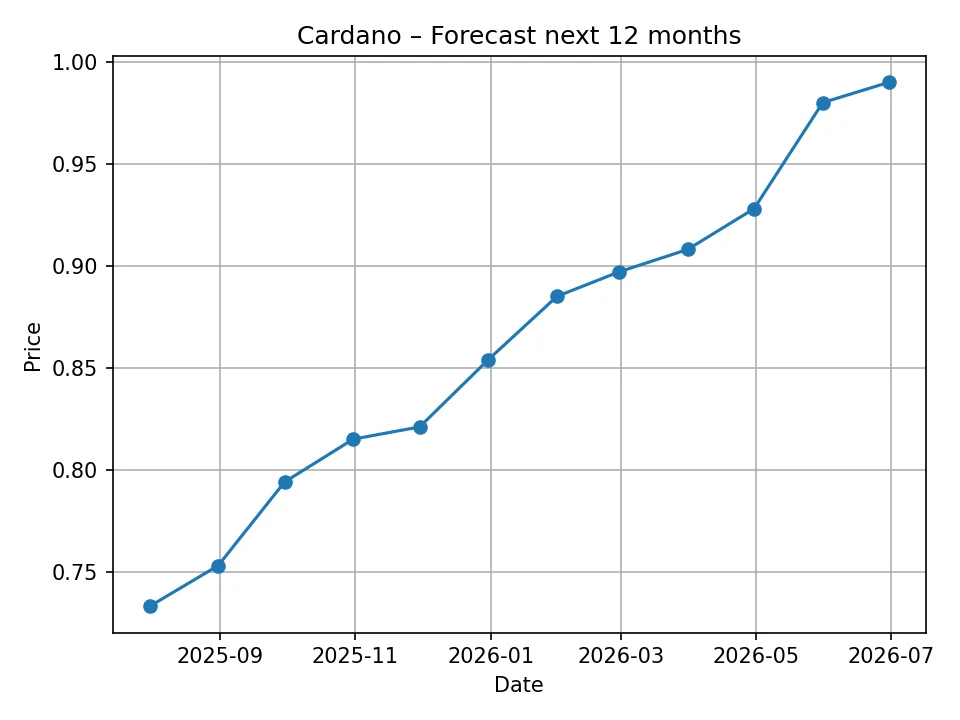

Looking ahead to the next twelve months, the PriceCast algorithm projects a period of gradual but consistent growth for Cardano (ADA). This outlook suggests that while sudden, dramatic surges might be less frequent, a steady upward trend is anticipated as the market matures and Cardano’s ecosystem continues to develop.

The prediction indicates that ADA is expected to consolidate around its current levels in the immediate future, with a slight upward bias. As we move into the latter half of 2025, the price is forecast to break past the $0.80 mark, potentially driven by anticipated network upgrades, increased dApp utility, or a positive shift in overall crypto market sentiment. The algorithm suggests that by the end of the 12-month period, around June 2026, Cardano could approach the $1.00 threshold, reflecting growing confidence in its long-term viability and expanded use cases.

This predicted trajectory implies that Cardano may continue to attract both retail and institutional investors, as its fundamentals strengthen and its position within the broader blockchain landscape becomes more defined. The consistent increase month-over-month, as indicated by the forecast, suggests a healthy, sustainable growth pattern rather than a speculative bubble. Factors such as the successful implementation of the Hydra scaling solution, increasing transaction volume on the network, and the launch of new innovative dApps could serve as key catalysts for this forecasted growth.

Here is the detailed monthly price prediction for Cardano (ADA):

| Month | Predicted Price (USD) |

|---|---|

| 2025-07 | 0.733 |

| 2025-08 | 0.753 |

| 2025-09 | 0.794 |

| 2025-10 | 0.815 |

| 2025-11 | 0.821 |

| 2025-12 | 0.854 |

| 2026-01 | 0.885 |

| 2026-02 | 0.897 |

| 2026-03 | 0.908 |

| 2026-04 | 0.928 |

| 2026-05 | 0.980 |

| 2026-06 | 0.990 |

This monthly forecast highlights a steady climb, with notable progress expected as Cardano continues to deliver on its roadmap. The journey towards reaching $1.00 and potentially surpassing it in the short-to-medium term suggests a strong foundation and increasing market confidence in ADA’s utility and ecosystem growth.

Cardano Price Prediction: The Next 10 Years (Annual Forecast)

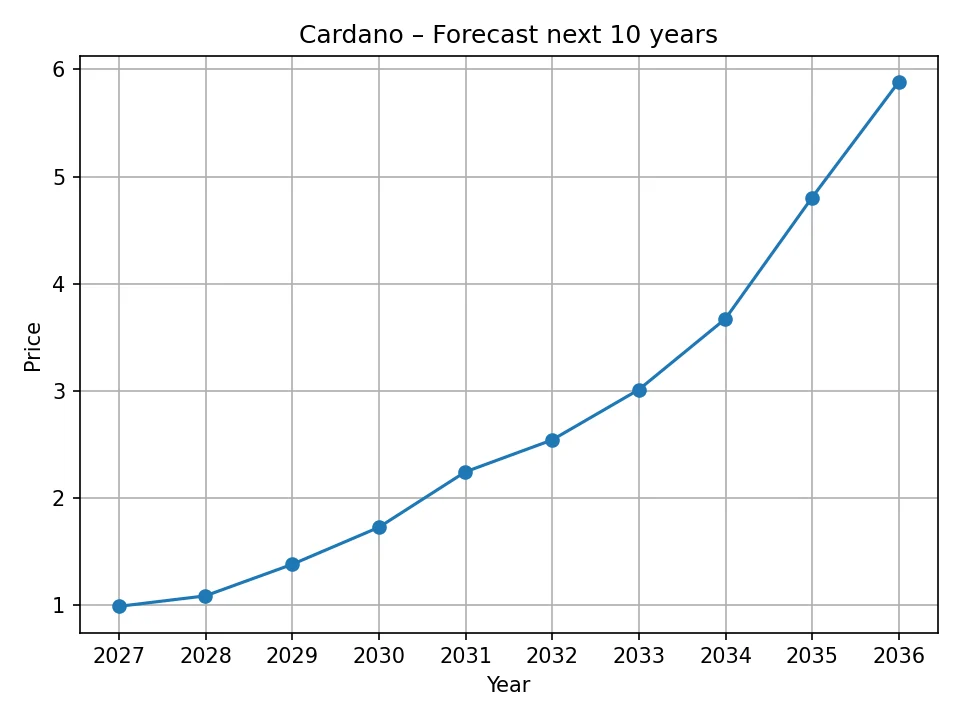

Peering into the long-term future, the PriceCast algorithm offers an optimistic outlook for Cardano over the next decade. This extended forecast takes into account not only the anticipated maturation of the Cardano ecosystem but also broader trends in blockchain adoption, technological integration, and the potential for cryptocurrencies to become more mainstream financial instruments. The predictions indicate a significant upward trajectory, suggesting that Cardano’s foundational strengths and strategic development could yield substantial returns over the long haul.

The annual forecast projects ADA to comfortably surpass the $1.00 mark in 2027 and then embark on a more aggressive growth path, with the price potentially reaching over $5.00 USD by 2035. This long-term appreciation is predicated on several key assumptions: continued successful implementation of Cardano’s roadmap (especially in scaling and governance), sustained growth in its dApp ecosystem, increased institutional adoption, and a generally positive regulatory environment for cryptocurrencies.

By 2028 and beyond, the forecast suggests that Cardano could become a dominant player in specific niches, leveraging its secure and sustainable infrastructure. The projected growth in the mid-2030s implies that if Cardano continues to deliver on its promise of a truly decentralized, scalable, and interoperable platform, it could capture a significant portion of the burgeoning Web3 economy. The academic rigor and meticulous development process that define Cardano might pay off significantly in the long run, as enterprises and developers prioritize reliability and robust security for their blockchain solutions.

Here is the detailed annual price prediction for Cardano (ADA):

| Year | Predicted Price (USD) |

|---|---|

| 2026 | 0.990 |

| 2027 | 1.088 |

| 2028 | 1.382 |

| 2029 | 1.727 |

| 2030 | 2.245 |

| 2031 | 2.542 |

| 2032 | 3.012 |

| 2033 | 3.673 |

| 2034 | 4.803 |

| 2035 | 5.881 |

This long-term outlook for Cardano is highly optimistic, suggesting that patient investors who believe in the project’s fundamental vision and technical capabilities could see significant value appreciation. The sustained growth trend points towards a future where Cardano plays an increasingly integral role in the global blockchain infrastructure.

Comprehensive Market Analysis and Future Outlook for Cardano

Cardano stands at a pivotal juncture in the rapidly evolving cryptocurrency landscape. Its journey from a meticulously researched academic project to a fully functional smart contract platform has been characterized by deliberate and phased development. The historical data from the past year shows Cardano’s resilience and its ability to participate in broader market rallies, while the proprietary PriceCast algorithm paints a picture of sustained long-term growth.

The current market environment for cryptocurrencies is influenced by a blend of innovation, regulatory scrutiny, and macroeconomic shifts. Cardano’s commitment to decentralization, scalability, and sustainability through its Ouroboros consensus mechanism and a robust development roadmap positions it favorably. The ongoing progress in the Basho era, focusing on scaling solutions like Hydra, and the upcoming Voltaire era, which will fully decentralize governance, are critical for attracting more developers and users. If these advancements translate into increased network adoption and transaction volume, they will undoubtedly bolster ADA’s value proposition.

Looking at the monthly predictions, the anticipated steady rise through 2025 and into 2026 suggests that market confidence in Cardano’s ability to deliver on its promises is solidifying. Breaking the $1.00 barrier consistently would be a significant psychological milestone, often catalyzing further investor interest. This short-to-medium term growth could be fueled by a growing ecosystem of dApps, successful real-world partnerships, and a general improvement in the broader crypto market sentiment.

The long-term annual predictions, stretching to 2035, indicate a powerful bullish trajectory for Cardano. This implies a future where blockchain technology moves from niche adoption to widespread integration across various industries. For Cardano to achieve the projected valuations of over $5.00, it would need to solidify its position as a leading smart contract platform, successfully competing with established rivals and attracting a massive influx of developers, enterprises, and retail users. Factors such as cross-chain interoperability, the expansion of its DeFi and NFT sectors, and its potential role in digital identity or supply chain management could be key drivers.

However, it is crucial to consider potential scenarios that could deviate from these optimistic forecasts. In a bullish scenario, rapid technological advancements, breakthroughs in layer-2 scaling, significant institutional investment, favorable regulatory clarity, and a booming global economy could propel ADA’s price even higher than predicted. Mass adoption of blockchain technology for everyday use cases would be a significant catalyst.

Conversely, a bearish scenario could involve unforeseen technical vulnerabilities, intense competition from other blockchains, adverse regulatory crackdowns, a prolonged global economic recession, or a significant loss of developer and community support. Any of these factors could lead to price stagnation or declines.

A neutral scenario would see Cardano continue its steady development but without explosive growth, navigating market cycles and slowly building its ecosystem. In this scenario, ADA’s price would largely track the broader crypto market, with its unique features providing a degree of stability but not necessarily outpacing its peers dramatically.

Ultimately, Cardano’s future price hinges on its ability to execute its ambitious roadmap, foster a vibrant and active ecosystem, and adapt to the ever-changing demands of the digital economy. Its methodical, research-driven approach may be slower than some competitors, but it aims for a more robust and sustainable foundation, which could prove invaluable in the long run.

The market for cryptocurrencies is inherently volatile and speculative. The price predictions presented in this article are based on data analysis from our proprietary PriceCast algorithm and should not be considered financial advice. Investors should conduct their own thorough research and consider their financial situation before making any investment decisions. We are not responsible for any investment outcomes based on these predictions.

Maxwell Reed is the first editor of Cryptovista360. He loves technology and finance, which led him to crypto. With a background in computer science and journalism, he simplifies digital currency complexities with storytelling and humor. Maxwell began following crypto early, staying updated with blockchain trends. He enjoys coffee, exploring tech, and discussing finance’s future. His motto: “Stay curious and keep learning.” Enjoy the journey with us!