As of June 8, 2025, the cryptocurrency market continues to evolve at a rapid pace, presenting both opportunities and challenges for digital assets. Among the myriad of tokens vying for attention, Toncoin (TON) stands out due to its unique lineage and its deep integration with The Open Network. Understanding Toncoin’s price trajectory requires a comprehensive look at its historical performance, the fundamental factors driving its value, and the insights provided by algorithmic forecasts.

Toncoin: An Overview of The Open Network

Toncoin is the native cryptocurrency of The Open Network (TON), a decentralized blockchain project originally conceived by Telegram. While Telegram has since distanced itself from the project, the community-driven development has propelled TON into a formidable ecosystem, aiming to redefine how decentralized applications and services interact with mainstream users. TON’s core vision is to build a highly scalable, secure, and user-friendly blockchain infrastructure capable of handling millions of transactions per second. This ambition positions Toncoin as a critical component in enabling this digital future, serving as the primary medium for network operations, transaction fees, and decentralized governance. Its strong ties to the Telegram messaging app, particularly through mini-apps and payment integrations, provide a unique and extensive user base for potential adoption, setting it apart from many other blockchain initiatives. The network’s structure, which includes sharding for scalability and a strong emphasis on user accessibility, underpinning its long-term potential.

Toncoin’s Historical Price Performance (Past 12 Months)

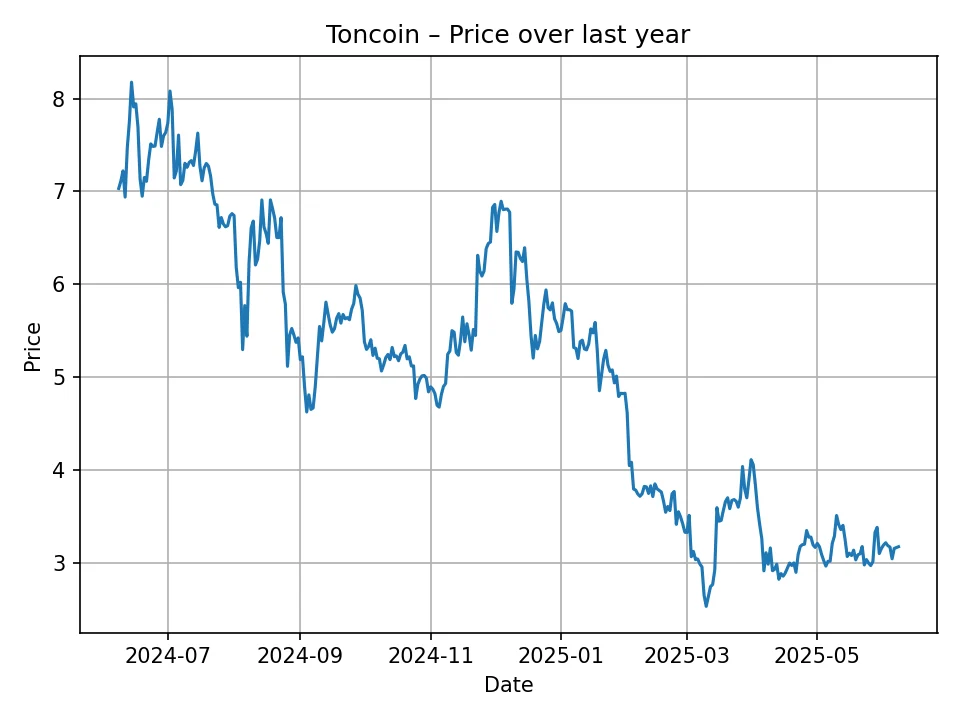

Analyzing Toncoin’s price movements over the last 12 months reveals a journey marked by significant volatility and distinct phases, characteristic of the broader cryptocurrency market. The data provided, spanning from June 2024 to June 2025, shows a dynamic range of prices, illustrating periods of strong upward momentum interspersed with notable corrections and consolidation.

At the beginning of this 12-month period, Toncoin was trading in the range of $7.00 to $8.00 USD, with an early peak hitting around $8.18 USD. This initial phase suggested robust investor confidence and a strong market presence. However, following this peak, Toncoin experienced a substantial downward trend, dipping significantly over several months. By late 2024 and early 2025, the price had fallen considerably, reaching lows around $2.53 USD. This period of decline could be attributed to a combination of broader market corrections, profit-taking after earlier rallies, or shifts in investor sentiment regarding the project’s short-term prospects.

Despite this downturn, Toncoin demonstrated resilience, showing intermittent recovery attempts. There were several instances where the price rebounded, testing higher resistance levels before retreating again. For example, after hitting its lowest point, TON saw periods where it climbed back above $3.00, then $4.00, and even briefly touched $5.00 USD or $6.00 USD on multiple occasions. These rallies indicate underlying support from its community and developers, as well as a certain level of speculative interest that continued to fuel bounces. The token’s ability to recover from steep declines underscores the belief in its long-term potential and the foundational strength of The Open Network.

However, the overall trend over the past year has been characterized by a gradual erosion of value from its earlier highs. The market has been consolidating, with Toncoin largely fluctuating in the $3.00 to $4.00 USD range during the latter part of the period. The data shows a series of lower highs and lower lows, indicating a bearish sentiment dominating much of the last few months. The price action suggests that while the TON ecosystem continues to develop, market participants have been cautious, possibly awaiting more significant catalysts or a broader bullish shift in the crypto landscape. As of the last recorded data point, Toncoin’s price sits at approximately $3.17 USD. This current valuation reflects a significant retreat from its peak but also positions it at a level that could represent a potential entry point for long-term investors if the fundamental outlook improves. The historical data underscores the imperative for investors to exercise caution and conduct thorough research, as the crypto market remains highly unpredictable.

Key Factors Influencing Toncoin’s Price Trajectory

Toncoin’s value is not solely determined by speculative trading but is profoundly influenced by a confluence of fundamental, technological, and macroeconomic factors. Understanding these elements is crucial for any informed projection of its future price.

The Open Network (TON) Ecosystem Development

The health and expansion of The Open Network ecosystem are paramount to Toncoin’s intrinsic value. TON is more than just a cryptocurrency; it’s a robust blockchain designed to host a multitude of decentralized applications (dApps), services, and digital assets. The successful rollout of new features, such as TON Storage, TON DNS, TON Proxy, and its native payment system, directly enhances the utility of Toncoin. As more developers build on TON and more users engage with these services, the demand for Toncoin to pay for transaction fees, storage, and domain registrations naturally increases. Significant partnerships and collaborations, especially those that leverage Telegram’s vast user base, can act as powerful catalysts. For instance, the integration of mini-apps within Telegram that utilize TON for payments or user incentives can expose Toncoin to hundreds of millions of potential new users, driving adoption and price appreciation. A thriving ecosystem, marked by high transaction volumes and a growing number of active wallets, fundamentally strengthens Toncoin’s position in the market.

Market Sentiment and Broader Cryptocurrency Trends

The cryptocurrency market is notoriously susceptible to sentiment-driven swings. Toncoin, despite its unique characteristics, is not immune to the broader trends affecting Bitcoin and Ethereum, which often act as bellwethers for the entire market. A bullish macro crypto environment, perhaps fueled by favorable regulatory news, institutional adoption, or a general increase in risk appetite, tends to lift most altcoins, including Toncoin. Conversely, a bearish market, triggered by regulatory crackdowns, global economic downturns, or significant security breaches within the crypto space, can exert downward pressure on TON’s price. Investor confidence, media coverage, and the overall narrative surrounding digital assets play a significant role in shaping these sentiments. Positive news about the TON project itself, such as major technological breakthroughs or successful funding rounds, can create localized bullish sentiment that temporarily decouples Toncoin from general market trends, but sustained growth usually requires a supportive macro environment.

Technological Advancements and Scalability

TON was designed with scalability in mind, aiming to support mass adoption. Continuous technological advancements, such as improvements in its sharding mechanism (TON Shardchains), network speed, and security protocols, are critical. If TON successfully demonstrates its ability to handle extremely high transaction throughput without compromising decentralization or security, it will gain a significant competitive edge over other Layer 1 blockchains. Furthermore, interoperability solutions that allow Toncoin to interact seamlessly with other major blockchain networks (e.g., through bridges) could expand its utility and reach. Any delays in implementing crucial upgrades, or discovery of significant vulnerabilities, could undermine investor confidence and negatively impact its price. Conversely, successful and timely deployment of roadmap features showcases the development team’s competence and strengthens the network’s long-term viability.

Regulatory Environment

The global regulatory landscape for cryptocurrencies remains a significant variable. Clear and supportive regulations can provide certainty for institutional investors and foster broader adoption, potentially leading to price increases. Conversely, restrictive or uncertain regulations, particularly in major economic jurisdictions, could dampen enthusiasm, limit exchange listings, and impede growth. Toncoin, having originated from Telegram, might face unique scrutiny given its history with regulatory bodies. The network’s decentralized structure aims to mitigate some of these risks, but evolving interpretations of digital asset laws, especially regarding securities classifications, could impact its operational freedom and market accessibility. Any adverse regulatory actions or increased FUD (Fear, Uncertainty, Doubt) stemming from regulatory concerns could lead to sharp price declines.

Tokenomics and Supply Dynamics

Toncoin’s tokenomics, including its total supply, circulating supply, distribution mechanisms, and inflation/deflation rates, also influence its price. Understanding how tokens are minted, burned, or locked within the ecosystem provides insights into future supply pressures. For instance, if a significant portion of TON is locked up in staking or used within DeFi protocols on the network, it reduces the circulating supply, potentially leading to price appreciation if demand remains constant or increases. Transparency regarding token allocation to developers, foundations, and community incentives is also important for building trust. Any unexpected release of large amounts of tokens into the market could lead to supply overhangs and downward price pressure. The overall design of its economic model, ensuring sustainability and incentivizing network participation, is fundamental to its long-term value proposition.

Monthly Price Forecast for Toncoin (Next 12 Months)

Forecasting cryptocurrency prices is inherently challenging due to market volatility and external factors. However, using advanced algorithms like our proprietary “Visionary” model, we can derive plausible projections based on historical data patterns and market dynamics. The following table presents the monthly price forecast for Toncoin (TON) for the next 12 months, from July 2025 to June 2026.

| Month/Year | Projected Price (USD) |

|---|---|

| 2025-07 | 3.29 |

| 2025-08 | 3.35 |

| 2025-09 | 3.33 |

| 2025-10 | 3.41 |

| 2025-11 | 3.31 |

| 2025-12 | 3.45 |

| 2026-01 | 3.41 |

| 2026-02 | 3.36 |

| 2026-03 | 3.39 |

| 2026-04 | 3.33 |

| 2026-05 | 3.38 |

| 2026-06 | 3.43 |

Based on the “Visionary” algorithm’s projections, Toncoin is expected to exhibit relatively stable growth over the next 12 months. The forecast suggests a gradual upward trend, moving from an estimated $3.29 USD in July 2025 to approximately $3.43 USD by June 2026. This indicates that while significant parabolic surges are not predicted in the short term, the algorithm anticipates a period of steady accumulation and slight appreciation. The monthly fluctuations are modest, suggesting a market that might be consolidating or slowly building momentum rather than experiencing sharp rallies or steep declines. For instance, there are minor pullbacks, such as a drop from $3.41 in October 2025 to $3.31 in November 2025, or from $3.45 in December 2025 to $3.41 in January 2026. These small dips align with typical market corrections within a generally upward-trending pattern. This period of stability could be seen as an opportunity for the Toncoin ecosystem to mature further, attracting more users and developers, which could then lay the groundwork for more substantial growth in the subsequent years. Investors should interpret this forecast as an expectation of continued fundamental development and market stabilization, rather than rapid speculative gains.

Annual Price Forecast for Toncoin (Next 10 Years)

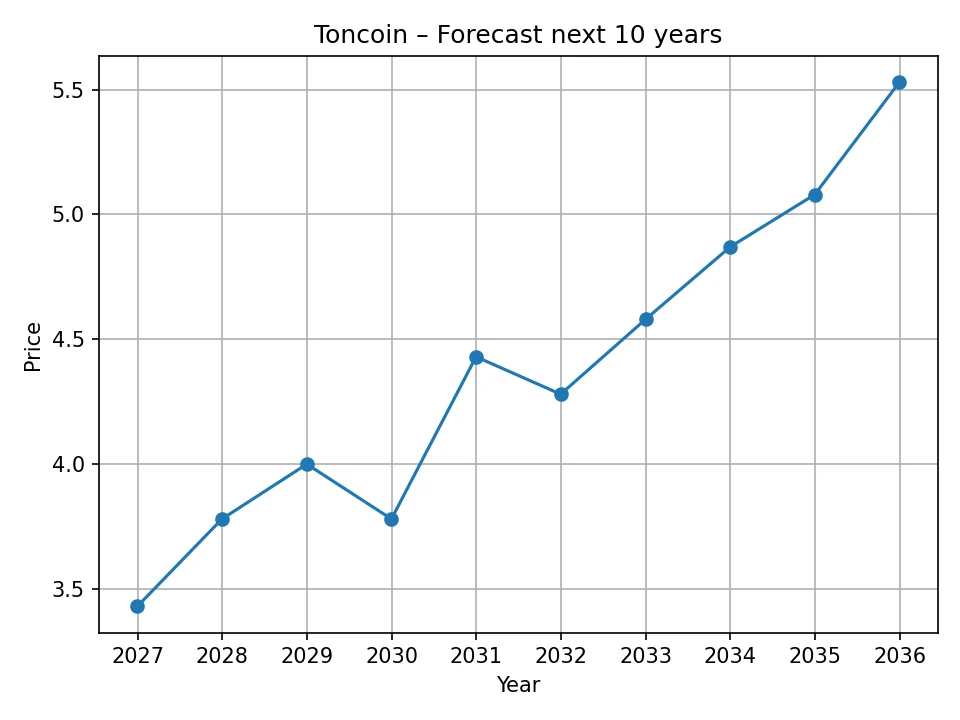

Looking further into the future, our “Visionary” algorithm provides a long-term annual price forecast for Toncoin (TON) for the next decade, from 2026 to 2035. These projections aim to capture the potential impact of long-term adoption trends, technological advancements, and the overall maturation of the cryptocurrency market.

| Year | Projected Price (USD) |

|---|---|

| 2026 | 3.43 |

| 2027 | 3.78 |

| 2028 | 4.00 |

| 2029 | 3.78 |

| 2030 | 4.43 |

| 2031 | 4.28 |

| 2032 | 4.58 |

| 2033 | 4.87 |

| 2034 | 5.08 |

| 2035 | 5.53 |

The long-term forecast from the “Visionary” algorithm paints a cautiously optimistic picture for Toncoin. Starting from a projected price of $3.43 USD in 2026, the algorithm suggests a consistent, albeit gradual, appreciation over the decade, reaching approximately $5.53 USD by 2035. This steady upward trajectory implies that the algorithm anticipates Toncoin capitalizing on the continued development of The Open Network and potentially benefiting from wider blockchain adoption.

The projections indicate that while there might be minor fluctuations or periods of consolidation, the overall trend is positive. For example, a slight dip is projected from $4.00 USD in 2028 to $3.78 USD in 2029, and again from $4.43 USD in 2030 to $4.28 USD in 2031. These minor corrections are natural in long-term market trends and could reflect cyclical market behavior or periods of re-evaluation. However, the consistent recovery and establishment of higher price floors in subsequent years underscore a fundamental belief in Toncoin’s enduring value proposition.

Several factors could contribute to this projected long-term growth. The ongoing expansion of The Open Network’s ecosystem, particularly successful integrations with Telegram and the broader Web3 space, could significantly increase the utility and demand for Toncoin. As more dApps and services are launched on TON, and as user adoption grows, the intrinsic value of Toncoin, used for transaction fees and network governance, will naturally appreciate. Furthermore, if Toncoin establishes itself as a leading contender in the blockchain scalability race, its market capitalization could expand considerably. The continued maturation of the crypto market, coupled with increasing institutional interest and clearer regulatory frameworks, could also provide tailwinds for Toncoin, allowing it to realize its full potential over the next decade. This forecast suggests that patience and a long-term investment horizon may be beneficial for those considering Toncoin as part of a diversified portfolio.

Potential Risks and Challenges for Toncoin

While the outlook for Toncoin may appear promising, it is crucial to acknowledge the significant risks and challenges that could impede its growth or lead to price depreciation. The cryptocurrency market is inherently volatile and speculative, and Toncoin is no exception.

Market Volatility and Competition

The primary risk for any cryptocurrency, including Toncoin, is the extreme market volatility. Prices can swing wildly in short periods due to a multitude of factors, ranging from global economic news to sudden shifts in investor sentiment. A significant downturn in the broader crypto market, often led by Bitcoin, could drag Toncoin’s price down regardless of its fundamental strengths. Furthermore, The Open Network operates in a highly competitive landscape. It faces fierce competition from established Layer 1 blockchains like Ethereum, Solana, and Avalanche, as well as emerging contenders. These networks are constantly innovating, and if TON fails to maintain its technological edge or attract a sufficient user base, its growth could be stifled. The “first-mover advantage” held by some networks, combined with their extensive developer communities and established infrastructure, poses a constant challenge to Toncoin’s market share aspirations.

Regulatory Uncertainty and Scrutiny

The regulatory environment for cryptocurrencies remains largely uncertain and varies significantly across jurisdictions. Governments worldwide are grappling with how to classify and regulate digital assets, and any adverse regulatory decisions could have a profound impact on Toncoin. Given TON’s origins with Telegram and its past interactions with regulatory bodies, it may face particular scrutiny. For instance, new regulations concerning stablecoins, DeFi, or even the classification of certain tokens as securities could limit Toncoin’s functionality, restrict its listing on major exchanges, or increase compliance costs. A lack of clear, consistent, and supportive regulatory frameworks could deter institutional investment and broader mainstream adoption, thereby suppressing Toncoin’s price.

Technological Risks and Development Hurdles

Despite its ambitious technological roadmap, Toncoin is not immune to development challenges. The successful implementation of its highly scalable architecture (sharding) and other complex features requires continuous innovation and rigorous testing. Bugs, security vulnerabilities, or unexpected technical setbacks could undermine confidence in the network. If TON fails to deliver on its promises of high throughput and low transaction costs, or if it experiences significant outages, users and developers might migrate to more reliable or performant chains. Furthermore, the pace of innovation in the blockchain space is incredibly fast. If new, superior technologies emerge that offer better scalability, security, or decentralization, Toncoin could struggle to keep pace, leading to a decline in its relative value and adoption.

Adoption Challenges and User Acquisition

While Toncoin benefits from its indirect association with Telegram, converting Telegram users into active TON blockchain users is a significant hurdle. Many users might not be familiar with blockchain technology or comfortable with the complexities of interacting with dApps and managing private keys. If the user experience on TON is not exceptionally intuitive and seamless, mass adoption could prove challenging. The network needs to continuously incentivize users and developers to ensure sustained engagement. Without a strong, active user base and a vibrant developer community building compelling applications, Toncoin’s utility remains limited, and its price appreciation could be hampered by a lack of organic demand. Competing for user attention in an oversaturated market requires substantial marketing efforts, community building, and a genuinely superior product offering.

Conclusion

Toncoin, with its ambitious vision for The Open Network, presents an intriguing case study in the evolving cryptocurrency landscape. Its historical performance over the past year has been characterized by volatility, marked by significant price swings and a general downtrend from earlier highs, ultimately settling at approximately $3.17 USD. However, this period of consolidation also reflects the inherent resilience of the project and its continued development.

Looking ahead, our “Visionary” algorithm projects a period of relatively stable and gradual appreciation for Toncoin. The monthly forecast suggests a modest upward trend over the next 12 months, with prices slowly climbing towards the $3.40 USD range. The long-term annual forecast extends this cautiously optimistic outlook, anticipating a steady increase over the next decade, potentially reaching over $5.50 USD by 2035. These projections are underpinned by the anticipated growth of The Open Network’s ecosystem, increased utility of Toncoin, and potential broader market maturation.

However, it is crucial for potential investors to recognize that these forecasts are based on algorithmic models and market assumptions. The cryptocurrency market remains highly susceptible to sudden shifts driven by global economic conditions, regulatory developments, technological breakthroughs, and unforeseen events. Toncoin, like all digital assets, faces inherent risks, including intense market volatility, fierce competition from other blockchain networks, ongoing regulatory uncertainties, and the significant challenge of achieving widespread user adoption.

Ultimately, Toncoin’s future price trajectory will hinge on the successful execution of The Open Network’s roadmap, its ability to attract and retain a vibrant community of users and developers, and the overall health of the broader crypto market. Investors should approach Toncoin with a comprehensive understanding of these factors and a long-term perspective.

Please note that this article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly speculative and carry a substantial risk of loss. Price predictions are inherently uncertain and should not be relied upon for investment decisions. The forecasts presented herein are generated by a proprietary “Visionary” algorithm and do not guarantee future performance. We are not responsible for any investment outcomes based on the information provided. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Maxwell Reed is the first editor of Cryptovista360. He loves technology and finance, which led him to crypto. With a background in computer science and journalism, he simplifies digital currency complexities with storytelling and humor. Maxwell began following crypto early, staying updated with blockchain trends. He enjoys coffee, exploring tech, and discussing finance’s future. His motto: “Stay curious and keep learning.” Enjoy the journey with us!