The realm of cryptocurrency is perpetually dynamic, characterized by rapid innovations, shifting market sentiments, and significant volatility. For investors and enthusiasts alike, understanding the potential future trajectory of digital assets is paramount. Among the myriad of projects vying for attention, Kava stands out as a unique layer-1 blockchain, positioning itself at the intersection of speed and developer flexibility. This article delves into a comprehensive price prediction for Kava, analyzing its historical performance, key influencing factors, and leveraging advanced algorithmic forecasts to provide an informed outlook on its potential valuation in the coming months and years.

Understanding Kava: A Hybrid Blockchain Powerhouse

Kava is a decentralized finance (DeFi) platform designed to offer a robust and scalable infrastructure for a wide array of financial services. What distinguishes Kava is its innovative architecture: a co-chain design that merges the speed and interoperability of the Cosmos SDK with the developer-friendliness of the Ethereum Virtual Machine (EVM). This unique hybrid approach allows Kava to support both Cosmos SDK-based applications and EVM-compatible dApps, making it a highly versatile platform for developers building across different blockchain ecosystems.

At its core, Kava aims to provide a reliable and secure environment for decentralized applications, particularly those focused on lending, borrowing, and stablecoin issuance. The KAVA token is integral to the Kava ecosystem, serving multiple purposes including governance, staking for network security, and as a reserve asset. Holders of KAVA can participate in critical decisions concerning the network’s future, secure the blockchain through staking, and earn rewards, thereby aligning their incentives with the long-term success of the platform. Kava’s commitment to growth is evident in its continuous upgrades and initiatives, striving to attract more developers and users to its ecosystem, thereby fostering a vibrant and utility-driven DeFi hub.

A Look Back: Kava’s Historical Price Movements

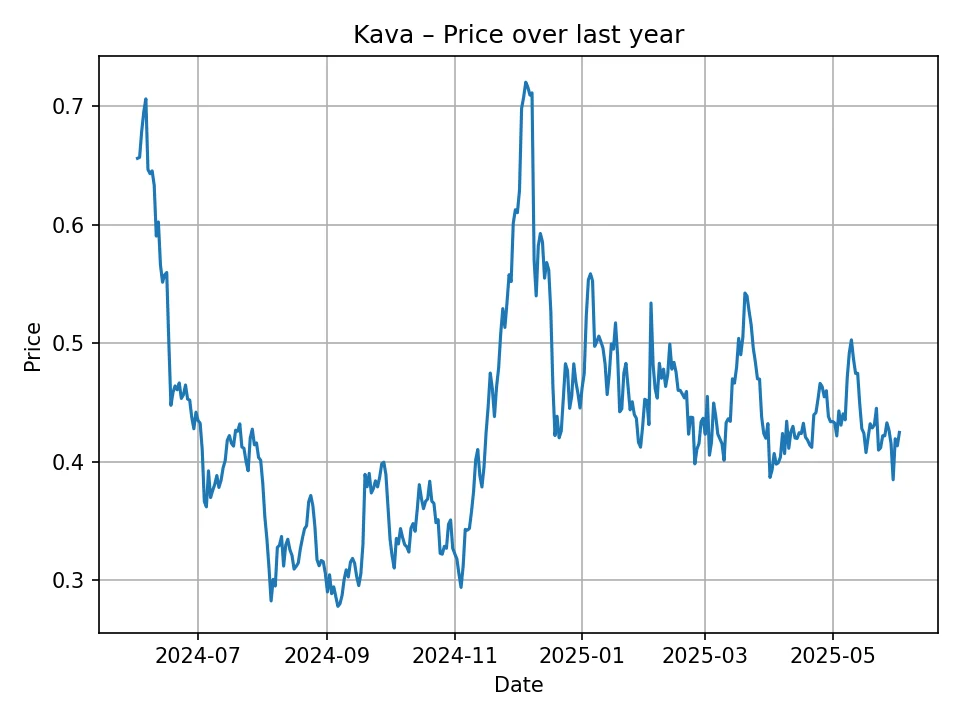

Examining Kava’s price history over the past 12 months provides crucial context for its current position and future potential. The period between June 2024 and June 2025 has seen Kava navigate a complex market, reflecting broader cryptocurrency trends while also being influenced by its specific developmental milestones and challenges.

Over the past year, Kava experienced significant price fluctuations. Starting the period around the $0.65 USD mark in early June 2024, the token saw an initial decline, reaching lows in the $0.28 – $0.35 USD range by late 2024. This downward pressure can be attributed to several factors, including a generally bearish sentiment in the broader crypto market during certain periods, coupled with potential profit-taking from earlier rallies. However, Kava also demonstrated resilience and periods of strong upward momentum. For instance, there was a notable surge that pushed its price temporarily to approximately $0.72 USD around February 2025, showcasing its capacity for significant rallies. This peak was likely driven by specific ecosystem developments, positive market sentiment, or increased trading volume. Following this peak, the price retraced, settling into a range typically between $0.40 USD and $0.55 USD for much of the latter part of the observed period. The token has shown a propensity for volatility, with sharp drops often followed by periods of consolidation or gradual recovery. As of early June 2025, Kava’s price is observed to be around $0.42 USD, marking a considerable decrease from its position a year prior, but also showing some stability within its recent trading range. This historical data underscores the inherent risks and rewards associated with investing in cryptocurrencies, emphasizing the importance of a comprehensive understanding of market dynamics and project fundamentals.

Key Factors Influencing Kava’s Price Trajectory

The price of Kava, like any cryptocurrency, is subject to a confluence of internal and external factors. Understanding these elements is essential for forming a nuanced price prediction.

Internal Factors: Kava’s Ecosystem and Development

- Ecosystem Growth and dApp Adoption: The health and growth of the Kava ecosystem are paramount. As more developers choose to build on Kava’s EVM and Cosmos SDK chains, and as more users engage with these applications, the demand for KAVA tokens for gas fees, staking, and governance could increase. Successful launches of high-profile dApps, DEXs, lending protocols, and NFT marketplaces on Kava can significantly boost its utility and perceived value.

- Technological Upgrades and Innovations: Kava’s commitment to continuous development, including upgrades to its hybrid architecture, improvements in scalability, and enhancements in security features, can positively impact its price. Innovations like Liquid Staking Derivatives (LSDs) and other DeFi primitives built on Kava could attract more liquidity and users.

- Tokenomics and Staking: The KAVA token’s utility within the network, particularly its role in staking and governance, influences its demand. A high staking ratio indicates strong community commitment and reduced circulating supply, which can be bullish for price. Changes in token issuance schedules or burning mechanisms can also affect supply dynamics.

- Partnerships and Integrations: Collaborations with other blockchain projects, traditional financial institutions, or technology companies can expand Kava’s reach and integrate it into broader financial ecosystems, driving adoption and price appreciation.

External Factors: Broader Market Dynamics

- Overall Cryptocurrency Market Trends: The price of Kava is highly correlated with the overall performance of the cryptocurrency market, especially Bitcoin (BTC). A bullish Bitcoin trend often pulls altcoins like Kava higher, while a bearish trend can lead to widespread declines. Macroeconomic factors, such as inflation, interest rates, and global liquidity, also play a significant role in shaping market sentiment.

- Regulatory Landscape: Regulatory developments across major jurisdictions can have a profound impact on the crypto market. Clear and favorable regulations can foster institutional adoption and increase investor confidence, whereas restrictive or uncertain regulatory environments can dampen enthusiasm.

- Competitive Landscape: Kava operates in a highly competitive DeFi space, vying with other layer-1 blockchains like Ethereum, Solana, Avalanche, and various Cosmos SDK chains. The ability of Kava to differentiate itself through unique features, superior performance, or a stronger value proposition compared to its competitors is crucial for its long-term success.

- Technological Advancements in DeFi: Broader innovations in decentralized finance, such as cross-chain interoperability solutions, new consensus mechanisms, or advancements in scalability, can create new opportunities for Kava or pose new challenges.

Kava Price Prediction Methodology: Leveraging EdgePredict

Forecasting cryptocurrency prices is inherently complex due to the multitude of variables at play. For the predictions presented in this article, we utilize a proprietary algorithmic model known as EdgePredict. This advanced algorithm is designed to analyze vast datasets, including historical price movements, trading volumes, market sentiment, and various on-chain metrics, to identify patterns and project potential future price trajectories. EdgePredict employs a combination of statistical analysis, machine learning techniques, and predictive modeling to generate its forecasts. While sophisticated, it’s crucial to remember that no algorithm can guarantee future performance in a market as volatile as cryptocurrency. These predictions serve as an informed guide, based on probabilities and historical correlations, rather than absolute certainties.

Kava Price Forecast: Short-Term Outlook (Monthly)

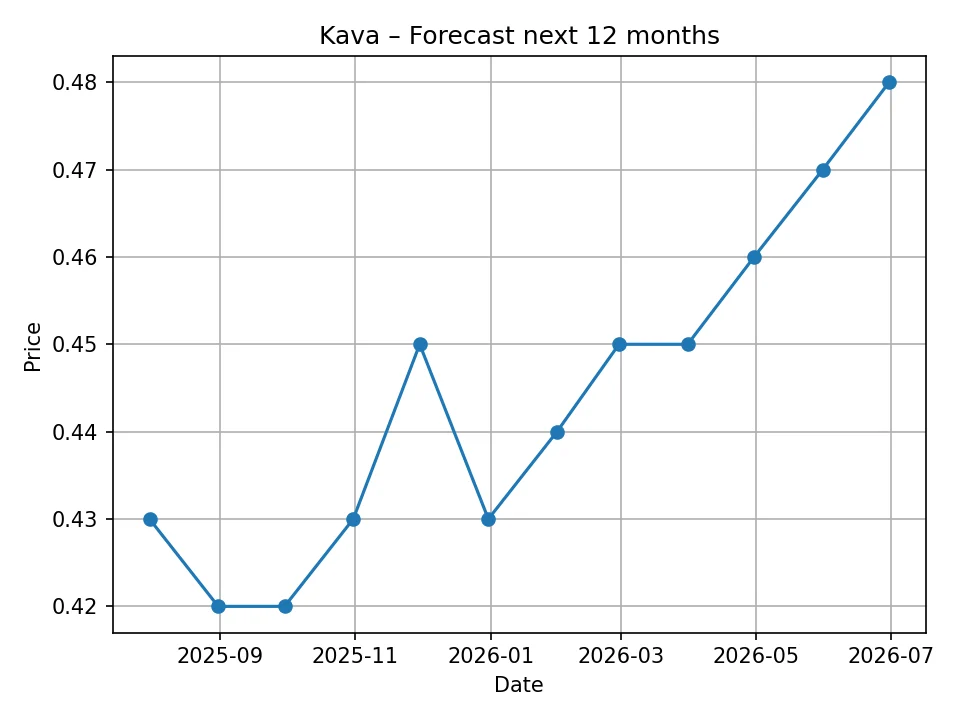

The short-term price outlook for Kava, as predicted by the EdgePredict algorithm for the next 12 months (June 2025 to June 2026), suggests a period of relative stability followed by a gradual upward trend.

The monthly forecast indicates that Kava is expected to trade within a relatively tight range, oscillating slightly but generally maintaining its value above the current levels. As we move into late 2025 and early 2026, the algorithm anticipates a slow but steady appreciation in Kava’s price. This forecast might reflect an expectation of continued ecosystem development, increasing adoption of Kava’s unique hybrid chain, or a general stabilization in the broader crypto market. Investors should be aware that even within this predicted range, short-term volatility remains a possibility, driven by news events, market sentiment shifts, or unexpected macroeconomic developments.

Here is the detailed monthly price prediction for Kava:

| Month/Year | Predicted Price (USD) |

|---|---|

| 2025-07 | 0.43 |

| 2025-08 | 0.42 |

| 2025-09 | 0.42 |

| 2025-10 | 0.43 |

| 2025-11 | 0.45 |

| 2025-12 | 0.43 |

| 2026-01 | 0.44 |

| 2026-02 | 0.45 |

| 2026-03 | 0.45 |

| 2026-04 | 0.46 |

| 2026-05 | 0.47 |

| 2026-06 | 0.48 |

Kava Price Forecast: Long-Term Outlook (Annual)

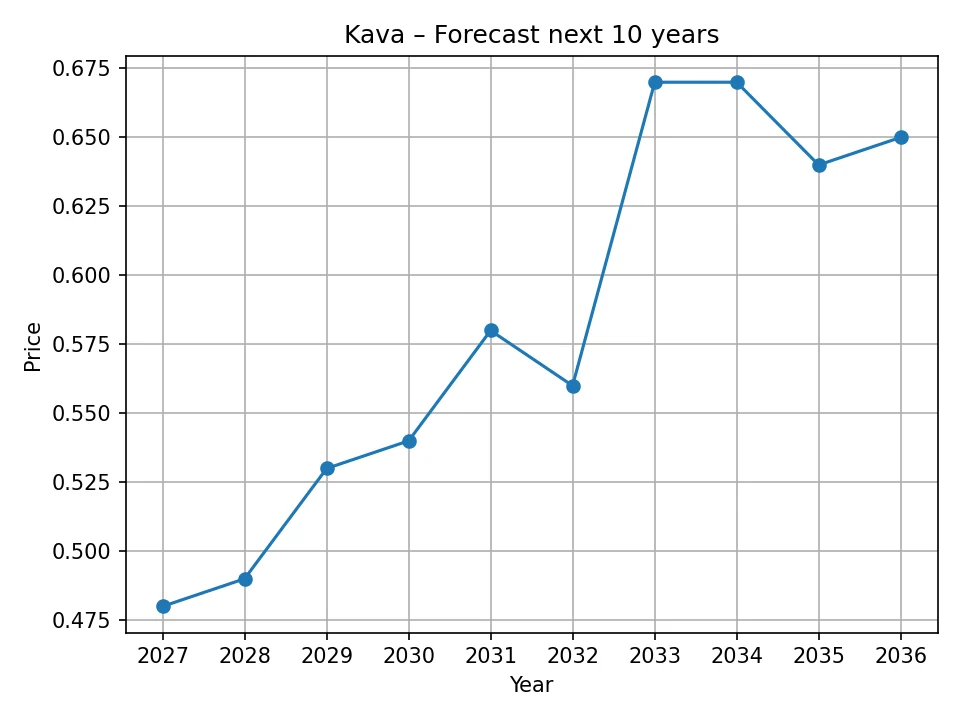

Looking further into the future, the EdgePredict algorithm provides a 10-year annual price forecast for Kava, offering insights into its potential long-term trajectory. The long-term prediction suggests a gradual but consistent growth for Kava, with some notable increases projected in the latter half of the decade.

The annual forecast indicates that Kava is expected to slowly but surely recover and build upon its current valuation. While the initial years show modest increases, the algorithm anticipates a more significant surge in price towards the early 2030s. This optimistic long-term outlook could be attributed to the potential for Kava to achieve broader adoption, solidify its position as a leading DeFi infrastructure, and benefit from the overall expansion of the decentralized finance sector. However, long-term forecasts carry an even higher degree of uncertainty, as they are susceptible to unforeseen technological breakthroughs, regulatory shifts, and major economic paradigm changes.

Here is the detailed annual price prediction for Kava:

| Year | Predicted Price (USD) |

|---|---|

| 2026 | 0.48 |

| 2027 | 0.49 |

| 2028 | 0.53 |

| 2029 | 0.54 |

| 2030 | 0.58 |

| 2031 | 0.56 |

| 2032 | 0.67 |

| 2033 | 0.67 |

| 2034 | 0.64 |

| 2035 | 0.65 |

Potential Scenarios for Kava’s Future

While algorithmic predictions offer a data-driven perspective, it’s crucial to consider various potential scenarios that could influence Kava’s actual price trajectory.

Bullish Scenario

A strong bullish scenario for Kava would see its price significantly exceed the algorithmic predictions. This could be fueled by several key developments:

* Accelerated Ecosystem Growth: If Kava successfully attracts a large number of developers and users, leading to a boom in dApp activity, Total Value Locked (TVL), and transaction volume, demand for KAVA would naturally surge.

* Major Institutional Adoption: If institutional investors or large enterprises begin to leverage Kava’s infrastructure for their DeFi needs, the influx of capital and validation could dramatically increase KAVA’s market cap.

* Breakthrough Technological Advancements: The successful implementation of new scalability solutions, enhanced security features, or groundbreaking cross-chain functionalities could make Kava a more attractive and competitive platform, driving its value higher.

* Favorable Macroeconomic Conditions: A sustained bull run in the broader cryptocurrency market, perhaps triggered by easing monetary policies or widespread acceptance of digital assets, would likely lift Kava along with other major cryptocurrencies.

Bearish Scenario

Conversely, a bearish scenario could see Kava’s price underperform the predictions, or even decline significantly. This could be triggered by:

* Stagnant Ecosystem Development: If Kava struggles to attract new users or developers, or if existing dApps fail to gain traction, its utility and perceived value could diminish.

* Increased Competition: The DeFi space is constantly evolving, with new layer-1s and innovative protocols emerging. If competitors offer superior technology or attract a larger user base, Kava might lose market share.

* Regulatory Headwinds: Unfavorable regulatory actions, such as strict prohibitions on certain DeFi activities or increased scrutiny on blockchain projects, could create uncertainty and negatively impact Kava’s market.

* Security Breaches or Technical Issues: Any significant security vulnerability, network outage, or major technical glitch on the Kava blockchain could severely damage trust and lead to a rapid price decline.

* Broader Market Downturn: A prolonged bear market across the entire cryptocurrency industry, perhaps due to global economic recessions or widespread fear, would likely pull Kava’s price down regardless of its fundamental strengths.

Conclusion

Kava stands as an ambitious and technologically advanced project within the decentralized finance landscape, striving to offer a robust and versatile platform through its unique hybrid chain architecture. Its historical performance reflects the inherent volatility of the crypto market, marked by both significant dips and periods of strong recovery. The price predictions generated by our proprietary EdgePredict algorithm suggest a cautiously optimistic outlook for Kava. In the short term, the token is anticipated to maintain a relatively stable trajectory with a modest upward trend towards mid-2026. The long-term forecast points to a gradual but consistent appreciation, with more significant growth projected in the distant future, indicating Kava’s potential to solidify its position and gain further adoption over the coming years.

However, it is crucial for every potential investor to approach these predictions with a clear understanding that the cryptocurrency market is highly speculative and subject to rapid, unpredictable changes. Factors such as technological advancements, regulatory shifts, global economic conditions, and competitor performance can all profoundly impact Kava’s actual price. Thorough research, an understanding of individual risk tolerance, and the recognition that past performance is not indicative of future results are paramount before making any investment decisions.

Disclaimer: The price predictions provided in this article are based on data analysis using a proprietary algorithmic model, EdgePredict, and should not be considered financial advice. The cryptocurrency market is highly volatile and unpredictable. Investing in Kava or any other digital asset carries significant risks, and investors may lose all of their invested capital. We are not responsible for any investment decisions made based on the information presented herein.

Maxwell Reed is the first editor of Cryptovista360. He loves technology and finance, which led him to crypto. With a background in computer science and journalism, he simplifies digital currency complexities with storytelling and humor. Maxwell began following crypto early, staying updated with blockchain trends. He enjoys coffee, exploring tech, and discussing finance’s future. His motto: “Stay curious and keep learning.” Enjoy the journey with us!